Rents up, home prices up, one still reigns

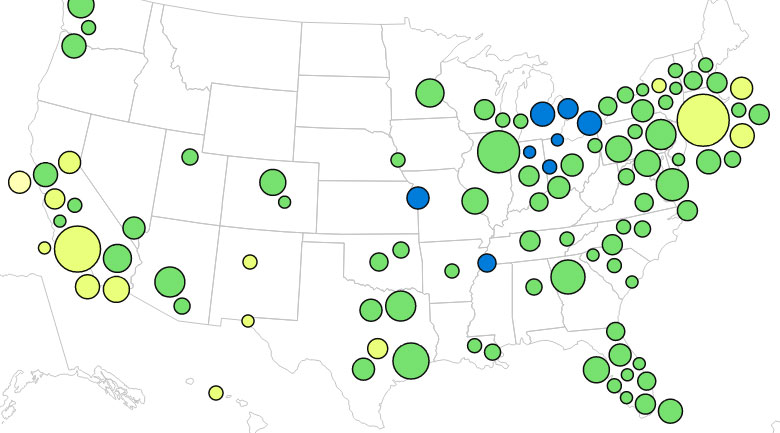

According to the Trulia Winter 2013 Rent vs. Buy Report, buying a home in the top 100 major metros is cheaper than renting, even in light of home prices rising. The company analyzes homes for sale and rent on the site from December 1, 2012 to February 28, 2013 factoring in transaction costs, opportunity costs, and taxes to uncover that although rents and home prices are both rising, home ownership is still more affordable. Trulia says buying a home is 44 percent cheaper than renting nationwide, down just slightly from 46 percent in 2012.

“Although buying a home is still cheaper than renting, the gap is closing,” said Dr. Jed Kolko, Trulia’s Chief Economist. “In 2013, home prices should rise faster than rents, and mortgage rates are likely to rise in the next year as the economy improves. By next year, buying could be more expensive than renting in some housing markets, even for people with the best credit.”

Housing affordability and mortgage rates

Asking home prices rose 7.0 percent year over year in February, which outpaced rents which rose 3.2 percent in the same period. Trulia reports that low mortgage rates (averaging 3.5 percent at the end of February) have kept homeownership costs from rising, and kept affordability high.

“Even in each of the 100 largest metros, buying is more affordable than renting with the range differing significantly from being 70 percent cheaper to buy than rent in Detroit, but only 19 percent cheaper in San Francisco,” Trulia reports.

The challenge that remains for housing

While a positive portrait of homeownership emerging, the stark reality is that many potential home buyers still won’t qualify for a mortgage under current lending conditions, and those that do qualify may not enjoy the lowest of rates unless their credit is near perfect.

That said, Trulia notes that “getting a higher rate does not mean homeownership is completely out of reach. Even with a 5.5 percent mortgage rate, buying a home is still cheaper than renting in almost every market. Only in San Francisco does homeownership become slightly more expensive than renting at the higher rate.”

Eventually, the rent bubble will pop and the tide will change once again, now time is the primary factor.

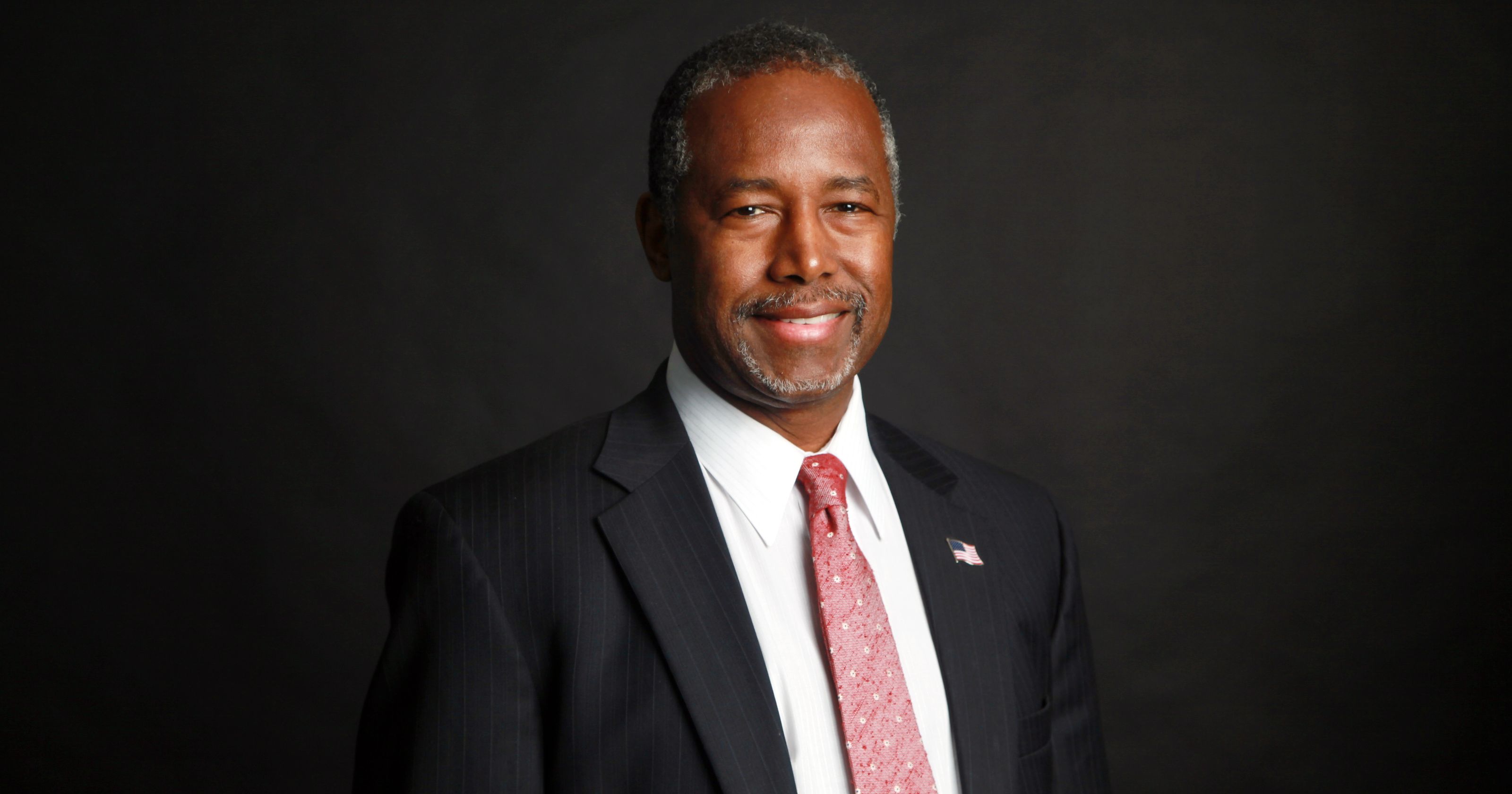

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.