Retirement: An age that keeps getting further away

It should not be news to anyone that in order to retire comfortably you can’t just count on Social Security benefits, especially because who the heck knows how long Social Security will continue to exist. That withstanding, it’s our savings that will make or break us in our golden years. The older we get, the harder it is to stash away anything of significance, which is why investment professionals recommend that you start saving as early as possible.

![]()

The big three

According to Life Hacker, there are three factors that influence when you’ll be financially independent: the age you start saving, how much of your income you save and the return on your investments. The other factor, I guess you can refer to it as number four on the list, is to consistently save the same percentage of your income every month/year once you start.

Think about it: there are very few things in life that you have more control over than your savings. That said, before you run off to the bank, let’s reiterate a few things. Again, Life Hacker offers up some great advice and is a lot more eloquent than I could hope to be.

Savings redeux

Step 1.

Determine when to retire: This is not your father’s or grandfather’s retirement. The age of 65 is no longer the typical retirement age. People live longer so they can work longer. Or they can retire early and party longer. No matter, whatever your retirement age goal is, be sure to plan for all the years you may need to be covered financially.

Step 2.

Create a longevity plan that takes in to account how many years to include in your savings plan: This is a critical part because the whole point of retirement planning is to not outlive your savings.

Step 3.

Estimate what your expenses will be in retirement:

Most people will have fewer living expenses by the time they’ve retired. That’s the hope anyway. Kids are out of school, house is paid off, etc. Industry professionals recommend needing 75%-80% of your current income in retirement.

Step 4.

Make an inventory of your current assets and savings:

Gather your investment and savings account statements so you can get a clear picture of what you have to work with right now.

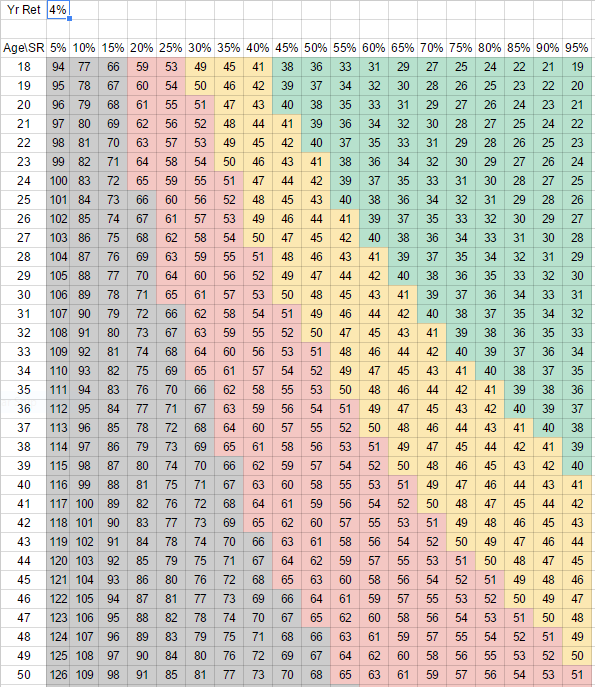

Take a look at the following chart (courtesy of Lifehackher). Feel free to plug in a number greater or lesser than 4% interest rate to see how the results change over time.

Resources a plenty

Keep in mind that there are a wide variety of asset allocation tools that can help you decide on the right mix of investments. A balanced portfolio will mitigate your risks while giving you the best chance of increasing your wealth.

It is possible to save for retirement. But you have to save right now if you haven’t already. “Now” being whatever age you are that enables you to start saving!

#Retirement

Nearly three decades living and working all over the world as a radio and television broadcast journalist in the United States Air Force, Staff Writer, Gary Picariello is now retired from the military and is focused on his writing career.