In 2007, the FDIC seized only 3 banks, in 2008 they shut down 25, and in 2009, 130 banks failed! We’re only finishing out the second quarter of 2010 and 86 banks have already been seized. Florida, Georgia and Illinois have been hit the hardest so far this year, accounting for a combined 44% of all bank closings.

In 2007, the FDIC seized only 3 banks, in 2008 they shut down 25, and in 2009, 130 banks failed! We’re only finishing out the second quarter of 2010 and 86 banks have already been seized. Florida, Georgia and Illinois have been hit the hardest so far this year, accounting for a combined 44% of all bank closings.

We predicted that at the acceleration rate over 2009 that 2010 would experience 178 closed banks and so far, we’re still on track for 2010 to see as many bank closures as 2007, 2008 and 2009 combined.

In the first quarter, it was said that the FDIC sees bank closures as a “short term problem,” yet each quarter this year has seen 43 bank closures each – that’s 88% more bank closures per quarter so far than the entire year of 2008 saw.

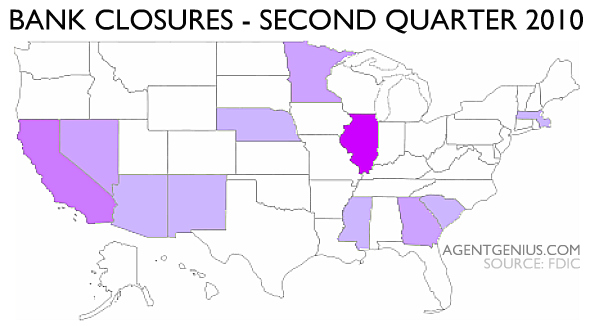

Below are heat maps comparing the quarters- the lighter the state, the fewer bank closings:

Q2 Closings:

To see all banks that closed in the first quarter click here. Below are all of the second quarter FDIC seizures:

- 04/09- Beach First National Bank, Myrtle Beach, SC

- 04/16- City Bank, Lynnwood, WA

- 04/16- Lakeside Community Bank, Sterling Heights, MI

- 04/16- First Federal Bank of North Florida, Palatka, FL

- 04/16- AmericanFirst Bank, Clermont, FL

- 04/16- Riverside National Bank of Florida, Fort Pierce, FL

- 04/16- Butler Bank, Lowell, MA

- 04/16- Innoavtive Bank, Oakland, CA

- 04/16- Tamalpais Bank, San Rafael, CA

- 04/23- Peotone Bank & Trust, Peotone, IL

- 04/23- Wheatland Bank, Naperville, IL

- 04/23- Amcore Bank, Rockford, IL

- 04/23- Broadway Bank, Chicago, IL

- 04/23- Citizens Bank & Trust, Chicago, IL

- 04/23- New Century Bank, Chicago, IL

- 04/23- Lincoln Park Savings Bank, Chicago

- 04/30- Champion Bank, Creve Coeur, MO

- 04/30- Frontier Bank, Everett, WA

- 04/30- BC National Banks, Butler, MO

- 04/30- CF Bancorp, Port Huron, MI

- 05/07- Access Bank, Champlin, MN

- 05/07- Towne Bank of Arizona, Mesa, AZ

- 05/07- 1st Pacific Bank of California, San Diego, CA

- 05/07- The Bank of Bonifay, Bonifay, FL

- 05/14- Midwest Bank & Trust, Elmwood Park, IL

- 05/14- New Liberty Bank, Plymouth, MI

- 05/14- Southwest Community Bank, Springfield, MO

- 05/14- Satilla Community Bank, Saint Marys, GA

- 05/21- Pinehurst Bank, Saint Paul, MN

- 05/28- Sun West bank, Las Vegas, NV

- 05/28- Bank of Florida- Tampa, Tampa, FL

- 05/28- Bank of Florida- Southwest, Naples, FL

- 05/28- Granite Community Bank, Granite Bay, CA

- 05/28- Bank of Floriday- Southwest, Fort Lauderdale, FL

- 06/04- TierOne Bank, Lincoln, NE

- 06/04- Arcola Homestead Savings Bank, Arcola, IL

- 06/04- First National Bank, Rosedale, MS

- 06/11- Washington First International Bank, Seattle, WA

- 06/18- Nevada Security Bank, Reno, NV

- 06/25- High Desert State Bank, Albuquerque, NM

- 06/25- Peninsula Bank, Englewood, FL

- 06/25- First National Bank, Savannah, GA

Bank closures continue to be a tricky economic health indicator, but we monitor closely not only how the real estate sector is performing but how lending is impacted over time.

Forecasting bank closures is tricky, but we are sitting at a steady pace currently for local banks to continue their fall. Perhaps the big box banks that got bailouts will scoop up the smaller banks. There are many political angles to take when it comes to bank closures and bailouts- let’s hear your take in the comments.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Real Estate Feeds

July 7, 2010 at 8:08 pm

FDIC calls bank closures a short term ill but closure rates remain high: In 2007, the FDIC siezed only 3 banks, in… https://bit.ly/d13Veb

kristin terry

July 7, 2010 at 8:19 pm

FDIC calls bank closures a short term ill but closure rates remain high: In 2007, the FDIC siezed only 3 banks, in… https://bit.ly/cYutzu

RealEstate Babble

July 7, 2010 at 8:45 pm

AgentGenius: FDIC calls bank closures a short term ill but closure rates remain high https://bit.ly/aavH3L Full https://bit.ly/d14ppJ

Michele

July 7, 2010 at 10:48 pm

FDIC calls bank closures a short term ill but closure rates remain high: https://bit.ly/8YGyvx via @addthis

MetroBrokersTV

July 8, 2010 at 12:30 am

FDIC calls bank closures a short term ill but closure rates remain high https://ow.ly/182FUo

Natasha Hall

July 8, 2010 at 12:42 am

FDIC calls bank closures a short term ill but closure rates remain high https://ow.ly/182CD3

Property Marbella

July 8, 2010 at 5:44 am

Bank closing and foreclosure together with short sale goes hand in hand. The four biggest foreclosure states are Florida, California, Nevada and Arizona; they stand together for over 50% of foreclosure. So look at the bank closed map again and you know where the next banks are going down.

Joe Loomer

July 8, 2010 at 3:47 pm

More bank data – my head hurts.