At the beginning of the month, California-based Avanath Capital Management and San Francisco’s MacFarlane Partners came together to launch a new real estate investment trust (REIT). The two firms state that this new REIT will be the first of its kind in that it will be the first publicly traded REIT to pursue a strategy focused on affordable and workforce multifamily housing. The trust – dubbed Aspire Real Estate Investors – is targeting $1.6 billion in investments.

This announcement comes at a crucial time. The economic fallout from the coronavirus pandemic has left much of the country’s working class in shambles. Affordable housing is becoming an increasingly coveted but scarce commodity. Not only do Americans need affordable housing, but they need affordable housing that will be invested in, accessible, and respected.

Avanath Capital Management and MacFarlane Partners – both Black-owned – are two of the largest minority-owned estate investment firms in the country. Avanath Capital was founded by Daryl J. Carter in 2007, and reported $1.2 billion in assets under management in 2018. MacFarlane Partners was founded by Victor MacFarlane in 1987.

Hopefully, Aspire will inspire other firms to follow suit, and invest in meaningful, necessary assets that will uplift working Americans, like affordable housing. If the morality aspect doesn’t do it, then maybe the profits Aspire will reap from being the first of its kind will inspire.

The filing stated: “[The affordable housing sectors] historically have been fragmented in ownership and underserved by institutional capital, yet they comprise a majority of the U.S. multifamily market (by units) and offer strong long-term fundamentals to generate the attractive returns for investors.”

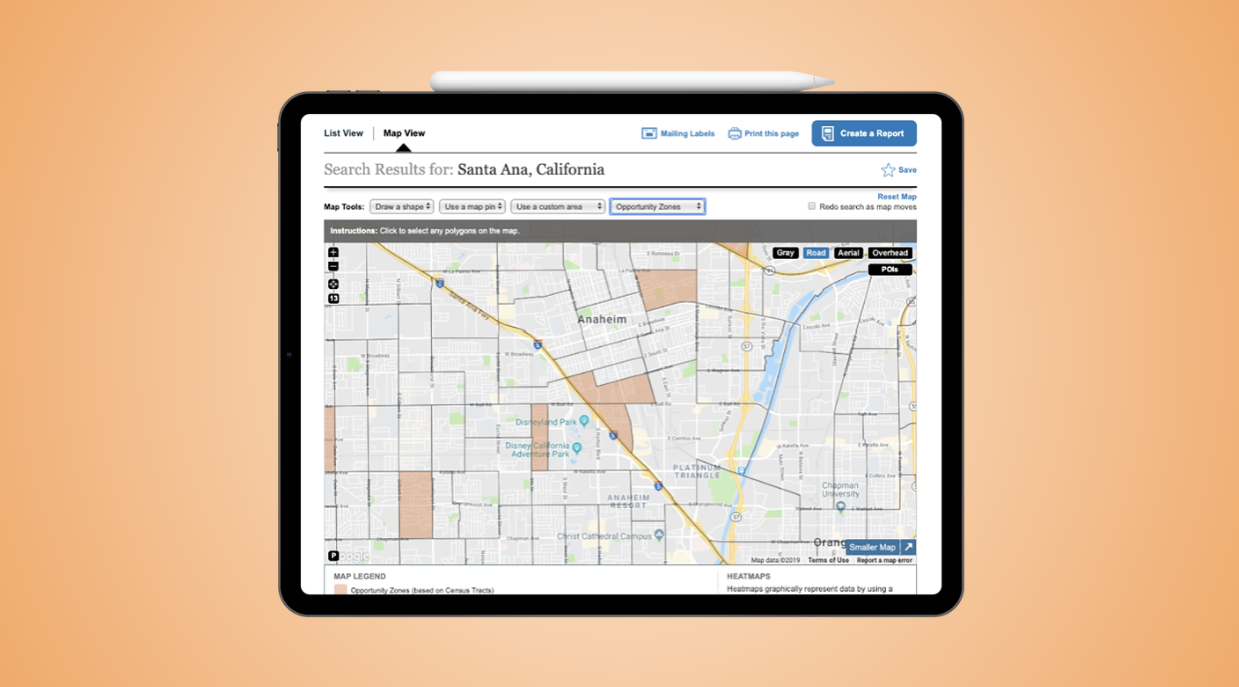

Aspire, who filed paperwork with U.S. Securities and Exchange Commission (SEC) already has an initial portfolio of 9 multi-family project investments. Six of these are located in Opportunity Zones – in Illinois, Florida, Texas, North Carolina, California and Michigan that will ultimately cost close to $582.4 million. Down the pipeline, Aspire’s acquisition pipeline totals $1.1 billion.

Anaïs DerSimonian is a writer, filmmaker, and educator interested in media, culture and the arts. She is Clark University Alumni with a degree in Culture Studies and Screen Studies. She has produced various documentary and narrative projects, including a profile on an NGO in Yerevan, Armenia that provides micro-loans to cottage industries and entrepreneurs based in rural regions to help create jobs, self-sufficiency, and to stimulate the post-Soviet economy. She is currently based in Boston. Besides filmmaking, Anaïs enjoys reading good fiction and watching sketch and stand-up comedy.