WePay: digital payment system for businesses

Allowing customers to shop both in store and online can be difficult for some small business owners as there is an assumption that you have to be a tech genius to set up a website and install an online payment system. But WePay takes that difficulty out of the equation with an action as simple as a quick copy and paste. If you’re looking to expand into the online marketplace but are struggling with how to accept payment, WePay has enabled businesses to embed “donate” and “check out” buttons so that they can easily remit payment from customers.

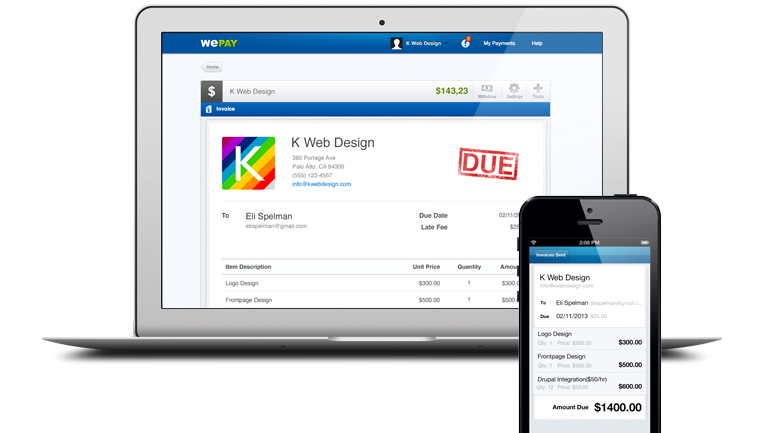

The payment software benefits small business owners and freelancers in a multitude of ways. In addition to the online checkout capabilities, WePay also offers e-invoicing services similar to PayPal and a virtual terminal that lets business owners accept credit cards both in person and over the phone.

WePay does not require any credit card processing hardware and users have the ability to process credit card payments through its iPhone app as well. Fees are 2.9 percent of the purchase total plus $0.30, which is identical to PayPal and some of the other companies that compete in the card processing market.

Benefits of using WePay

WePay also permits customers to pay via direct bank account authorization negating the need to process credit card transactions if they would like to forgo using a card. The cost for account authorizations is 1 percent plus $0.30 and offers flexibility for customers looking to use differing forms of payment for online shopping.

Business owners who are looking to increase their amount of customer donations can embed a “Donate” button on their website and start to collect money via their online marketplace. This feature expands the reach of company fundraising efforts and can work to make them top of mind for customers as they navigate throughout the site and finalize purchases.

By utilizing the various processing options that WePay has to offer, businesses can expand to meet customer payment needs whether online, in a brick-and-mortar store or on-the-go.

Destiny Bennett is a journalist who has earned double communications' degrees in Journalism and Public Relations, as well as a certification in Business from The University of Texas at Austin. She has written stories for AustinWoman Magazine as well as various University of Texas publications and enjoys the art of telling a story. Her interests include finance, technology, social media...and watching HGTV religiously.

Charity Kountz

September 9, 2013 at 11:27 pm

Ooh – I will definitely be checking into this as I would love for my clients to pay me via direct deposit instead of a third party like PayPal. Great article Destiny!