What is the Curse-Of-Experience?

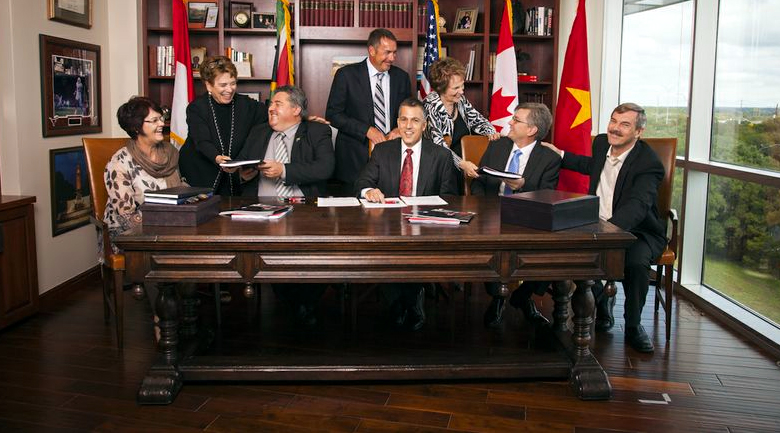

The skies were tall, blue and sun glasses bright. Lounging in circled chairs sat 3 supremely smart real estate types, and me. One woman and three dudes. We were in Austin, sitting in The GoodLife Team’s backyard. We met to share ideas and shoot the breeze about our beloved real estate industry. (FYI, while we four played, Kristinna, Gary, Jack and the rest of The GoodLife Team were working with and serving others – thanks for letting us hang out.)

The conversation drifted into eLead territory and the horrid reality of piss-poor conversation rates, unserved consumers, lost opportunities and income. Eric, a young (compared to me), accomplished and brilliant entrepreneur, shared his thoughts on a strategy process service he was contemplating. He was aiming to turn what many real estate agents consider Fools Gold and frustration, into 22K Gold. I was listening hard. In our company and in my office, the lost opportunities we were talking about were opportunities we squandered struggled with too.

After Eric outlined how his service might work, he arrived at the part where he shared what his GCI-Generating-Service might cost a real estate broker to swing it into action. Like I shared earlier Eric’s brilliant, so naturally components of his proposed approach were counter-conventional in nature. Eric asked what we thought. Linsey and Rob responded, then I chimed in.

Most of it sounded pretty good, but the fee structure he was imagining would never work. Brokers would never go for such a thing. I know, I’ve been doing this for 30+ years, we’ve never done it that way. The conversation continued.

There was some back and forth troubleshooting, um-hums, whys, why nots and what have yous. Next, Eric smiled and asked a question. I’ll never forget the moment. His smile was genuine, relaxed and hinted amusement.

Eric, “Do you know why you think the fee structure won’t work Ken?”

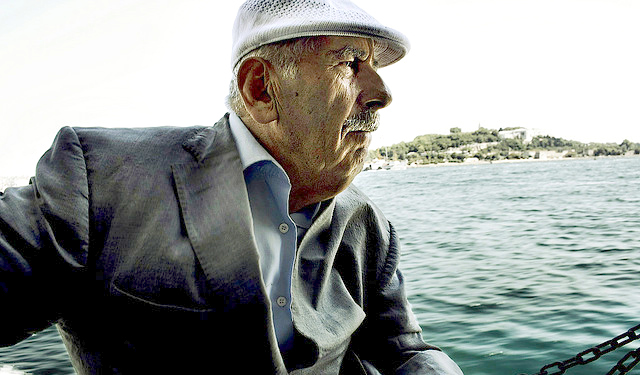

I thought, “Yeah, I know why it work. Because nobody will go for it. I’ve been around since there were MLS books, one page contracts with pink, blue and yellow carbon copies and pay phones. I’ve survived 20% mortgage rates and three real estate depressions busts. I’m an experienced Pro – a 32 year Vet. I know what I know.” But that’s not what I said.

I said, “No, why?”

Eric, “You don’t think it will work because you’ve been in the business for 30 years.”

My eyes widened. My pupils dilated. I remember leaning back and tilting my head. I could feel the sun beaming down on my ever growing bald spot (but that’s another story?), and I knew. He was dead-bang right. In this case, my experience was not a benefit. In an instant I realized that my reliance on experience, when mixed with lazy thinking, was not a asset or a blessing, it was a hateful liability!

That’s what the Curse-Of-Experience is. It’s when we rush to conclusions based on previous experiences. It’s when we approach opportunities and challenges with a half-open or closed mine. It’s when we think we know it all and we forget that everything is ever-changing.

If we allow it, our experience can become a curse and a liability, instead of a blessing and an asset.

The Curse-Of-Experience murders our opportunities when we become comfortable and over-confident. When we’re comfortable and over-confident, we don’t what to mess with what we think we know works. When we’re comfortable and over-confident, instead of thinking ahead, learning and leading, we protect our status-quo. Before you know it, we’re falling behind and earning less. Further and further behind, earning less and less. Ugg. The Curse-Of-Experience is real and to be avoided at all costs.

I’ve learned my lesson. These days, here’s what I do. . .

When I approach a challenge, I try to remember to consciously pause and ask myself to suspend my experience and wide-open my mind and imagination.

Yeah, how to keep the Curse-Of-Experience from murdering your real estate business can be that simple.

As a friend, I thought I’d share my experience with you. I don’t know if on occasion you suffer from this curse as I do? But, if on occasion you do too, hopefully we can all avoid future missteps and course correct our current behavior.

Thanks for reading. Cheers to a good year.

PS. I want to thank Eric Stegemann for reminding me of the importance of keeping my eyes, ears, mind and imagination – wide open. Thanks man.)

Ken Brand - Prudential Gary Greene, Realtors. I’ve proudly worn a Realtor tattoo for over 10,957+ days, practicing our craft in San Diego, Austin, Aspen and now, The Woodlands, TX. As a life long learner, I’ve studied, read, written, taught, observed and participated in spectacular face plant failures and giddy inducing triumphs. I invite you to read my blog posts here at Agent Genius and BrandCandid.com. On the lighter side, you can follow my folly on Twitter and Facebook. Of course, you’re always to welcome to take the shortcut and call: 832-797-1779.

Chris Hanson

May 2, 2011 at 7:48 am

Yes, I to suffer with an occasional case of "hardening of the attitudes;" however, it is easily cured with a quick injection of reality. Now I know the main topic of this blog is possibility thinking, but I'd like to know more about your friends eLead conversion proposition. Perhaps a future blog on the subject?

Ken Brand

May 2, 2011 at 8:42 am

Goog question Chris. Maybe we'll hear more about it soon. Thanks for you comment. Cheers.

Scott L

May 2, 2011 at 8:49 am

You've described exactly what has happened to the entertainment industry. They desperately hold onto the status quo and fall behind. All the while they are losing market share. What worked before doesn't always work best now. Embracing that idea will help move you forward and not left behind.

Ken Brand

May 2, 2011 at 9:36 am

I think it's the same everywhere in every industry. Things are moving so fast, you can't rest in comfort or you'll rest in Peace. Thanks.

Denise Hamlin

May 2, 2011 at 9:32 am

Great food for thought on this Monday morning Ken. I run into agents all the time who think real estate is a relationship business and tell me you can't form relationships online. (!) Another example on how experience can be a curse.

Ken Brand

May 2, 2011 at 9:37 am

That's the perfect example Denise. Cheers and thanks for sharing.

Liz Benitez

May 2, 2011 at 3:08 pm

Great story and great insight for the future. Thanks for sharing.

Ken Brand

May 2, 2011 at 6:12 pm

Thanks Liz. Yeah, when I realized what I was doing, it was a big Ah-Ha. Then I sorta went Ut-Oh. Then tried to be open minded. It's tricky work to strive, strive, strive. Cheers.

Paula Henry

May 3, 2011 at 10:45 am

Ken – I haven't been around long enough to be too entrenched in the past. The right now is moving much too quickly. I struggle with the lost opportunity of leads and have been evaluating how to better manage that aspect of my business and I'm just a five man/woman team at a small brokerage. Even so, I hesitate to spend money on unchartered territory, especially when I don't know exactly how much you I am losing. It is an area we, as agents and brokers are going to have to get better at or continue losing. Of course, if we stick our head in the sand, we will never know how much we are losing or the potential of what we have. That's probably the easier course 🙂