This is not good news

It could be argued that the market is surviving only the fittest and weeding out the weak, or in this case, all of those who bet on risks that turned bad, while others can argue that the market is poor all the way around no matter what industry. We’ve been watching the banking industry as an economic indicator and are astonished at how the recession has impacted the sector.

It could be argued that the market is surviving only the fittest and weeding out the weak, or in this case, all of those who bet on risks that turned bad, while others can argue that the market is poor all the way around no matter what industry. We’ve been watching the banking industry as an economic indicator and are astonished at how the recession has impacted the sector.

In 2007, only 3 banks were on the FDIC’s bank failure list (aka the FDIC shut down their operations), in 2008 there were 25 banks closed, but 2009 ended with 130 banks failed! If that isn’t startling, note that by March 3 of 2009, 16 banks had closed, but as of today, 22 banks have closed in 2010, a 37.5% acceleration rate over 2009. If the current rate of bank failures continues, 2010 could see over 178 failed banks.

Which banks have been shut down in 2010 so far?

- 01/08- Horizon Bank, Bellingham, WA

- 01/15- Barnes Banking Company, Kaysville, UT

- 01/15- St. Stephen State Bank, St. Stephen, MN

- 01/15- Town Community Bank & Trust, Antioch, IL

- 01/22- Bank of Leeton, Leeton, MO

- 01/22- Evergreen Bank, Seattle, WA

- 01/22- Charter Bank, Santa Fe, NM

- 01/22- Columbia River Bank, The Dalles, OR

- 01/22- Premier American Bank, Miami, FL

- 01/29- First Regional Bank, Los Angeles, CA

- 01/29- American Maine Bank, Bainbridge Island, WA

- 01/29- First National Bank of Georgia, Carrollton, GA

- 01/29- Florida Community Bank, Immokalee, FL

- 01/29- Marshall Bank, N.A., Hallock, MN

- 01/29- Community Bank & Trust, Cornelia, GA

- 02/05- 1st American State Bank of Minnesota, Hancock, MN

- 02/19- George Washington Savings Bank, Orland Park, IL

- 02/19- La Jolla Bank, FSB, La Jolla, CA

- 02/19- Marco Community Bank, Marco Island, FL

- 02/19- The La Cost National bank, La Cost, TX

- 02/26- Rainier Pacific Bank, Tacoma, WA

- 02/26- Carson River Community Bank, Carson City, NV

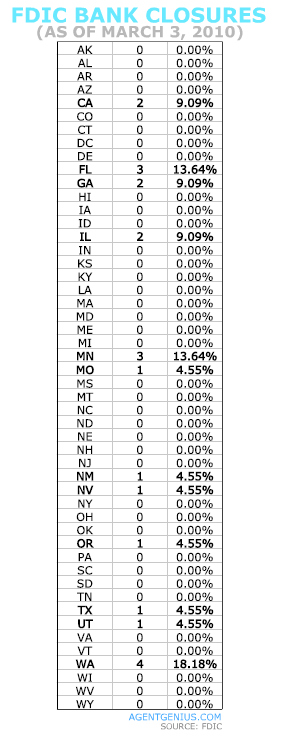

Want to know how your state is faring? Check out our breakdown of closures by state:

What now?

Forecasting failed banks is difficult, according to Ben Goheen, Realtor and Appraiser with Bridge Realty in Stillwater, MN. “Banktracker is tracking the troubled asset ratio of these banks. This is gathered from public information that banks submit to the FDIC every quarter,” said Goheen. “The FDIC doesn’t make the list of banks they’re going to shut down available to the public, so this is the best resource of how safe any lending institution is.”

Goheen wrote about the FDIC closing banks and at the time wrote, “the FDIC sees this as more of a short-term problem.”

Could this be so? Time will tell, but it’s a tricky economic health indicator to monitor due to closed doors.

UPDATE: to round out the third quarter, March saw a slew of bank closures as listed below but not accounted for in the stats graphic above:

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Mike

March 4, 2010 at 6:00 am

Haven’t we been hearing and reading for a few years now that CRE will hit the Regional and local banks very hard? Perhaps it is happening. How bad will it get? It’ll be interesting.

Justin Boland

March 4, 2010 at 9:36 am

Looking over that list, though, I don’t see Bank of America on there anywhere. If this was really weeding out the weak and punishing bad risks, I don’t think we’d be seeing so many community banks going under.

Hopefully when the dust from the housing crisis settles and the economy starts to turn around, Washington DC will take a serious look at the FDIC and their behavior during this time. I know responsibility and rational thought is an awful lot to ask from our elected representatives, but a boy can dream.

Al Lorenz

March 4, 2010 at 12:05 pm

Banking will look like a different industry in another year or two, just as it is different than it was 3 years ago. Hopefully more folks will start making sure that they don’t have deposits at risk. The reduced number of banks in the longer term will mean fewer choices and less competition. I suppose we’ll find out that works.

Jay Ferguson

March 5, 2010 at 12:55 pm

As a former commercial lender and having lived through the S&L failures in Texas, this is just part duex. tradional lender is needed, back to the basics, and more time or distance from 2008-2009.