A New York Communities for Change study points to failed HAMP results and claims JP Morgan Chase has refused to modify loans responsibly. “Affordable, permanent, transparent, and timely mortgage modifications using principle reduction are necessary to protect New York families, communities and economies.”

A New York Communities for Change study points to failed HAMP results and claims JP Morgan Chase has refused to modify loans responsibly. “Affordable, permanent, transparent, and timely mortgage modifications using principle reduction are necessary to protect New York families, communities and economies.”

As a result, Churches United to Save and Heal (CUSH, a New York coalition of dozens of religious leaders) recently organized a protest in front of JP Morgan Chase’s world headquarters on Park Avenue in New York City to rid the bank of the demons of “selfishness and avarice,” based on the aforementioned study’s findings that 6% of New York homeowners seeking a loan modification have gotten it in the past year, leaving 94% unserved.

The group, led by CUSH leaders Bishop Orlando Findlayter, Minister Patricia Malcolm and Reverend Allan Ramirez met to perform an exorcist on the bank. Although not performed in the traditional sense as by the Catholic church, the group organized to “sprinkle holy water on this evil empire,” Reverend Ramirez said on the sidewalk of Park Avenue.

The group met and began the ritual against “unfair practices as it relates to the modification of mortgages.” They attempted to enter the Chase building and were told by security that Chase was closed, but buy waiving their blue Chase cards and asking to close their account, the religious leaders gained entry to the building to finish the ritual as they waited for their accounts to be closed.

On May 24, 2010 CUSH organized a protest in Lower Manhattan, calling for immigration reform, resulting in civil disobedience arrests of Bishop Orlando Findlayter and 36 others, according to Findlayter.

According to Malcolm, Minister and Huffington Post blogger, on March 18th at noon, United Auto Workers National President, Bob King will be joining their next protest in New York at the same Chase location to “fight against the bank’s predatory practices.”

Malcom says “everyone who is disgusted by the attacks on homeowners and workers because of Chase’s recklessness needs to be heard as well. That is why this fight continues.”

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.

Jim Lee

March 14, 2011 at 10:42 am

This is novel. I hope they don’t ask Chase to repent next.

Lani Rosales

March 14, 2011 at 12:45 pm

Jim, wouldn’t THAT be interesting!?

Benn Rosales

March 14, 2011 at 12:28 pm

Amen – lol this is awesome!

Lani Rosales

March 14, 2011 at 12:46 pm

I agree! I’ve never heard of an exorcism at a protest, that’s an interesting approach. Also, I like the part where they aren’t allowed in, so they flash the bright blue Chase card…

Mel

March 20, 2011 at 7:13 am

I hate that ripoff thieving crook ass bank. Helping America my ass…Ripping off the taxpayers and poor in America more like it.

Greedy bastards!

They tried stealing the equity in my house. They would never give me a payoff quote. By the time I hired loan sharks, lawyers, realtors, paid fees fines etc…I lost 50k…What kind of rip off bs is that where you can’t sell your house withoff a payoff quote from them. All they have to do is string it out till you fall so far behind thay take your home from you. I had many sales fall through all for more money.

I would call them and they and then wait a week and they would say they never talked to me or would always refer me around someswere else.Over and over and over again. I would call trustee and they would say it would take a week or two. After a week or two they would say I had to call Chase…back and forth. Finally after more than a month they would say they couldn’t get a payoff quote because Chase computer system is being redone and I would have to wait..all the while my house is getting closer and closer to the auction date. I call Chase they have the same computer system they always had and I will have the quote in about a wek or two…a week or two they have no idea and have to start over. I came one day from burning that house down and killing myself. I had an angel of a realtor helping me record. photo copy, get me loan sharks talk with them for hours on end or I would be dead today.

I had to photo copy, duplicate everything and finally threaten their lawyers with lawsuits. They are the most evil I have ever dealt with. Everytime I would call I would have to start all over again and each time wait a week or two in between. Then call for payoff quote and have to do it all over again. That is motis operandi.

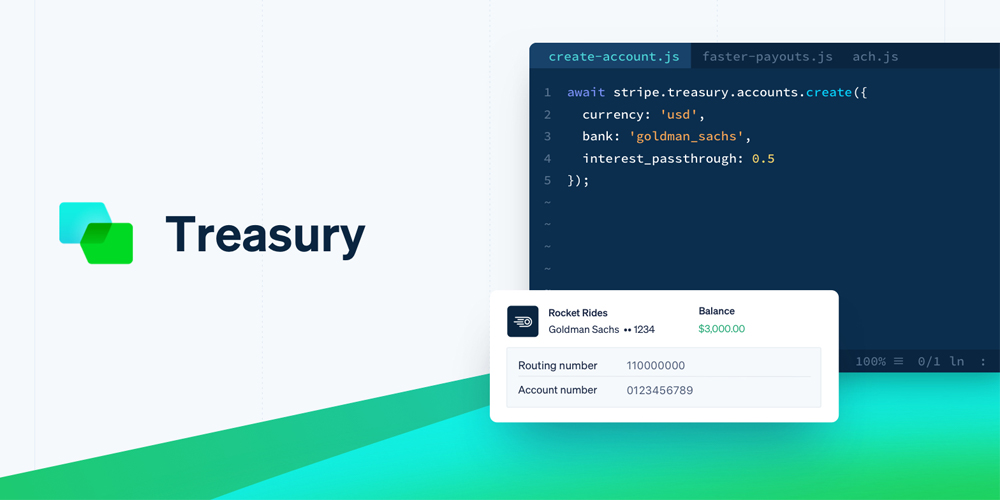

They are evil and when their CEO gets to be Treasury Secretary we are all screwed.

Helping America my ass. Ripping off the poor and tax payers more like it. Evil, Evil, Evil and I hope they all burn in hell. The stress they put me and what they put others through is criminal at the very least.

I haven’t read one positive thing about them yet other than their propaganda commercials that they spend millions of our hard earned money on. Burn in hell Chase!

bennett

June 4, 2011 at 1:47 pm

Exorcisms and flash mobs are coming to a bank near you – or as Obasma famously said once to a group of banksters, "Gentlemen, (?) if you do not mend your ways they will come at you with pitchforks and torches"

What ever happened to President Obama since then?

Ever tried to get a mortgage modified? Pigs will fly first.