Everyone still seems to think that changing your ARM (adjustable rate mortgage) to a fixed rate mortgage is in your best interests. But is it really? I have talked about this before, but people still contact me wanting to get their ARM changed when their ARM isn’t really broken. In fact, many of those ARM holders that contact me would actually be paying for a higher rate on a fixed mortgage than if they simply let their ARM adjust.

The media and most mortgage professionals are not going to tell you that. Why? They can make a killing during this “lull” by having you feed off the negativity that currently surrounds ARMs. Heck, I could be doing the same thing, but I have found that most ARM holders that have come to me for guidance are better off in their ARM than converting to a fixed rate product.

There are of course some concerns, some of which are valid. The primary concerns are the effects of the tightening access to credit. Will the borrower likely qualify when they need to switch down the road? Will they be able to afford to refinance later? Will their home value drop significantly preventing a viable refinance? The list goes on.

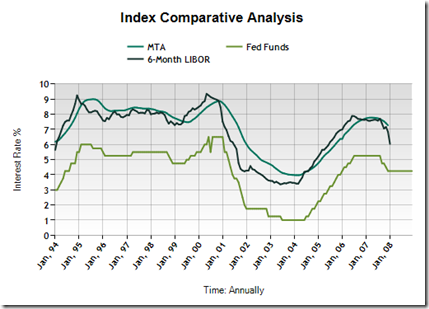

Whether or not you should be converting your ARM to a fixed rate mortgage depends on a lot of variables, but you shouldn’t rush into a refinance, especially with indexes on their way lower. Take a look at the chart below which highlights some ARM indices and the Fed Funds Rate and how they are all headed lower right now.

In fact, if you let your LIBOR ARM adjust right now, your fully indexed rate will be below 6%, roughly where 30-year fixed rates are right now and those LIBOR rates will likely drop significantly after the next Fed rate cut. Keep in mind that the Fed’s decision does not directly affect mortgage interest rates, but it does have an impact on the indices that ARMs are based on.

Writer for national real estate opinion column AgentGenius.com, focusing on the improvement of the real estate industry by educating peers about technology, real estate legislation, ethics, practices and brokerage with the end result being that consumers have a better experience.