Roost.Com launched yesterday. It was kind of hard to miss in the RE.net. If you haven’t yet heard about the site. It’s a real estate search portal that at first blush seems similar to what Greg Swann refers to as a member of the “Realty.Bot” family (Trulia, Zillow, Propsmart, Etc.). Benn would refer to them as another tech incursion. It has a slick search interface and is getting quite a bit of buzz

Roost.Com launched yesterday. It was kind of hard to miss in the RE.net. If you haven’t yet heard about the site. It’s a real estate search portal that at first blush seems similar to what Greg Swann refers to as a member of the “Realty.Bot” family (Trulia, Zillow, Propsmart, Etc.). Benn would refer to them as another tech incursion. It has a slick search interface and is getting quite a bit of buzz

Deeper analysis reveals the site to be a completely different animal. Dustin asked the question on his blog “Who Gave Roost Complete MLS listings?” and I would imagine when agents begin to discover the site they will be asking the same questions. It’s been a while since I have been involved with IDX (Internet Data Exchange) so the idea that a broker could redistribute a feed of data to a third party site intrigued me. I found out that “technically” the brokers are not providing the data to Roost.

Each market in the site is represented by an IDX feed of MLS data from a broker that is essentially a co-branded version of a broker web site. That will not be clear to you as you visit the site, nor will it be clear to any consumer, but from a purely technical standpoint it is. Still confused?

Here’s how it works. If you visit Roost.Com and select a target market you will be sent to a page that offers you search options. Roost calls this “Geo-Targeting”. The page you land on is redirected to a domain name that is either a second level domain to Roost in some markets. (https://coldwellbankeronline.idx.roost.com for Aurora IL) or a domain owned by the brokerage (https://garygreeneidx.com/ Prudential Gary Greene in Houston). I’m not sure but I think it will depend on how locked down the IDX contract language is from one area to the next as to what level you will see a domain at. Evidently there is no limitation on the number of IDX web sites that a broker can own and provide the MLS listing data to. It’s apparent that one struggle will be implementing the strategy from one market to the next.

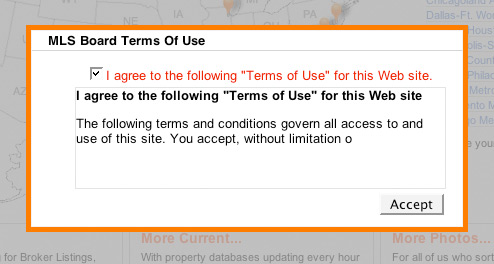

When visiting one of the Minnesota cities in Roost I was presented with a “Nag” screen that said I must agree with the MLS Terms of Service. The statement did not display completely in the text box and ended with…..You accept, without limitation o…… I figured what the hell, who wouldn’t want unlimited o’s? I’m sure it’s just a launch day bug, but it demonstrates an example of the challenge before them in having to accommodate different rules for different areas of the country.

When visiting one of the Minnesota cities in Roost I was presented with a “Nag” screen that said I must agree with the MLS Terms of Service. The statement did not display completely in the text box and ended with…..You accept, without limitation o…… I figured what the hell, who wouldn’t want unlimited o’s? I’m sure it’s just a launch day bug, but it demonstrates an example of the challenge before them in having to accommodate different rules for different areas of the country.

So the next question that is probably on your mind is how each market will be represented by more than one broker? According to Roost they will be rotating different brokers through the system. In a comment on 4Realz a Roost representative said

“Roost is a completely open/inclusive platform for any type of broker (large, small, independent, franchise group, corporate, etc)”

How will they make money? From what I have read thus far, each broker will pay based on CPC model, (cost per click). Each time a broker shows up in a rotation and someone clicks for more detail on a listing, it will redirect to the brokers “primary” IDX site and the broker will pay for that click.

I think essentially what Roost has done is create a system by which they will create and host a broker IDX web gateway with their search technology and put the clicks up for auction in each market.

The overall concept isn’t completely original, Prudential has been doing the same thing with Yahoo Real Estate for some time now but Yahoo has maintained an exclusive relationship with Prudential thus far. One of things I found interesting is that Prudential is not placing a lead capture form up before giving access to the detail info in Roost.

What does this all of this mean if you’re an agent? In the end it’s nothing more than another way to advertise listings on the web and it will be up to your broker to decide if it represents a good return on investment. Building a national portal and brand isn’t going to be easy so at this point it’s anyone’s guess whether Roost will be able to gain traction. The search technology is cool, but that alone isn’t going to equate to a rapid uptake in consumer adoption.

It’s certainly a very aggressive and creative endeavor but I think in the long haul business models like Trulia and Zillow are being built in a way that offers them much more flexibility with regard to the overall consumer experience. More importantly it gives them an ability to generate revenue from a much wider base of options without being restricted. I know the process is certainly more tedious but I personally like the strategy better. Hey who knows? I’m no genius, I just play one on this blog!

I'm not an Agent, nor a genius. I do what I can on the Interwebs to share some wisdom and knowledge and stick my nose into a few conversations here and there. I write for my own blog at mlbroadcast.com/blog along with this one and Zillow's GeekEstate Blog. I also have a kick ass product for Agents and Brokers - Check it out: https://www.mlbroadcast.com

Benn Rosales

January 24, 2008 at 10:25 am

Outstanding. I spent a great deal of time on the site last night, and I can see several ways roost.com can help agents become competitive with the so-called realtybots in some respects, but I am always cautious when it comes down to anything with the words pay per or click in the agreement. I’ve watched folks search homes before, and it’s so random when they’re home shopping. Most end up back on realtor.com but not until after they’ve clicked 700 times on 700 different things. We shall see… Great write-up.

Jay Thompson

January 24, 2008 at 10:30 am

One thing I like about Roost is they are willing to work with *very* small, independent brokerages. (unlike some of the “big players”).

That is a good thing.

Like Benn, I find PPC is a bit disturbing, though from my conversations with the guys at Roost, it will work much like Adwords in the sense that you can set budget limits. I’ll freely admit though, I am weak when it comes to CPC/PPC as I’ve never used it in any fashion.

Jessie B

January 24, 2008 at 12:49 pm

“In the end it’s nothing more than another way to advertise listings on the web…”

Not really.

What it really creates is the opportunity to be the main point of contact for all listings in an area.

As the broker providing the idx, it makes it seem like you are representing all of those listings. (Marc Davidson from 1000wattblog.com addressed this at Inman Connect or a blog post if I remember correctly)

If your area has 300 active MLS listings, you now represent 300 homes as the point of contact using roost or your own IDX.

Compare this to a broker who is providing the entire office listing inventory feed of say 20 listing (or individual agent with 2) to Trulia or Zillow they would have much less opportunity since you represent a small portion of all the listings. This is why T & Realtor offer featured listings.

In theory this seems great for the little guy….

The downside to this on the CPC model that both of you address, is say the “one” user comes via roost and you are the sponsoring broker.

Assume the CPC is .10 cents (I don’t know what it actually is – maybe someone can share some info) each but this person clicks on 40 listings*… then the users impression “session” cost you $4.00.

(* Note: if the user is savy they will perform the search again on “your” site assuming you have the correct navigation, then your cost will be only the .10. But the “average” user will look for the most popular button on the internet – “BACK”. This is not possible since roost opened a new window, so most likely the user will see the original Roost window and continue searching)

Now ideally, the user will love the search experience on roost and constantly use it for the average 4-7 months (per NAR Homebuyers report) he / she will spend researching homes for sale, possibly looking at a few hundred homes before actually contacting an agent listed next to the listing (hopefully you) when they are ready to buy / see the inside of a home.

In this scenario, the cost of your “lead” can be pretty expensive – i.e. 20 visits over 4 months each home viewing “session” cost you $4.00 = 20 x $4.00 = $80.00 to have the consumer actually inquire.

(This math is probably what the VC looked at prior to investing 5.5 mill)

Granted you can control your cost, so like adwords you can stop at any time or you may get lucky and the buyer may inquire on the very first visitor session.

If you are an agent with an IDX feed on your own site (which you would probably have, if you are looking into doing this with roost anyway). You can do your own CPC with the major engines and get the same users for probably a lot less and get them used to the search experience on your own site, eliminating the future search “session” cost of each user sent to you via roost.

Also, I thought this scenario would only apply to those doing the sub-domain but it looks like it would the same branded domain as well.

I maybe wrong about this as I haven’t personally spoken to the folks at roost like Dustin or Jay but it’s my initial observations. I’m sure the roost team will elaborate more about the model either in private with each broker.

Alex Chang

January 24, 2008 at 3:02 pm

Hi guys, Alex from Roost here. I’m really excited to see the level of insight in this discussion about what we’re trying to do here at Roost. Wanted to share a couple of random comments:

– As has been pointed out we believe that Roost is a great platform for brokers of all sizes (and agents eventually). Roost is built off the notion of Broker Reciprocity/level playing field

– We’re actually still working through the details of our CPC model because we want to ensure that it is consistent with that goal to be open to all. And I imagine our initial partners will give us some good direction here. One thing you can be sure of is that we know we have to offer something that makes economic sense and drives real ROI to transaction, otherwise we won’t have any clients :). What that means is that we know that the effective cost per lead (and ideally to close if you can track it) has to end up providing good ROI.

– The great thing about the model is, like AdWords, the client has total flexibility/control on their marketing. They can take it up or down when they want and keep it within budget easily.

– Our belief is that Roost visitors will convert at a higher rate to lead than broader search engine CPC buys because Roost is all about Real Estate. This is the current dynamic that exists in other industries (e.g. retailers who advertise on comparison shopping sites tend to get higher conversion there and so they use them alongside AdWords)

– Finally, one of the reasons we chose that model is that we didn’t want to be a lead generation company. We think the most powerful leads a broker can generate are under their own brand

Please feel free to reach out to me directly if you want to discuss any of this more. You can email sales@roost.com, drop my name and it will get to me.

Michael

January 24, 2008 at 3:05 pm

“What it really creates is the opportunity to be the main point of contact for all listings in an area.”

Maybe I should have expanded my point to say it’s basically a duplication of your current efforts to advertise IDX listings.

You alluded to that later in your comment.

I would still like to hear them expand on their comments that small brokers will be able to participate. Does that mean small brokers with huge ad budgets?

Alex Chang

January 24, 2008 at 4:53 pm

Alex from Roost again. It means that small brokers can spend an appropriate amount for them. Just like Google Adwords where you can set a budget of your own liking ($50, $100, etc) in any given month.

Michael Price

January 27, 2008 at 6:34 pm

“Just like Google Adwords” There’s the rub. Perhaps since it’s more targeted it will generate a better ROI, but my experience has shown small ad budgets in Adwords are a waste of money, for lack of a better analogy, It’s like a piss in the pacific. Larger companies that can afford automated systems that geo target and manipulate campaigns on the fly have made it harder for smaller players to get a decent ROI on PPC programs. Maybe this will be different, time will tell.