Mel Watt nominated to lead FHFA

President Obama has nominated Democratic Rep. Mel Watt to lead the Federal Housing Finance Agency (FHFA) which regulates Fannie Mae and Freddie Mac, after endless contention between the parties over the government’s role in housing, particularly principal forgiveness, which current FHFA Director, Ed DeMarco remains firmly against, putting him at odds with the White House, leading to many to call for his resignation.

The moment Obama’s nominee was named, it brought to mind his 2010 nomination of Joseph A. Smith, Jr. to replace DeMarco which failed miserably, as this nomination will also likely do, as the confirmation will likely be blocked by Senate Republicans.

Watt fought for civil rights, was raised in a shack

Watt wasn’t born with a silver spoon in his mouth, no, he literally grew up in a shack without electricity or plumbing, yet made it all the way to law school at Yale, a history that is impressive and worthy of respect. He worked at a major civil rights law firm right out of school, and later was a campaign manager. Also a savvy businessman, he has invested in a restaurant and hotel and owns a nursing home. Watt was elected to the state senate in the 80s, and was ultimately elected to Congress in 1992.

Democratic leader Nancy Pelosi said, “Mel Watt has never failed to fight on behalf of homeowners facing foreclosures, and he worked with Members to pass tough federal anti-predatory lending legislation in Wall Street Reform to better protect underserved Americans who are looking for a home loan. Once known as the conscience of the North Carolina Senate, he will provide a much-needed moral compass to the operations and housing interests of our financial industry.”

Pelosi added, “Elected as one of the first African Americans in over 90 years to serve North Carolina in Congress, Mel has overcome obstacles and beat back outside influence in order to fight for the best interests of his district. It is a source of pride to all of his colleagues in the House that President Obama has asked Mel to lead the FHFA and bring his tenacious spirit to the task of protecting and promoting the economic security of the middle class and the American people.”

Watt is blamed for the subprime crisis

Political columnist, Charles C. Johnson notes that “In 2002, Watt teamed up with Freddie Mac and Fannie Mae, Bank of America, BB&T, and UJAMMA Inc., to announce Pathways to Homeownership, a pilot initiative designed to give home loans to welfare recipients. A press release from Watt’s campaign office in October 2002 said that the loans to the welfare recipients would require “as little as $1,000 of the down payment to come from their own funds” and that the city of Charlotte would help borrowers obtain a “down payment subsidy” to cover the rest of the 3% down payment.”

Johnson observes that, “If approved to head up Federal Housing Finance Agency (FHFA), Watt will be regulating the very government agencies whose rules he negated in 2003.” It is noteworthy that Watt and Barney Frank were on the same page with subprime lending prior to the housing crash.

Watt at center of several controversies

Aside from the fact that this nomination is said to be a complete waste of time since it is nearly impossible that Watt will be confirmed, Watt has been and continues to be at the center of various controversies, for example, Watt supports the Stop Online Piracy Act (SOPA), mocking critics by saying that it is “beyond troubling to hear hyperbolic charges that this bill will open the floodgates to government censorship.”

Watt was found guilty of racial gerrymandering in his district in 1994 and his response to a 2009 investigation by the Office of Congressional Ethics was to slash funding for the Office, even though he was cleared of wrongdoing. Nearly a decade ago, he went head to head with Ralph Nader who demanded and never received an apology for Watt’s racist rant, allegedly stating, “You’re just another arrogant white man — telling us what we can do — it’s all about your ego — another [expletive] arrogant white man.”

In 2009, Ron Paul’s bill HR 1207 called for mandatory audits of the Federal Reserve, and in subcommittee, Watt altered the bill so substantially that all audits were essentially removed, a move which Paul said left nothing ofthe original bill. When Paul called for the bill to be restored, Chairman Barney Frank sided with Watt. The stripping of the bill was suspect as Bank of America is headquartered in Watt’s district and threatened to leave.

Most agree this nomination will never succeed

Watt is an amazing success story, but most agree that his nomination will not pass the confirmation stage, not only for the aforementioned reasons, but because the FHFA director is the most powerful person in housing, so his existing ties and policies make him unpopular on both sides of the aisle. There are even rumors that the next fall guy is already being set up for the next housing slump in the cycle.

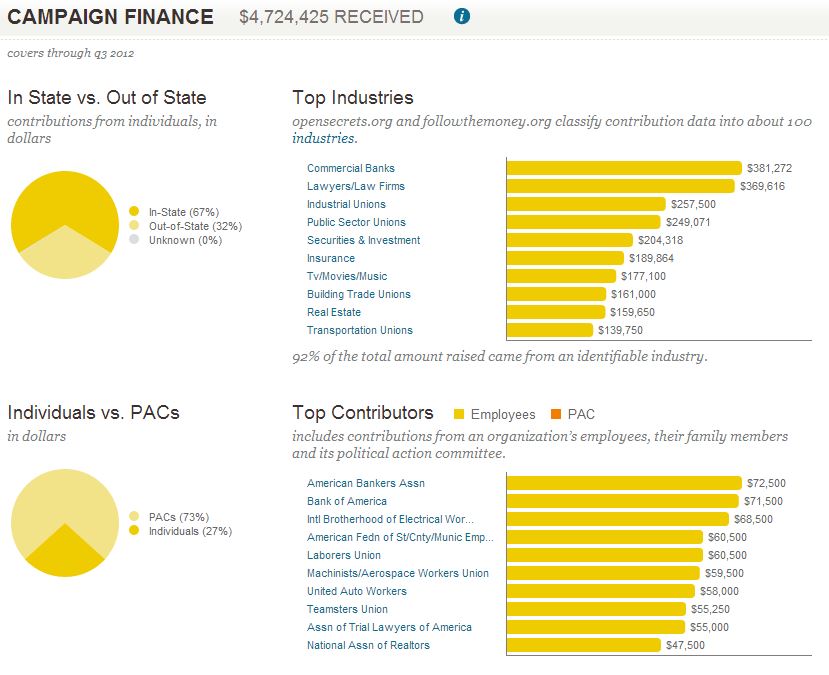

Lastly, Watt will not likely be confirmed because as “Deep Throat” once said, all you have to do is “follow the money.”

Click for interactive version of contribution data:

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Ed Neuhaus

May 6, 2013 at 3:33 pm

oh this is exciting! Not working has even more advantages. Best of luck to this guy.