Signet advances the shipping industry

Remember when scanners came out and we all started printing FedEx (or whichever) labels and eventually scheduling pickups online? That was years ago, and little has been done to innovate the consumer side since. Yes, we all know that Amazon wants to ship your eyeliner and cat food via drone, but that is still not the reality.

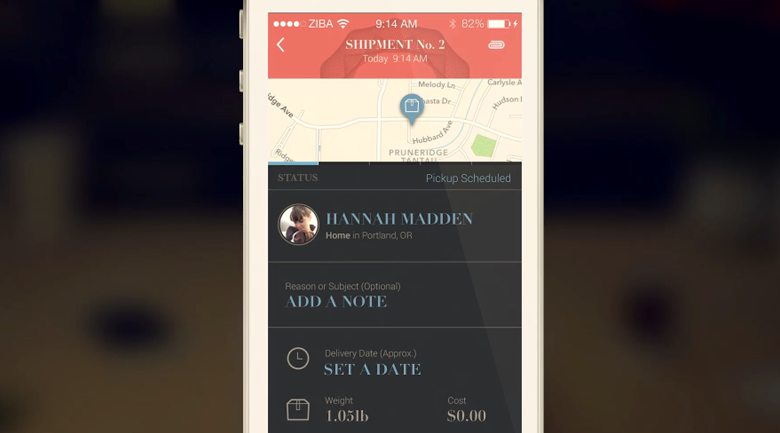

Signet is a shipping concept by a small team of Portland designers at Ziba, to transform personal shipping by moving the data component online and making it more collaborative. Imagine: you order those boots from Nordstrom online and you get an alert that your package will be delivered, and they’re paying for delivery, but you want to see those boots tomorrow, so with a slide of the finger, you agree to pay the few extra dollars to expedite, and the process is done.

![]()

Let’s let the folks at Ziba demonstrate:

The company explains, “By turning address entry, shipping method, payment, notifications and confirmations–which are all just bits of data–into digital interactions, it creates a more flexible shipping system, where you can redirect a shipment by tapping your smartphone during lunch, or split the cost with a recipient by clicking a tab.”

They say they want to bring back the “delight” to shipping. “Since the information is digital, a sender only needs to do one thing in the physical world: mark the letter or package with a unique identifier, and set it out. The Signet stamp and the mark it makes are designed to celebrate the moment of shipping, and the new process means you’re sending your parcel to a person, not a place.”

They conclude that with their concept, “missed and unexpected deliveries become a thing of the past. And it expands the market, by making small, impulse shipments as easy and commonplace as a text or email.”

Businesses, pay attention – if this gets off of the ground, you could see even more sales.

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.