Eric Holder speech updated

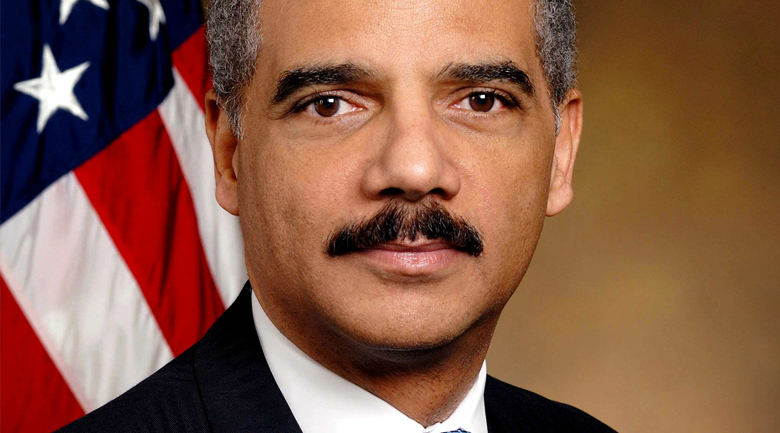

Recently, it came to light that U.S. Attorney General Eric Holder misled Americans about mortgage fraud, claiming that the high profile Mortgage Fraud Task Force was making great headway and uncovering endless fraud and charging hundreds, but Bloomberg uncovered that the facts in his 2012 speech on the topic were wildly inaccurate.

When the news agency pressed the Department of Justice (DOJ), they were never given access to the list of people charged, or other information that would be easy to verify.

We reviewed the web version of the Holder speech prior to publication of our outline of Holder’s missteps and verified the overstated facts, but it appears the speech online has been edited. According to Rolling Stone, Paul Thacker, former Hill staffer and currently a fellow at Harvard’s Edmond J. Safra Center first discovered edits to the original transcript on the DOJ website, which is akin to going back in time and changing a printed newspaper story – it just doesn’t happen.

Comparing the two versions

“Transcript” typically refers to the actual words said by a person, as transcribed to the web, but in this case, someone at the DOJ has simply updated the actual words with what the words should have been.

The second paragraph of the official transcript of Holder’s 2012 speech as it now appears on the DOJ website:

This national effort – known as the Distressed Homeowner Initiative – ran from October 1st, 2011, to September 30th of this year – and was led by members of the Mortgage Fraud Working Group of the Financial Fraud Enforcement Task Force. This landmark Initiative, spearheaded by the FBI, was launched to help streamline and advance investigations and prosecutions against fraudsters who allegedly targeted, and preyed upon, Americans struggling to keep their homes. And it’s been a model of success. Over the past 12 months, it has enabled the Justice Department and its partners to file federal criminal charges against 107 defendants for allegedly victimizing more than 17,185 American homeowners – and inflicting losses in excess of $95 million. On the civil side, as part of this Initiative, Mortgage Fraud Working Group Members have filed federal civil cases against 128 defendants for losses totaling at least $54 million, and involving more than 19,000 victims.

The transcript originally read:

This national effort – known as the Distressed Homeowner Initiative – ran from October 1st, 2011, to September 30th of this year – and was led by members of the Mortgage Fraud Working Group of the Financial Fraud Enforcement Task Force. This landmark Initiative, spearheaded by the FBI, was launched to help streamline and advance investigations and prosecutions against fraudsters who allegedly targeted, and preyed upon, Americans struggling to keep their homes. And it’s been a model of success. Over the past 12 months, it has enabled the Justice Department and its partners to file 285 federal criminal indictments and informations against 530 defendants for allegedly victimizing more than 73,000 American homeowners – and inflicting losses in excess of $1 billion. On the civil side, as part of this Initiative, we have filed 110 federal civil cases against over 150 defendants for losses totaling at least $37 million, and involving more than 15,000 victims.

What next?

In light of endless scandals hovering over Holder’s head, it will be of note how this particular issue is handled. The DOJ should have stuck to their original statement that a mistake was made rather than attempt to go back in time and rewrite the record.

Editing transcripts is a substantial ethical breach in a world where information is currency and transparency was a promise offered by the President on the campaign trail so many years ago. Will the DOJ re-edit their edits, leave it as it stands with a link to the original unedited version, or will this be swept under the rug like so many other “hiccups” today?

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.