Working as a freelancer is something that just meshes well with my personality. I love having the ability to take on a variety of different projects and work in different facets of the communication industry.

Unfortunately, my one semester of high school economics did not fully prepare me for the financial aspect of freelancing. Figuring out what to deduct, how to do 1099 taxes, and properly save in general was something I’ve had to learn as I go.

However, as I always say, in this day and age, there is someone out there who has a solution to your problem.

Such is the case with Catch, which is a tool that is perfect for freelancers as it helps with automated tax withholding, health insurance, and the other head-scratchers in between.

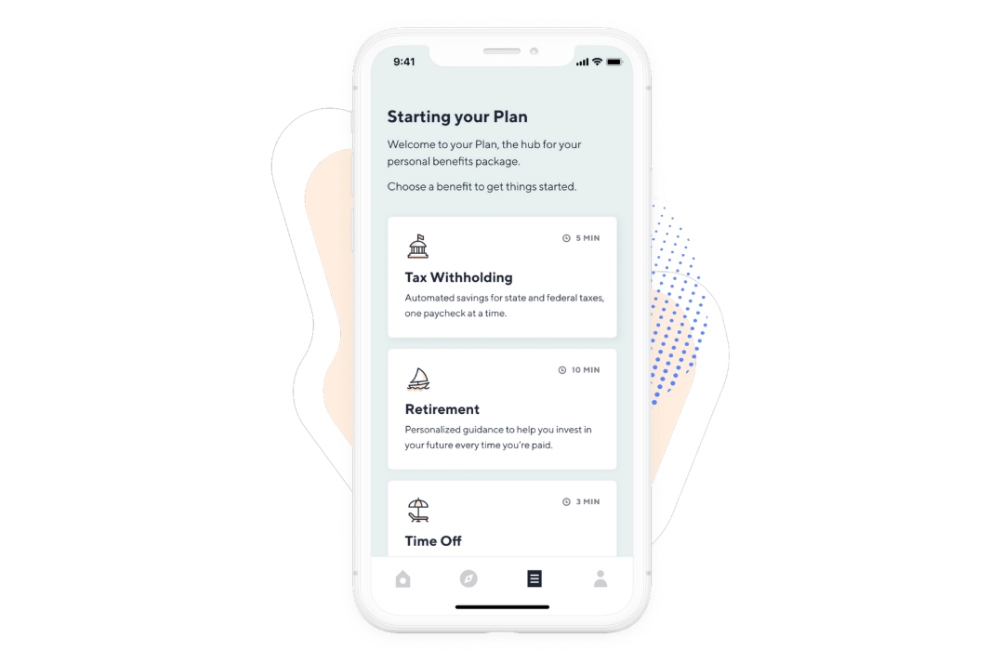

After signing up, you build a plan by using custom recommendations to get the benefits that will help you the most. Catch will tell you about the coverage you need, whether you work for yourself, a boss, or multiple bosses.

All of your benefits will be put into one place and will be ready when you are. You’ll be able to see your savings grow the more you work and use Catch. As time goes on, Catch will offer suggestions to help you prepare for the future.

From there, you can set aside money automatically. After getting paid, Catch confirms your benefits plan and will automatically put money away for taxes, time off, and retirement.

All of this helps to rid yourself of freelance financial blind spots, and Catch’s official Guide allows you to see a personal screenshot of the full benefits landscape. In addition to seeing all of your coverage at a glance, you’re also able to learn what coverage you need and why, sign up for new benefits in minutes, and easily report existing benefits.

Additionally, you’re able to see a people-centric view of your plan on the platform by adding in spouses, dependents, beneficiaries, and trusted contacts. With this information in place, you’re able to choose the plan that works best for you; allowing you to edit as needed, check savings instantly, and view full paycheck and contribution history.

And as your life evolves, Catch is there to help with the transition. The platform offers recommendations for how benefits and coverage can change with things like: job relocation, getting married, starting a family, or starting a new job.

As Catch says, it’s “peace of mind at the palm of your hand.” This is definitely something for freelancers to consider as part of their financial strategy.

Staff Writer, Taylor Leddin is a publicist and freelance writer for a number of national outlets. She was featured on Thrive Global as a successful woman in journalism, and is the editor-in-chief of The Tidbit. Taylor resides in Chicago and has a Bachelor in Communication Studies from Illinois State University.