Over the years, research has proven that the housing sector is crucial to the economy and the long term financial and social benefits of homeownership. According to research conducted by NAR, the housing sector accounted for 19% of total economic activity in 2022.

It’s no secret that not everyone gets the same opportunities when home ownership is on the table. In fact, some face huge hurdles when trying to own a home, and NAR highlights those that struggle the most in a study. The majority of low-income households are renters and the homeownership percentage in this group is 47%. Naturally, home ownership rates soar to 69% for middle-class families and 87% for the upper-class group.

Black home ownership rates lag behind rates of other ethnicities, sitting at 44.9%, compared to 74.5% for white Americans and 61.9% for Asian Americans. This data shows that low-income households and people of color are much less likely to own a home compared to other racial/ethnic groups.

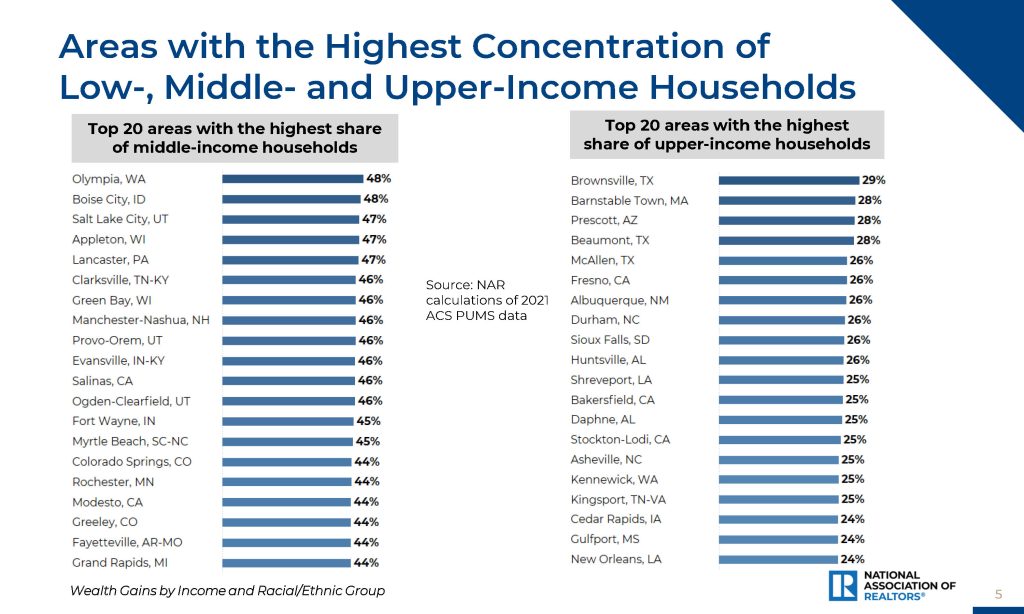

The study showed diagrams of the top 20 areas with low/middle/high income households, shown here:

Referencing the study, most low-income households are located in the South and Eastern regions (with a decent mix of other places), while most middle-income households are in the Midwest. While home ownership rates vary based on several factors, NAR reported that the highest homeownership rates for low-income households were in Ocala, FL, Barnstable Town, MA, and North Port, FL. Port St. Lucie, Deltona, Cape Coral, and Palm Bay FL were also included in the list.

NAR also computed how many homes owned by each ethnic group appreciated over the course of several years based on four milestones:

5 years

- White: $92,810

- Black: $90,410

- Asian: $141, 190

- Hispanic: $109,570

7 years

- White: $115,310

- Black: $103,530

- Asian: $181,240

- Hispanic: $135,506

10 years

- White: $138,430

- Black: $115,430

- Asian: $239,430

- Hispanic: $162,450

15 years

- White: $114,250

- Black: $107,890

- Asian: $174,840

- Hispanic: $92,720

Numbers aside, we have good news! Based on findings by NAR, low-income homeowners were able to build $98,900 in wealth in the last decade from home appreciation ONLY. And although black homeowners experienced the smallest wealth gains in comparison to other racial/ethnic groups, they were able to accumulate over $115,000 in wealth over the last ten years. And along with wealth gains that homeowners appreciated over the last decade, their debt has dropped by 21% already.

Macie LaCau is a passionate writer, herbal educator, and dog enthusiast. She spends most of her time overthinking and watering her tiny tomatoes.