Multi-billion dollar mortgage settlement

In Februay, the historic $25 billion mortgage settlement was finalized between 49 states’ attorneys general, the federal government and America’s largest mortgage servicers Bank of America, JPMorgan Chase, Wells Fargo, Cigitroup and Ally Financial for illegal foreclosure practices.

Settlement details were not made completely public immediately, but the the U.S. Department of Justice has filed agreements with all five servicers separately, each consisting of over 300 pages in which relief measures were outlined in detail that will go toward helping underwater borrowers and victims of illegal foreclosures. Relief measures and details on how foreclosures would be handled in the future were formerly only made public by statements to the press by officials and single page summaries.

The settlement that stalled repeatedly for over a year is still pending final judicial approval, but is expected to be approved.

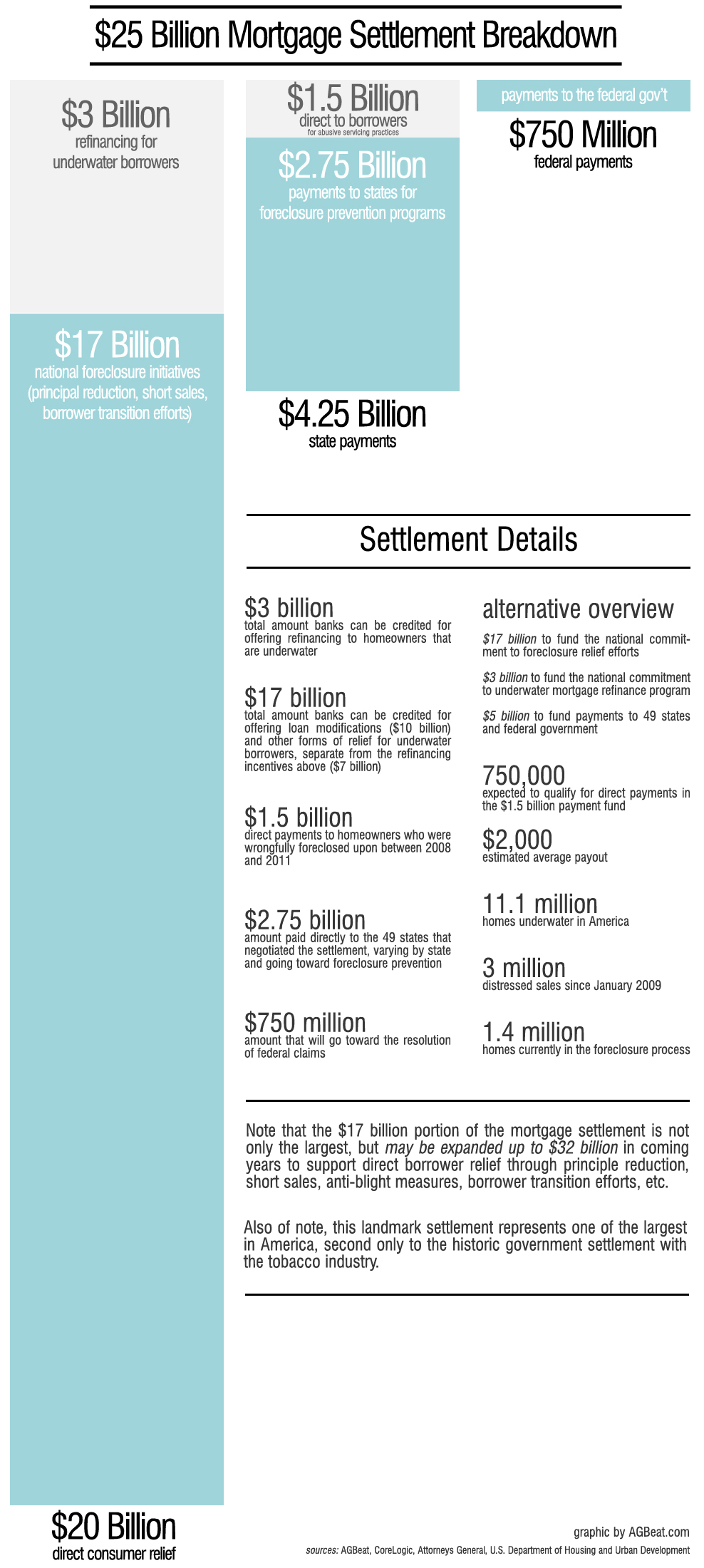

Full breakdown of the settlement

Click the image below to enlarge:

- $3 billion: total amount banks can be credited for offering refinancing to homeowners that are underwater

- $17 billion: total amount banks can be credited for offering loan modifications ($10 billion) and other forms of relief for underwater borrowers, separate from the refinancing incentives above ($7 billion)

- $1.5 billion: direct payments to homeowners who were wrongfully foreclosed upon between 2008 and 2011

- $2.75 billion: amount paid directly to the 49 states that negotiated the settlement, varying by state and going toward foreclosure prevention

- $750 million: amount that will go toward the resolution of federal claims

Alternative overview:

- $17 billion: to fund the national commitment to foreclosure relief efforts

- $3 billion: to fund the national commitment to underwater mortgage refinance program

- $5 billion: to fund payments to 49 states and federal government

Additional details:

- 750,000: expected to qualify for direct payments in the $1.5 billion payment fund

- $2,000: estimated average payout

- 11.1 million: homes underwater in America

- 3 million: distressed sales since January 2009

- 1.4 million: homes currently in the foreclosure process

Note that the $17 billion portion of the mortgage settlement is not only the largest, but may be expanded up to $32 billion in coming years to support direct borrower relief through principle reduction, short sales, anti-blight measures, borrower transition efforts, etc.

Also of note, this landmark settlement represents one of the largest in America, second only to the historic government settlement with the tobacco industry.

Additional data:

Settlement documents:

- Complaint (pdf)

- Ally/GMAC Settlement (pdf)

- Bank of America Settlement (pdf)

- Citi Settlement (pdf)

- JPMorgan Chase Settlement (pdf)

- Wells Fargo Settlement (pdf)

Additional information:

- Settlement Executive Summary (pdf)

- Settlement Fact Sheet (pdf)

- Benefits to Servicemembers and Veterans (pdf)

- Servicing Standards Highlights (pdf)

Settlement parties:

- Ally/GMAC: 800-766-4622

- Bank of America: 877-488-7814

- Citi: 866-272-4749

- JPMorgan Chase: 866-372-6901

- Wells Fargo: 800-288-3212

- State Attorneys General

- Conference of State Bank Supervisors

- United States Department of Justice

- U.S. Department of Housing and Urban Development

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.

Baltimore Real Estate

March 24, 2012 at 4:50 pm

It would have been better if the federal government did not get involved. Basically the larger banks are receiving incentives for executing bad loans and the borrowers who could not afford to make the payments are getting a free pass to reduce their mortgage or get out of debt via a short sale.

While this does benefit banks, consumers and the national real estate recovery, the cycle will most likely repeat itself in the future.

Attorney Wendy Alison Nora

March 24, 2012 at 5:59 pm

The 5 banks have only agreed to stop breaking the law! And, they have not stopped breaking the law. Bank of America is producing forged original notes in Wisconsin courts.

Furthermore, this agreement to stop breaking the law only applies to the 5 banks involved. Fannie Mae is still using robo-signers and is failing to prove its standing in Wisconsin state courts and bankruptcy courts. To me, the most chilling part of the settlement is in Exhibit F, in which the US Trustees for bankruptcy courts have to stop all discovery of false claims filed in bankruptcy courts by the 5 banks prior to February 8, 2012. I do not believe that the false claims will be corrected by the law firms for the 5 banks and the termination of US Trustee investigations for false claims prior to February 8, 2012 essentially exonerates the 5 banks from bankruptcy crimes. Crimes cannot be prosecuted where there is no investigation.

The United States District Court for the District of Columbia should not approve this settlement.

bficker

March 24, 2012 at 7:14 pm

What I love is how there is all this money, but no one seems to know how to access it. The website they set up for Oregon says that it could take three years before they sort out who gets what. Doesn’t do much to help those who need it now.