Diversity of Realtor incomes

For many real estate agents, selling homes just isn’t enough income. The NAR® recently released a study based on the 2017 Member Profile report, detailing the alternative sources of REALTORS®. The report looks at the median income for randomly selected NAR® members, as well as the sources of their income.

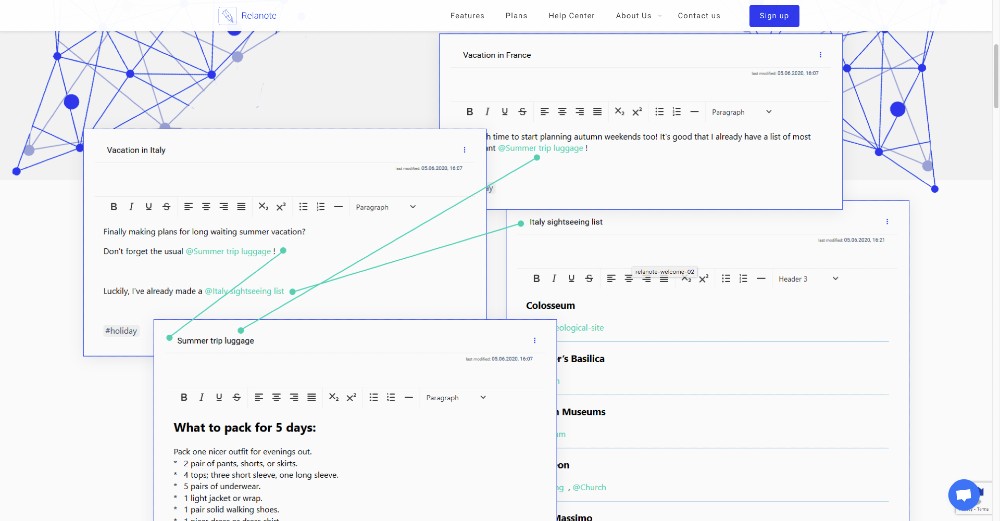

![]()

The 2017 Member Profile report was based on a random sampling for the NAR’s membership and asked a variety of questions based on demographics, economics, and business practices.

All the questions proposed aim to answer the question “who are REALTORS®?”

The report found that the median income for all agents in 2016 was $42,500 and the net income (after taxes and expenses) was $26,820. For members with less than two years of experience, the median gross income was $8,930 and the net income was $7,690. Conversely, those members with upwards of 16 years experience, their median gross income was $78,850 and their net was $46,790.

Of the specified income for the surveyed agents, income was predominately earned from selling homes. Approximately 46 percent of agents received 100 percent of their income from their real estate specialty, and another 33 percent received between 50 and 99 percent of their income from real estate. Of the members surveyed, approximately 70 percent stated their main specialty was residential brokerage. 70 percent also stated they were sales agents.

Supplemental Realtor incomes

Agents were also asked about their commission sales and 35 percent stated they received a fixed commission split. 26 percent received a graduated commission split (which increases with production), and 14 percent received a capped commission split (which rises to 100% after a predetermined threshold). Numerous agents also detailed where their supplemental income derives.

Approximately 16 percent of the agents surveyed offer home relocation services; 14 percent offer property management services; and 12 percent offer commercial brokerage service to supplement their incomes. In short, of the surveyed members “half obtain their income entirely from their primary real estate specialty, where two-thirds specialize in residential real estate and two-thirds are sales agents,” according to the NAR®.

The customers who contribute to income

The NAR’s® report also detailed the types of customers that contributed to REALTORS’® income. 13 percent of REALTORS® business came from repeat customers; for agents with more than 16 years experience this number more than doubles to 36 percent.

“Typical” REALTORS® also reported that 18 percent of their business was from referrals of past clients; for those with over 16 years experience reporting 25 percent of their business being from previous client referrals.

While some REALTORS® main source of income may be sales, other have turned to other specialties to supplement their income. Since this was random sampling of REALTORS®, it would be interesting to see how (or if) the statistics changed if all REALTORS® were surveyed. What do you think about the report? Do any of the figures in the NAR’s® report surprise you?

#narincomestudy

Jennifer Walpole is a Senior Staff Writer at The American Genius and holds a Master's degree in English from the University of Oklahoma. She is a science fiction fanatic and enjoys writing way more than she should. She dreams of being a screenwriter and seeing her work on the big screen in Hollywood one day.