Today, Erion Shehaj makes his debut here at Agent Genius. Erion is a real estate broker in Houston, Texas at Signature Real Estate specializing in the niche of conservative real estate investments. Erion has a BA in Accounting & Finance and combines that with his passion for people in his practice. Erion’s writing has proven to make waves, so we look forward to his joining us- we’re sure he’ll make your gears turn!

The greatest market economy at work

When I was born in 1981, my country was under one of Eastern Europe’s most repressive communist regimes. How communist? Let’s just say that we broke our alliance with the Russians and the Chinese because they were “getting too soft”. A decade later, as the winds of democracy were blowing south from Berlin, I heard terms like “pluralism” and “market economy” for the first time. When I finally made it across the pond as an 18-year old finance student, I got to see the greatest market economy at work and I was amazed at its sheer size, efficiency and modus operandi.

Growth Infatuation

Like it often happens on your first visit to Manhattan, once the amazement wore off, I started paying attention to the actual details. To my surprise, I noticed that at this stage of this mamoth economy, growth trumped performance. It wasn’t about profitability as much as it was about how many more stores were being opened, small companies being swallowed, loan applications being taken, or new homes being built. This blurred focus on growth alone was further being fed by a “get in and out” culture of daytraders, derivativers (I just trademarked that term), flippers and speculators looking to make crazy scratch on the latest market figures uptick. One hell of a party. Now, we need to “get back to the basics”, tighten our regulatory belts and return to boring old Monday. Right?

I think exclusive focus on growth while neglecting timeless business principles inevitably leads to bad decisions, bubble-bust cycles and as the latest recession showed, even possible death of the economy.

Bad decisions

The evidence for bad decisionmaking caused by exclusive focus on growth is everywhere. More than a business, Starbucks was an unbelievable phenomenon that took the world by storm one uberpriced latte at a time. During its expansion in the 1990s, they were opening stores at a rate of one store per weekday. Focus on growth alone led the company to open stores in locations that had no chance of thriving. In 2008, the company closed 900 underperforming US stores and it’s now focusing on the profitability of the rest. Same thing with McDonalds in 2002. The latest financial crisis also offers a plethora of examples (i.e. Countrywide, Merrill Lynch, AIG) where once solid businesses seriously underestimated risk due among other things the need to “hit the number”. Real estate brokerages that rode the high of ever rising prices opened sometimes unnecessary offices with lots of fatty overhead.

Hyperactive Growth is Unsustainable

At this point, many of you are thinking I’m against growth. Not so in the least. Real, natural growth is great for business when supported by (wait for it) actual profits. The level of growth that is expected of companies in boom times is unreal, unsustainable and it leads to boom-bust cycles. Do you really think that Starbucks or Wal-Mart can continue to open 400 new stores a year forever? There’s got to be a point where they will run out of countries. Lowes and Home Depot can convince customers to “do it themselves” but those remodeled kitchens and backyard paradises would not be possible without all those HELOCs. The Countrywides of this world cannot get people to ATM their homes enough without defaults coming back to bite them. In turn, real estate companies cannot keep up with the cost of bloated staffs when sales drop due to inventory spikes courtesy of those defaults. Full Circle.

We don’t need to get back to the basics. We must never forsake them.

Houston Real Estate Rainmaker and Uberproud Father/Husband (not necessarily in that order). When I'm not skinning cats or changing diapers you can find me on Twitter or Facebook. I blog about marketing, social media and real estate. I might not always be in agreement, but you can rest assured I'll be honest. Oh, and I can cook a mean breakfast...

Clint Miller

June 25, 2009 at 11:24 am

I follow Erion on twitter and have always enjoyed his posts.

And, having a degree in Business Economics, I can tell you that his analysis inside this post is dead on accurate! And, to him, I would like to say, “Excellent job!”

Also, Welcome to AG! Keep up with posts like this, my friend. You have a nack for them.

Lisa Sanderson

June 25, 2009 at 11:37 am

Makes perfect sense to me. Why is it that no one, the experts running these companies especially!) realized this until it was too late?

Welcome to AG, Erion. Your expertise is a welcome addition and I look forward to your analyses.

Real Estate Continuing Education

June 25, 2009 at 11:38 am

I agree that long term economic growth is not completely sustainable but the problems will continue to mount until sellers and buyers alike read up on the market before making decisions.

Ines Hegedus-Garcia

June 25, 2009 at 11:57 am

I am so TOTALLY PSYCHED that you are here Erion! you know I’m a fan.

As for crazy growth – I think a lot of people just jump on the bandwagon without actually scrutinizing numbers and hope that their crystal ball doesn’t lie to them. It’s similar with urban sprawl (if I have to use an analogy) – but with the latter, we’re stuck with poor planning and bad architecture for LIFE!

BawldGuy

June 25, 2009 at 12:23 pm

After my first conversation with Erion I knew I’d spoken with a young man who was gonna be known. A real coup, Lani.

Jeremy Blanton

June 25, 2009 at 12:35 pm

Welcome to the AG team! They made a great choice in adding you!

Matthew Hardy

June 25, 2009 at 1:53 pm

Another reason Agent Genius is setting the pace… excellent addition!

Any venture on how many real estate agents are too many? 😉

Ken Brand

June 25, 2009 at 2:15 pm

Welcome. How true and worth remembering.

It’s so easy to get caught up in the “size matters” mentality. I think the recent crisis + the your and younger generation will place a higher priority on value and substance instead of scale and size.

Nice article.

Joe Loomer

June 25, 2009 at 3:07 pm

First saw an Erion post thanks to Ines. Glad to have him here!

Simple principles executed properly still are the foundations of natural growth. Great post Erion – can’t wait to read more from you.

Navy Chief, Navy Pride

Jim Little

June 25, 2009 at 3:12 pm

Welcome to AG Erion.

I have followed Erion on Active Rain, glad to see him here.

RealEstate Babble

June 25, 2009 at 3:40 pm

AgentGenius: Obsessive Growth Syndrome https://tinyurl.com/lkeyjn Full https://tinyurl.com/m52gur

Ines Hegedus-Garcia

June 25, 2009 at 3:52 pm

OMG – @erionhouston is on AG!! one of my favorite tweeples!! https://twurl.nl/4lcdmo

Robert Johnson

June 25, 2009 at 3:53 pm

RT @Ines: OMG – @erionhouston is on AG!! one of my favorite tweeples!! https://twurl.nl/4lcdmo

Erion Shehaj

June 25, 2009 at 3:58 pm

RT @Ines: OMG – @erionhouston is on AG!! one of my favorite tweeples!! https://twurl.nl/4lcdmo (YOU ROCK!)

Danilo Bogdanovic

June 25, 2009 at 4:03 pm

Welcome to AG Erion. Your first post was music to my ears – I love this kind of stuff!

And you get the quote of the day award with “There’s got to be a point where they will run out of

countries.” LOL

sheilabragg

June 25, 2009 at 4:11 pm

Obsessive Growth Syndrome: Don\’t be stingy with your thoughts- stop by and comment!Today, Erion Shehaj makes hi.. https://tinyurl.com/m52gur

Real Estate Feeds

June 25, 2009 at 4:16 pm

Obsessive Growth Syndrome: Don\’t be stingy with your thoughts- stop by and comment!Today, Erion Shehaj makes hi.. https://tinyurl.com/m52gur

Missy Caulk

June 25, 2009 at 4:42 pm

Welcome to AG !! Did you ever play the board game Risk?

Interesting to watch folks play that game, you buy too quick you loose.

Jason Sandquist

June 25, 2009 at 9:50 pm

Jay Thompson

June 25, 2009 at 11:27 pm

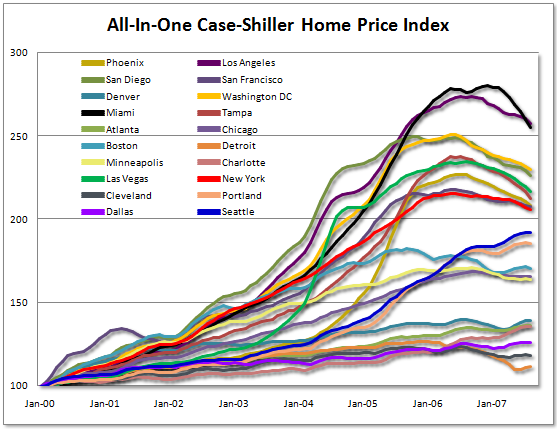

Cool chart.

Hey, I’ll be in Houston July 22 for HAR’s “Social Media Summer Camp” — you coming Erion?

Welcome to AG. Nice adddition.

Erion Shehaj

June 26, 2009 at 11:04 am

First, thanks everyone for the kind words and the warm welcome 🙂

@Ines Urban Sprawl is a very good analogy. Good news is we don’t have to get stuck with “bad architecture” on this issue if we only focus on the basics.

@Danilo I’ll gladly accept that award and I want to thank the academy …

@Missy Never played Risk. Sign of my conservative nature, perhaps? 😉

@Jason Right back at you. ::fist bump::

@Jay Definitely. I look forward to meeting you, Sir.

Russell Shaw

June 26, 2009 at 11:49 am

Welcome, sir.

Erion Shehaj

June 26, 2009 at 11:55 am

Thank you! Glad to be here.

Matt Stigliano

June 26, 2009 at 4:37 pm

Erion – Welcome to AgentGenius. I’ve seen your name and face before, but I don’t think we’ve met officially. Just read the first post and have to say it’s one well written common sense post. Here’s the thing, those companies had to know (I have a hard time believing they didn’t) that some day growth would have to slow or reverse. It’s inevitable. Much like you said, they’d run out of countries some day. It’s like my obsession for cupcakes. I love them, but if I keep eating them at a rate of one a day, eventually there will be no more room for cupcakes, because I’ll be dead of a fat-riddled heart that can barely keep a beat.

My question is where has all the common sense gone. It’s easy to say these companies/people have none, but really…? Have they just plain lost it? Or do they just plain ignore it? Are they just nodding their heads to their bosses and saying “sure it can be done” or are they really just missing the big picture and thinking it can be done?

Accounting/finance/economics is probably my weakest point (although I love math – go figure), yet I have to wonder if we haven’t made it more difficult than it needs to be. Much like when the banks took advantage of “new accounting rules” and I sat and scratched my head and had to ask – “new accounting rules? I thought it went like this “+” means a gain and “-” means a loss. You take all your +s and subtract your -s and get a number. That’s what you made. Now take some of this and save it for a rainy day. Rinse and repeat.” I wish it was that simple, but it isn’t.

Erion Shehaj

June 26, 2009 at 6:55 pm

Does our economy suffer from Obsessive Growth Syndrome? https://bit.ly/10YQ4s Where do YOU stand?

Erion Shehaj

June 29, 2009 at 8:43 pm

Matt

Thanks for the warm welcome and I’m looking forward to the conversations.

To address your comment, I think greed was surely a factor in this crisis as it has been in previous ones and will continue to be in the next ones to come. The “best and the brightest” had to know this was going to come to a stop. But the question becomes, did they push forward all the same because they were simply trying to “milk the cow all the way”, or was it because they were constantly being pushed to “hit the number”. The answer probably lies midway between the two.

Matt Stigliano

June 29, 2009 at 10:37 pm

Erion – Your comment about “hitting the number” is one that frustrates me as well. When a company releases their projected earnings, then misses the mark which causes their stock to drop I always shake my head. As long as the company is remaining profitable, they shouldn’t be sent spiraling towards the bottom just because they missed a number. Just my thoughts, but I have always seen this as one of the problems.