Rough year for banks

We all know it’s been a tough year for the economy and the falling dominoes of banks is just one of the scars America has to prove it. On Friday, the FDIC closed six more banks, bringing the total to 130 in 2009 alone.

We all know it’s been a tough year for the economy and the falling dominoes of banks is just one of the scars America has to prove it. On Friday, the FDIC closed six more banks, bringing the total to 130 in 2009 alone.

The recent closings weren’t international banks or big conglomerates, rather the most recent gravestones belong to smaller banks:

- AmTrust- Ohio

- Benchmark Bank- Illinois

- Greater Atlantic Bank- Virginia

- Tattnall Bank- Georgia

- Buckhead Community Bank- Georgia

- First Security National Bank- Georgia

One look at the FDIC Failed Bank List and it’s staggering how many banks have closed this year compared to previous years, just scroll down. In 2008 only 25 banks failed and only THREE failed in 2007 to give you an idea of the acceleration of FDIC seizures. Along with many other factors, the health of banks is an economic indicator that often goes overlooked by real estate professionals– it’s not just the health of mortgage originators or insurers that is important in forecasting.

Georgia alone accounts for nearly 20% of all bank closings this year and according to Brad Nix, Broker of Maxsell Real Estate in Atlanta, “Georgia had too many banks to begin with. Sprawl in Metro Atlanta encouraged many new banks in the area to start-up and fund the residential growth. Many of the failures are from smaller community banks which had too much money in A&D loans (Acquisition & Development). Atlanta has a surplus of 10 years worth of developed lots in some of the outlying suburbs. Overbuilding supply and demand halting is a dangerous recipe for banks.”

What’s on the horizon?

While this isn’t the case in all states, it is a common tale. But what’s next? Nix said, “Atlanta will recover as the valve was shut off to new construction over a year ago. Once foreclosures are flushed from the system and some of the blue pipe farms just go back to being real farms, I expect to see Metro Atlanta to be one of the early markets to emerge from this cycle.

The amount of bank closures in Atlanta had less to do with money-backed securities and more to do with A&D loans being defaulted upon. The commercial downturn hasn’t helped things. Another big factor is that local Atlanta banks started lending money on the coasts of Georgia, Florida, and the Carolinas by partnering with other banks – too many participation and not enough local knowledge making decisions.”

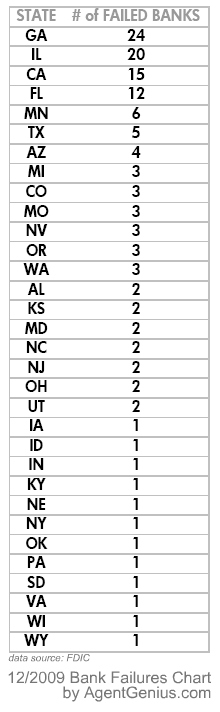

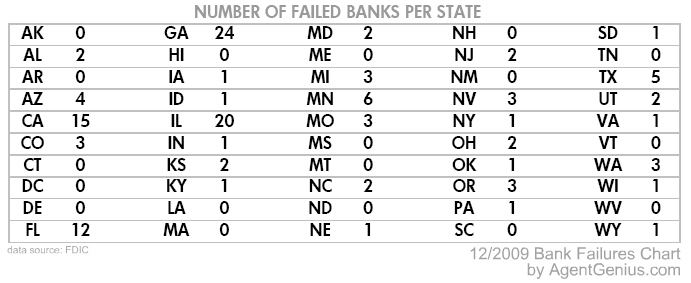

Here’s the 2009 bank closing breakdown by state:

What is the climate like in your state? What factors have contributed to the changes in your local economy?

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

sjkurtz

December 7, 2009 at 1:55 pm

Now is the time to buy if you can. If you have the cash and the credit, the bottom is either here or we are close to it. Everyone who is solvent has been waiting for a long time.

Gotta love capitalism!