According to science and/or math, the internet is fueled by pet pictures. We all love pictures of animals, but more than that, we love our actual tangible animals, and as a culture, we’ve used social media to do more than share – we’re all learning from each other about best practices and products.

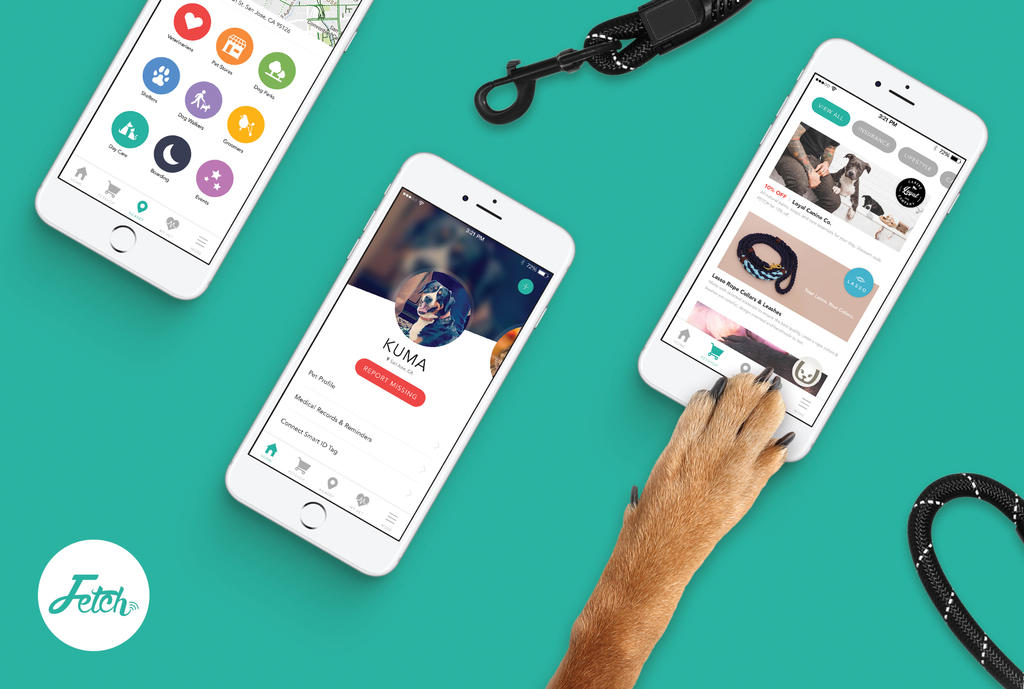

We’ve noticed that the pet technology space is figuratively blowing up right now, so we asked Greg Tariff, Founder and CEO of Fetch my Pet why the industry’s blossoming in such a way.

In his own words below, Tariff effectively explains why entrepreneurs are making their way into the $70 billion industry:

This growth is driven in part by millennial consumers: about 75% in their 30s own a dog and about 50% own a cat—and 44% see their pets as “starter children.” In other words, millennials not only own more pets than any other generation, but offer a better standard of care and are changing the pet business landscape with their buying habits. Millennials think of pets as family.

It’s a great time for entrepreneurs to be making their way into the pet technology space. Studies show consumers are willing to pay more for higher quality food and pet products, and they are ready to engage in experiences with their pets. Now it’s up to pet brands to connect with these pet owners on a deeper level, and I believe technology can bridge that gap. Here’s how technology is improving pet ownership thanks to a number of new innovations and a shift in consumer trends:

Humans can interact with pets remotely. Marketed as “digital daycare for pets,” technology like PetChatz lets pet parents interact with their pets from outside of the home. The need for this type of technology is driven in part by our view of pets. We no longer see pets as owned objects, but rather members of our family. How we classify pets has a ripple effect on the pet ownership experience. Consumers are more willing to pay for high quality products and services, and businesses will have to offer the highest-quality experiences to retain customers. Plus there’s a market for technology like PetChatz that allows us to interact with our pets from a distance in real time.

Making pet life management simple for pet parents. Worldwide online sales of pet food increased from 6 to 14 percent in 2016, with sales of dog and cat food rising at least 14% in the U.S. alone. It’s very easy for pet owners to click to order food, find places to walk and play with their pets, and connect with other pet owners. For example, Fetch my Pet is learning about customers and their pet needs to make more contextual suggestions. If you have an 7-year-old Golden Retriever, your technology shouldn’t tell you to buy puppy food or puppy Chew toys. As pet life management technology continues to advance, the pet ownership experience will become more personalized and intuitive.

Artificial Intelligence enables predictive fulfillment. As more data is collected on pets and their habits via makers of the products and services consumed by pet parents, we will soon have the ability to embark on preventative pet healthcare and predictive fulfilment of products and services for our pets. What if Petco sent you a notification once they had a new sustainable dog food in stock because they knew you were low on kibble? We’re inching close to this reality.

Paving the way for brand and ingredient integrity. The more innovation that occurs in the pet space, the more selective consumers can be about what they purchase and why. We care very deeply about what we feed our pets. According to Purina, young adults are more likely than other groups to research foods when designing their pet’s diet, and they like to have options that include natural ingredients and real meat.

Companies like BareItAll Petfoods are taking food-sourcing one step further by selling food products made from Asian Carp, which threaten to harm waterways including the Great Lakes. Businesses are doing their part to get smarter about ingredient integrity – and consumers are being more selective.

The American Genius is news, insights, tools, and inspiration for business owners and professionals. AG condenses information on technology, business, social media, startups, economics and more, so you don’t have to.

Pingback: Pet Technology - Assurance of Enhanced Comfort and Security For Your Pets

Pingback: Why Entrepreneurs are Flocking to the Pet Technology Space • PetChatz®