Able Lending is a creative, impressive platform

Small businesses provide half of America’s jobs, and produce trillions of dollars in revenue each year. In no uncertain terms, small businesses like yours are the bread and butter of the American economy. And yet, it is more difficult than ever to get the loans from banks. Alternative lenders are thriving as the small businesses that drive much of the US economy continue to seek sources of capital to grow.

![]()

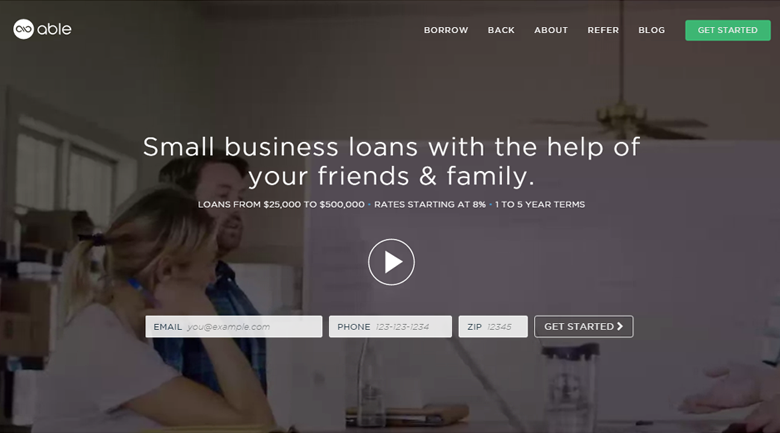

Able Lending is such an alternative lender offering a unique style of “collaborative credit.” Borrowers are asked to find three to five backers – generally friends, family, or fans who believe in the vision of their business – who agree to collectively fund at least 25 percent of your total loan.

Able loans the remaining 75 percent, as well as taking care of all of the legal paperwork, managing your monthly payments, collecting payments from your backers, and repaying your friends and family with interest.

There is a new way

Based in Austin, a veritable hotbed of startup and small business activity, Able seeks to empower the “Fortune Five Million” because they understand the importance of small businesses. The company states, “Right when you’ve been serving customers and serving communities, banks stopped believing in you and no longer lend you money. We all know that capital is your life blood. It’s how you grow and tell the story of your business. But now there is a new way.”

Able believes that if you can find a few backers willing to fund you partially, it shows that you and your closest collaborators truly believe in the business. By asking you to find some of your own backers, Able is also able to offer lower interest rates than most alternative lenders and banks.

What types of loans are available, how the process works

Loans are available from $25,000 to $500,000 with interest rates starting at eight percent, and loan contracts from one to five years. To qualify, your business must be at least six months old (most banks require one year) and must generate an annual revenue of at least $50,000. Most banks and other alternative lenders require businesses to be at least a year old with much higher revenues. Able is also looking for small businesses “strong growth prospects, passionate leadership, and supportive customers.”

The process of getting a loan from Able is relatively simple. You create a short profile about your business, connect it with your social media accounts, and find three to five backers. Within 24 hours, Able will contact you for more information. Able reviews your financials and completes a credit check, and will notify you within three days if you’ve been approved for a loan.

Finally, a win-win in a win-less financial world

Collaborative credit seems like a win-win situation for everyone involved. You get your loan at a reduced interest rate, and your backers get to support a business they believe in while also earning interest. Several Austin startups, such as Capital Factory, Rose & Fitzgerald, Chi’lantro, and Branch Basics, have funded their businesses through Able’s unique collaborative credit loans.

#AbleLending

Ellen Vessels, a Staff Writer at The American Genius, is respected for their wide range of work, with a focus on generational marketing and business trends. Ellen is also a performance artist when not writing, and has a passion for sustainability, social justice, and the arts.