Investing on the rise

Real estate investors are dominating many real estate markets across the country that have high volumes of REO properties. A lot of them are drawn in by the great opportunity of multiple exit strategies and the historically great returns. A great way to expand your business is by helping these investors succeed by providing the best tools and information to turn them into long term clients. One perk of working with investors is that they usually buy more than one property and they are generally very experienced in the buying process. Here are some tips on providing great service to investors to help improve success in flipping property.

Finding deals

Finding great properties with a desired return can be a tedious process, as it needs to be done daily and is just plain boring. In my market area, we get about 125 new listings a day and only about five are worth looking at, so we need a great screening system to save time. This is a starting point with any investor and is one area that most don’t want to put work into. Start by sorting all zip codes by average price per square foot. A lot of MLS systems will have stats, and if not, you can pull the monthly sold properties and calculate the average price per square foot. This will only need to be done once a month, so the initial work is worth the long term time savings.

After the analysis is done, you will have a list of zip codes with an average PPSF for each. This will be like looking at the expected end zone of price of each asset purchased. Now, simply multiply that PPSF number by 0.7 to give yourself a 70% of the average number, if the average is $100 PPSF, you’ll only want to look at properties listed around $70 PPSF. This immediately eliminates all of the homes that are not even close to returns that investors need in order to profit and will leave only the best homes like a gold nugget at the bottom of a pan. This will save you and the investors tons of time right off the bat and leaves nothing but opportunity in the shopping cart.

Analysis

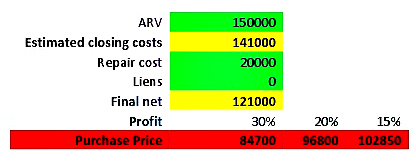

This is the step that that really needs to be done consistently to get accurate results that can be tested by multiple people. A quick way to calculate properties on the fly will be to make a spreadsheet that is simple with important numbers that are calculated in the right order. Here is a snapshot of one I made that will work on my smart-phone:

The ARV will be what you expect the asset to sell for after it has been repaired. This number will need to be perfectly accurate once the property is ready for purchase, but to get a quick number, just take that average PPSF you determined earlier and multiply it by the square footage of the property. From there, you can calculate disposition costs like title, escrow, tax, commissions and whatever else based on the final sales price (ARV).

From there, subtract repair cost which you will get a good idea of an average after doing a few of them. This will leave us with a final net number that we can calculate a profit margin from. To make your own spreadsheet, just copy and paste these in the respective excel boxes:

- ARV-B1 (this is where you put after repair value).

- Closing cost-B2 =(B1-(B1*0.06)) instead of 0.06 put whatever % your estimated closing costs are.

- Repair cost-B3 (Whatever your repair cost is).

- Liens-B4 (this would be any additional cost).

- Final net-B5 =(B2-B3-B4).

- Offer prices- B7 =(B5-(B5*0.3)) this will show the number you will have to offer to get the desired profit margins. 0.3 would be 30% cash on cash return but you can make a bunch of different numbers.

Buying

With the first two steps, you can consistently generate great lists of assets for your investors which saves them a lot of time weeding through junk, and provides easy to read values on a smart phone while you are at the house if you want. Now you affirm that you are the expert with access to hot deals in your market, and with this system, you will be able to outperform the competition and get your clients to these assets first. If your clients trust you enough you can even generate the offers on these after only you have looked at them and save your client even more time by just digitally signing them from home, (note to never make a mistake while doing this, I have seen a few people get thrown in the trash after costing an investor money).

Selling

If the previous steps have been done well, selling should be relatively easy. If you provide a solid product at an affordable price, any first time buyer will jump on it over a beat up REO any day. Plus, you and the investors are out revitalizing neighborhoods and stabilizing prices, which is much needed right now. One factor to note is time. Time impacts annual return, and the longer a flip is expected to drag out, the less predictable market conditions and demand will be which can further impact return.

The final take away

To break into the investor market, you just need to make the process easy for them by doing most of the work for them, and by providing consistent results. Investors are great to work with, plus the more money you make them, the more money you make. The investment market is too big right now to not be working it. This may be the only time in the foreseeable future that we will have this much opportunity in the real estate market for investment.

Ryan Schattner is a real estate broker associate with RE/MAX Gold in California, specializing in investment properties. He is also the creator of the Escrow Coordinator PLUS real estate business platform. His writing focuses on increasing productivity and efficiency through the use of technology, and planning.

Andrew McKay

September 7, 2011 at 7:54 pm

Right on my Ryan. I would say 50% of my business is with investors. It helps that I have several investment properties myself so walk the walk as they say. This undoubtedly gives clients confidence and allows "you" to speak with experience.

Do it right for one investor and I have found they refer you to other investors. A number of Realtors have not wanted to work with investors as they believe there is extra work involved. there is in that a number of deals don't come together as the numbers don't work and emotions won't make the buyer pay more but this is offset by the repeat business. It's amazing how nearly every new investor buys a second property within 2 months as the first worked and the "fear" has been overcome. I have people buying 4 properties a year.

Andrew

Jon Sigler

September 8, 2011 at 12:10 pm

Investors are the ultimate "repeat" customer. Occupant buyers move every few years at best, but an investor might buy a few times a year. They aren't fickle about colors or this or that. They care about one color, green. Are they going to make money or not. Evaluate the opportunity for them and they will come back for life.