Your alternate timeline

Do you ever wonder how much that stock you could have invested in years ago is worth today? Perhaps that Apple stock you thought of investing in around say, 1998, before Apple came out with colorful Macs, iPhones, and became the powerhouse it is today.

If you had invested $5,000 in Apple on January 1, 1998, it would be worth approximately $855,133 today. I know this thanks to website, New Investor Daily, that tells you what a hypothetical investment in the past would be worth today.

![]()

A simple idea

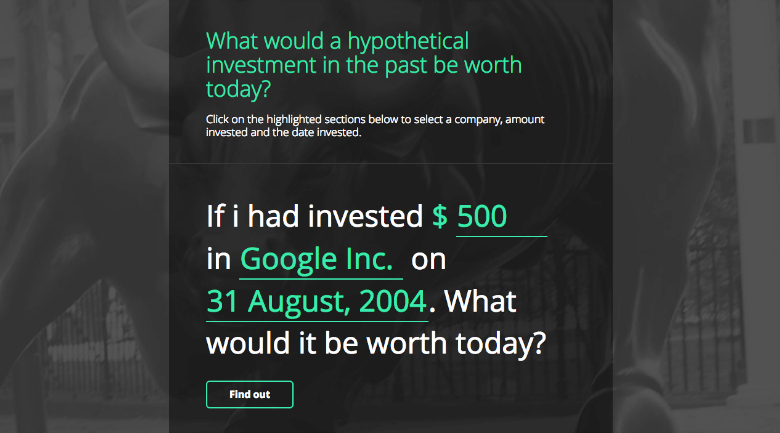

At first glance, the site is very unassuming. With a simple design, the site only has a bit of text and an area for you to calculate the hypothetical investment. That’s pretty much it. Upon visiting the homepage, you’re directed to click on highlighted sections select a company, amount invested, and the date invested.

The highlighted sections are contained within the phrase, “If I had invested $______ in _________ on _________. What would it be worth today?” Once you fill in the blanks with your hypothetical investment, you click a find out button which leads you to the calculated answer. So for my 1998 Apple investment of $5,000, the site returned the answer of $855,133.

“Not to be used for making real investment decisions”

Along with the estimated worth of your hypothetical investment, the site also gives you information regarding the percent gain, price purchased and price sold, as well as chart illustrating the growth over time.

As the F.A.Q. section states, this site should not be used for making real investment decisions. According to the site, it is “just an interesting way to look at historic stock prices and it should not be used to make any kind of decision about anything.” However, it does give some recommendations on what to read for more information about investing. The site’s author even has a newsletter you can sign up for to help you learn about investing. The F.A.Q. section of the website also provides some great answers to investing questions.

Explore your hypothetical past

So check the site out, maybe wallow in a little bit of regret about that investment you didn’t make years ago, or be motivated to take action in investing today. I know after I played around with the tool, I felt more motivated to invest more seriously. While there’s no real way to tell how much you’ll make from investing, it might be something you want to explore.

#NewInvestorDaily

Nichole earned a Master's in Sociology from Texas State University and has publications in peer-reviewed journals. She has spent her career in tech and advertising. Her writing interests include the intersection of tech and society. She is currently pursuing her PhD in Communication and Media Studies at Murdoch University.

Pingback: This calculator determines if you're going to be rich or poor - The American Genius