Well, well, well, Facebook’s at it again. The social media giant has been in the news in recent months (namely due to a scathing NYT story on the leadership’s mishandling of the campaign interference crisis). While you were probably seething about Zuck and Sandberg, a new feature was quietly released in past months – you will soon have the ability to unsend a message on Facebook Messenger.

The ugly origins of unsend

At first it may seem innocuous, but its origins are anything but innocent. In April 2018, TechCrunch reported that some of Zuckerberg’s Facebook messages had been deleted; some messages were even to non-Facebook employees, and they were deleted due to “privacy concerns.” Hmm.

Unlike the current unsend feature, there was no “tombstone” message indicating something had been deleted. This was a clear abuse of power — and even worse, the messages could contain important information about ethical wrongdoings (perhaps related to Cambridge Analytica or the Russian election interference?) at Facebook. What was in the messages? The world may never know.

How unsend works

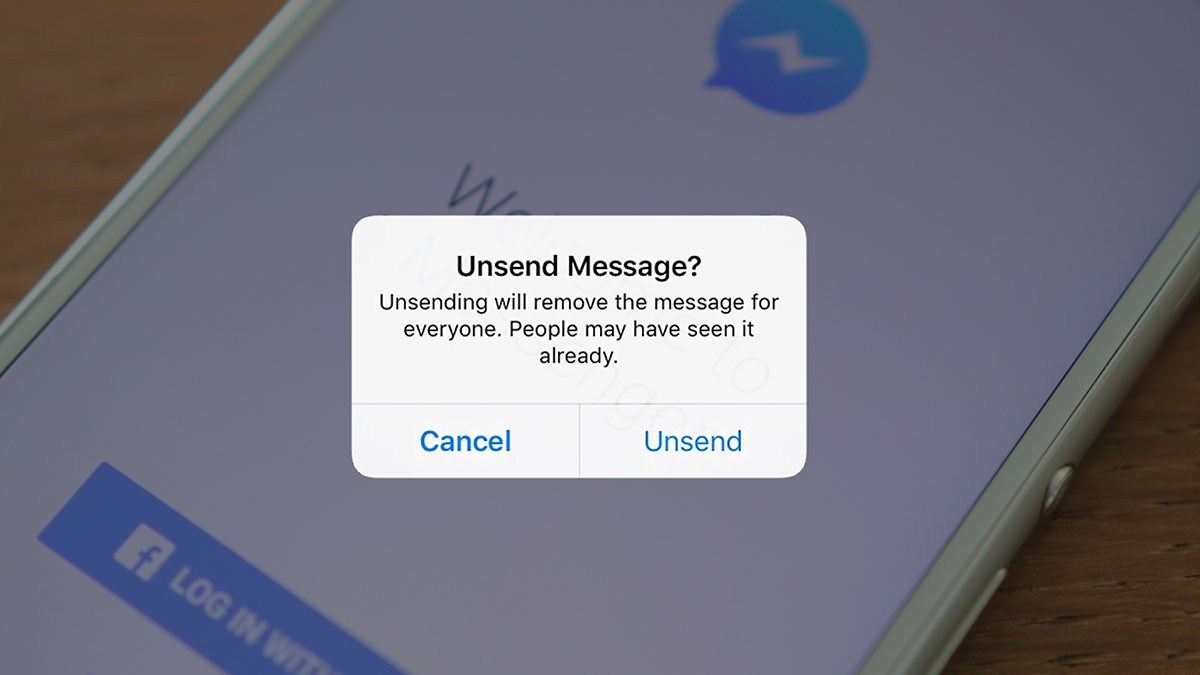

If you’re wondering how this new “unsend” feature works, here’s what you need to know:

- You can unsend any message in Messenger within 10 minutes of sending.

- This applies to text, group chats, photos, videos, and links.

- A “tombstone” message is displayed indicating a message has been deleted.

- You can’t remove a single text bubble (within a message) of something someone’s sent you.

- You have the choice when unsending to remove just for you, or remove for everyone.

What it means for your business

If you’re using Messenger for your business (especially Messenger chatbots), this could mean good and bad things, but the real implications are yet to be seen.

For customers that may tend to act out in anger and angrily message your business, you might see people unsend angry messages. This could be good for the egos of your customer service team, but you’ll also want to reach out and talk your customers down in those moments they’re frustrated.

But for most businesses, the legal effects on this new feature leave more questions than answers.

In short, your digital paper trail to CYA may be compromised with unsend. In a world where legal departments are already leery of Facebook, and rightfully so, this could make things a lot more complicated.

For instance, if you use a Messenger chatbot and someone claims discrimination based off the conversation and they used unsend, you’ll have less information to back up your story.

“But don’t worry!” Facebook tells us. “We’ll keep the messages on our server for a short period of time!”

A short period of time…? Are we talking one week, six weeks, one year? What does that even mean?

Overall, make sure to consider possible scenarios on how this change might affect your business.

Does this mean you might need to up your business insurance in light of more potential legal battles? Maybe. Does this mean you might need to shorten your response time to catch the angry customers or even potential customers before they unsend? Probably.

As this new feature rolls out, we’ll see more and more of the unknown implications coming to light. Regardless, make sure you and your business are prepared.

Elise Graham Kennedy is a business writer at The American Genius and is an Austin-based digital strategist. She's a seasoned entrepreneur, started and sold two companies, and was on a TV show for her app. You can usually find her watching The Office on her couch with her dog and husband.