The Classic Definition Of Insanity Is Wrong

Ok, it’s not wrong-wrong, it’s half wrong. Here’s the classic definition of insanity:

The definition of insanity is doing the same things over and over again, expecting a different result. ~ Albert Einstein

It’s true. For example, you can’t lose a dollar on every deal and make it up in volume. I think we’d all agree, if what we’re doing isn’t working, we need to make dramatic changes. Right? But, what if what we’re doing is working? What if we’re not lazy? What if we’re the opposite – we’re successful? Should we keep doing the same things over and over again, expecting the same successful result? You’d think so. But doing so would fall into the insanity category as well. Here’s why.

The Other Definition Of Insanity

Because the expectations of our prospects, suspects and clients are steadily rising and savvy competitors are constantly upping the ante, doing the same things that made us successful yesterday will leave us in the dust tomorrow. Where would Apple be if it thought their first iPhone was such a big hit they didn’t need to change it or improve it? You know, what if their mindset was, if it ain’t broke why fix it? They’d be pipsqueaks instead of what they are now, right? It’s the same for you and me. If Einstein was alive today, I believe he’d approve of this second definition:

“The definition of insanity is doing the same thing over and over again and expecting the same result.”

You see, to succeed tomorrow,we have to reinvent and relaunch ourselves today and everyday. If we don’t, we fall behind. Then disappear. I bet you can think of a two or three formerly famous companies that fell on hard times because they didn’t change with the times. For example Blockbuster comes to mind. Renting DVDs was all the rage once, you know? What will you reinvent and relaunch this week?

~~~~~~~~~~~~~~~~~~~~~~~

Cheers. Thanks for reading. Photo Credit

Ken Brand - Prudential Gary Greene, Realtors. I’ve proudly worn a Realtor tattoo for over 10,957+ days, practicing our craft in San Diego, Austin, Aspen and now, The Woodlands, TX. As a life long learner, I’ve studied, read, written, taught, observed and participated in spectacular face plant failures and giddy inducing triumphs. I invite you to read my blog posts here at Agent Genius and BrandCandid.com. On the lighter side, you can follow my folly on Twitter and Facebook. Of course, you’re always to welcome to take the shortcut and call: 832-797-1779.

MH for Movoto

February 14, 2011 at 1:35 pm

Interesting stuff, Ken. I think if Einstein had been a business man he’d totally agree.

Ken Brand

February 14, 2011 at 7:44 pm

Thanks.

BawldGuy

February 14, 2011 at 4:22 pm

Hey Ken — thoughtful stuff. It reminds me of Dad’s advice when I’d come home from yet another real estate investment seminar lead by a legit icon, or CCIM class. He’d tell me never to forget that what fuels success in business, possibly more so in service industries, is results. Following that advice has often been the tipping point in allowing me to compete with larger firms, or simply to survive in difficult times.

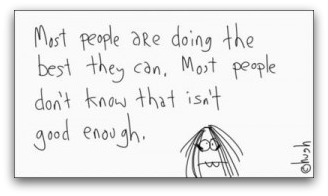

“Most people are doing the best they can. Most people don’t know that isn’t good enough.” The quote above your post.

The question is usually begged, in my experience. The real question is, ‘What’s good enough’?

The answer to that question hasn’t changed for thousands of years.

Producing results is always the right answer. The rest is HappyTalk.

Thanks again, Ken, for excellent food for thought.

Ken Brand

February 14, 2011 at 7:43 pm

Yeah, making 6 figures is hard Work, with a capital W. Cheers man.

Matt Thomson

February 14, 2011 at 11:55 pm

Kind of. When Apple made the iPhone, it didn’t just make the iPhone. They made an advance in technology that noone else had done. That’s what they’ll continue to do. When McDonald’s bought a piece of prime real estate and sold a cheap burger, that’s what made them successful. They don’t need all the new things to succeed. The very fact that they have cheap burgers, addictive fries, and the best locations makes them successful.

In real estate, we need to keep doing the same things over and over again. That doesn’t mean doing it well once and sitting on your heels; it means doing it better than everybody else once, and doing it better than everyone else over and over again.

What repeats isn’t the action, it’s the mindset.

jqb

December 30, 2012 at 2:23 am

This is stupid, not least because it was Rita Mae Brown, not Einstein, who said it. if you want the “classic” definition of insanity, look in a dictionary or the DSM.