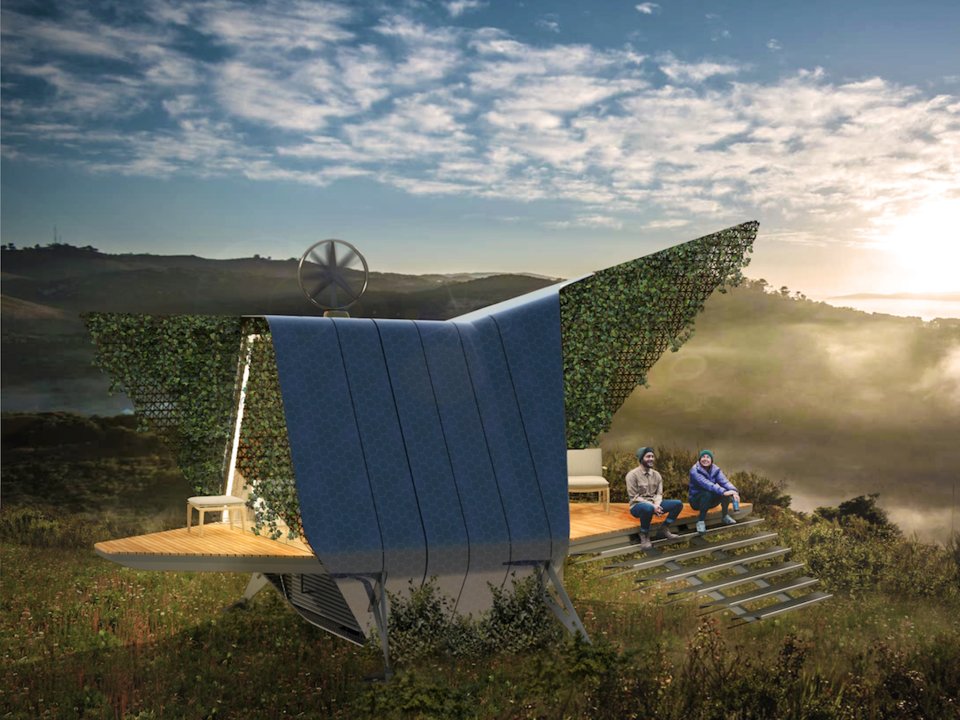

The tiny house movement is growing – as many people seek to escape the traditional home ownership paradigm.

Kelvin Young is a developer who’s currently working to build a tiny house community in Northwest Charlotte that he hopes will attract first time homebuyers or downsizers – but it seems that he’s run into some stopping blocks.

The development, Keyo Park West, has fallen on the radar of several neighbors, who have taken to the City Council to stop the development – citing a fear of the impact on property values.

Young envisions a 56 tiny house community – with the smallest of 500 square feet selling for 89,000. The average home value falls between 179-225,000. The City Council is in a mixed place: the homes meet the qualifications of a single-family home (with a concrete foundation) rather than a trailer/mobile home park.

However, the plans for the community are not yet clear, so the Council isn’t set on whether or not the plans meet the standards. They plan on reviewing the community plans in November.

“The opposition to this project links several to several challenges nationwide.”

The movement for tiny houses is becoming more and more popular, thanks to HGTV – but communities are not always on board.

Affordable housing (even those without income requirements like Keyo Park West) faces community and government intervention consistently. Stereotypes about the affordable housing customer – who are seen to drive junky cars, have too many children, and diminish otherwise beautiful neighborhoods – consistently reinforce this.

The process is also a challenge – the people building affordable housing (nonprofits) are often bound by complex rules and stakeholders, and risks like zoning costs, construction costs are often insurmountable. Few, if any, professional developers are currently involved in small housing projects.

Young is in the middle of a great challenge.

The affordable housing and tiny house movement are looking to solve the massive shortage of affordable housing in this country. But the processes, communities, and developers aren’t connecting.

What happens next in Charlottesville may be a template of what to do (or even not to do) going forward for those interested in following Young’s lead across the country.

Young has built one house and sold it for $89,000 – with two more lots under contract. The fate of his 19 acre parcel and envisioned community will be up for review in November.

Time to see if these tiny houses become the next big solution.

Kam has a Master's degree in Industrial/Organizational Psychology, and is an HR professional. Obsessed with food, but writing about virtually anything, he has a passion for LGBT issues, business, technology, and cats.