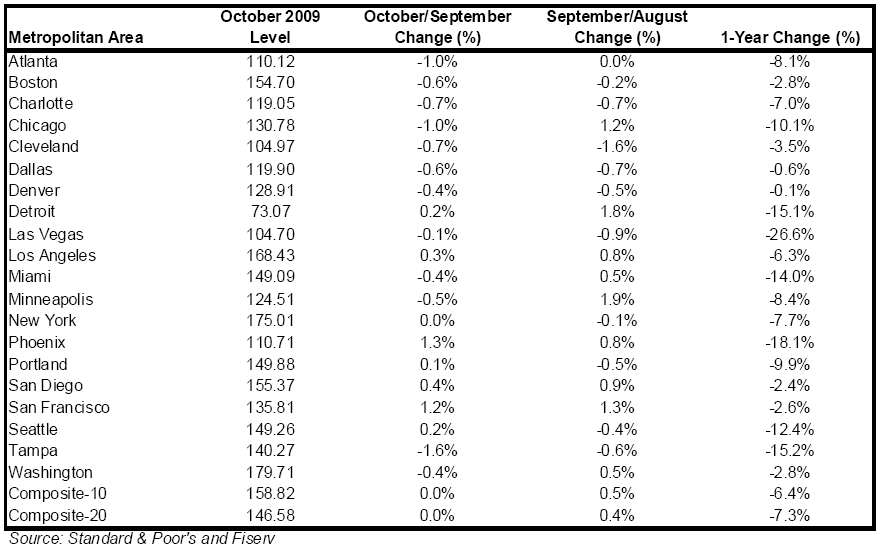

S&P Case-Shiller Index

Today’s S&P Case-Shiller Home Price Index numbers show that October marked the ninth month of improved home prices across the nation with all 20 cities in their composite showing higher numbers. Although October barely saw a change and some are saying prices are flat, if you look at the last several years, we just might be seeing a recovery:

What is it like in your market?

We know, we know, all real estate is local. Some cities have spiked, others are still declining but overall it appears we just might be seeing a recovery in home pricing which is one of the main ingredients of an overall market recovery.

Andrea Geller with Sudler Sotheby’s International Realty told us that “in the Chicago real estate market, a greater number of transactions are occurring and are negatively impacting pricing as a result of distressed sales. In 2010 we should continue to see an increase in the numbers of homes sold but values will further be effected by short sales and foreclosures.”

David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s said, “coming after a series of solid gains, these data are likely to spark worries that home prices are about to take a second dip. Before jumping to conclusions, recognize that the one time that happened at the beginning of the 1980s, Fed policy saw dramatic reversals, which is very different from the stable and consistent Fed policy we have today. Further, sales of existing homes – those included in the S&P/Case-Shiller Home Price Indices – have been very strong in recent months, working off the inventories of houses for sale. At the same time, housing starts remain weak, fears that the market will be swamped by a wave of foreclosures are heard and government programs aimed at the housing market will expire in the first half of 2010.”

So, what do you think- is the market in for a recovery in 2010 or do you think a full recovery will be realized in 2011 or beyond?

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Ruthmarie Hicks

December 30, 2009 at 1:45 pm

I’m in Westchester NY and the local market trends are all over the map. Some areas appear to be bottoming out while others are still in decline. There are even a couple of bidding wars here and there for more desirable properties in great locations. Overall the market is still suppressed (though volume is up this year) and the very high end $2 million+ which I don’t generally service – is doing very poorly. What is selling is great location and prices under about $850k thus avoiding jumbo loans.

Joe Loomer

December 30, 2009 at 3:27 pm

We started the year down 28% on 2008’s numbers, but have rebounded solidly since mid-summer to the point we’re on track to match last year’s sales – no small feat given the way the year started. Prices are surprisingly stable, and our average sales price only came down about eight grand since 2006.

Days on the market, however, have remained in triple digits all year, with an absorption rate in January of last year of 16.1 (now down to about 11).

In short – Augusta, Georgia – the state’s second largest city – is plodding along in what seems to be the bottom of this Buyers Market cycle.

Our recovery through 2010 should be very slow, especially given new FHA downpayment (5%) and seller contribution (max 3%) requirements and the expiration of the tax credit in April. Over 50% of our market is VA/FHA – has been for some time. This means anyone who purchased in 2005 or later can’t sell because they don’t have the equity. Folks smart enough to realize this (or who have a smart enough Realtor) rent their homes if they’re moving, which has kept our inventory from skyrocketing. I look for a good spring, followed by a bad summer and not-so-great winter in 2010 – keeping us at about this year’s numbers.

Keith Lutz

December 30, 2009 at 4:36 pm

Charlottes market has been down, but we came to the party late. I expect since NC is an inbound state, with North Carolina (58.2%) capturing third place (dropping from the No. 1 spot in 2007) we will see some recovery in the spring… finger crossed!

newhomelistings

January 4, 2010 at 5:12 pm

The Charlotte market has been down but there are a lot of promising factors in its recover. Charlotte has been able to actually create jobs recently. I believe that job creation will be a huge factor in Charlotte’s recovery in the coming months. Job creation, Im sure, has played a large part in the rebound from many of these markets listed.