If you haven’t been living under a rock for the last week, chances are you’ve heard about the drama surrounding the GameStop stock. Essentially, GameStop – or that spot I used to frequent in middle school to search through bins for used N64 games – has become the epicenter for what’s being called the first populist uprising in finance. We love to hear it.

What happened?

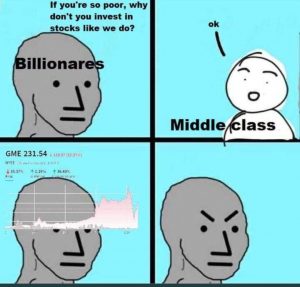

For some background, GameStop became one of the most shorted stocks on the market. Groups within Wall Street’s hedge funds, known as the short sellers, have been colluding with each other and using the media to manipulate the market – and in doing so, were able to drive down the value of specific stocks (i.e., GameStop, which was essentially put on-course for bankruptcy) and, in turn, collect billions. This is common, legal practice on Wall Street. Just in case you were wondering.

Enter Reddit’s r/WallStreetBets page; another key player in this drama. With just shy of 2 million users last week (and now with over 7.4 million), WallStreetBets is a place where amateur day traders can exchange tips on penny stocks and rake in the “tendies”. Recently, one user popularized the fact that over 100% of GameStop’s stock was being shorted for no valid reason, so many from the group decided to take action – they began buying up cheap shares of the stock and demanding that their brokers not lend their stocks to short sellers, which in turn exploded the market value of GameStop as the short sellers attempted to “cover their shorts”.

Long story short (ha!), the entire GameStop drama has resulted in at least $3.3 billion disappearing from hedge fund balance sheets. One of the Wall Street hedge funds targeted by the Redditors, Melvin Capital, had to take a $2.75 billion bailout from other industry insiders. GameStop’s stock skyrocketed from $17.25 at the beginning of the year to $325 by this past Friday – reportedly the largest gains the company has seen in 18 years.

What you should consider

- GameStop is brick-and-mortar. They sell the clunky, physical versions of games, which can be bought online with less hassle. Let’s face it; outside of the few nerds who still enjoy the experience of standing in line to be the first to buy the new game, the retailer is essentially becoming obsolete. COVID, of all things, has only expedited this process. Even with the release of new gaming consoles, such as the PS5, the likelihood of GameStop bouncing back to its former heyday is highly unlikely. Hence the term “meme stock”. With a meme stock, users chose to invest in the name of an allegiance, based on a feeling, or just “for the lulz”, not because of perceived value. Wall Street elites do this all the time (Tesla, anybody?), but with the complicity of the media so we all buy into it as well. When people say: “The stock market is just a graph of rich people’s feelings”, they’re not kidding.

- Many of the involved Redditors are likely unemployed millennials, disenfranchised by the economic fallout from the pandemic, who have sat by and watched as the rich have gotten richer. Like, so much richer. According to some, this movement is less about the financial gains (though they must be sweet) and more about screwing the shorters – it’s about pointing out how corrupt a minimally-regulated free market is when it is only truly serving the elite inner circles of Wall Street at the expense of everyone else. So why can shorters short with mainstream backing just because they’re wearing suits?

- While I wish GameStop-gate was a simple populist win, it’s important to note that the rich own most of the market shares. Though some Wall Street wealth is undoubtedly being redistributed into the pockets of Main Street right now, let us not forget that a byproduct of the Redditors’ rebellion is that the already rich stockholders are now even richer. This poses the question of if you can have a real populist financial uprising if you’re working within the current market systems in place, which are designed to feed the few and deregulated to insure it.

What does the future hold?

Good question. As of now, everyone is scrambling to make sense of what has happened; Redditors are celebrating with a sleuth of victorious memes while politicians (*cough* Janet Yellen), the hedge funds, and the media gatekeepers are calling foul play, collusion and even meddling from the Russians (LOL).

Also, can we talk about the fact that the politicians (on both sides!) who reacted so urgently to the GameStop mania were the same ones dragging their feet to come up with a stimulus checks agreement?

In addition, Robinhood — the now infamous commission-free investing tool — put a pause on GameStop and other meme stocks, like AMC, Nokia, BlackBerry, and American Airlines. Others want the FCC to get involved. The pot WOULD call the kettle black.

All this being said, I think that GameStop-gate has, in a lot of ways, opened Pandora’s box, exposing the possibility of power-shifts and new financial realities to many who might feel powerless and financially vulnerable, especially right now. That the average Reddit day trader, when properly rallied alongside her fellow troops, could give such a massive middle finger to the hedge funds and make a little extra cash along the way is truly inspiring.

I think we’re going to see more meme stock shenanigans (AMC’s stock had quadrupled at one point!), and the weeding out of greedy short sellers with the methodical drole-ness that only a subreddit could conjure. Unfortunately, I do also see an eventual crash, a bubble bursting, that will leave many investors who didn’t get out in time at a loss. And many plan on riding out the storm, when she comes, in solidarity.

My two cents

Don’t get me wrong – I don’t think short selling as it stands now should be legal, nor do I think speculative buying is a good idea. It’s gambling. And it’s dangerous.

But the Government would never enforce a blanket policy against all speculative buying, not when the billionaires who reap the majority of the benefits are buddy-buddy with the media and lawmakers. Plus, how would the right, in all its free-trade glory, react to increased market regulations? Could this mania uncover the elusive partisan glue we’ve all been looking for? Oh, how the turn tables.

My take? Beyond everything else, I see this as an opportunity for something even larger. We’ve learned that everyday people like you and me can be a part of something greater; something that shakes our market’s foundations. GameStop (sorry nerds!) is a random company that doesn’t have too much appeal beyond the games they sell (the same ones you can get online).

But what if we could drive up the market price on other companies that are being shorted for the wrong reasons? Companies that we could all get behind, such as ones that pay their workers well or that share equity with their employees. What we’ve learned from this all is that with collective action directed towards the corrupt “cartel” of Wall Street’s inner circle, you can take key players down and make waves.

And, at the end of the day, isn’t that the best way to approach a free market — to make it serve the people?

Anaïs DerSimonian is a writer, filmmaker, and educator interested in media, culture and the arts. She is Clark University Alumni with a degree in Culture Studies and Screen Studies. She has produced various documentary and narrative projects, including a profile on an NGO in Yerevan, Armenia that provides micro-loans to cottage industries and entrepreneurs based in rural regions to help create jobs, self-sufficiency, and to stimulate the post-Soviet economy. She is currently based in Boston. Besides filmmaking, Anaïs enjoys reading good fiction and watching sketch and stand-up comedy.

Pingback: GameStop hires 20+ employees to lead a new NFT and crypto division – The American Genius | Trends on Nft