The Paycheck Protection Program (PPP), a federal forgivable loan program established by the CARES Act, was designed to alleviate the burden of companies who experience business disruptions during the coronavirus pandemic. But of course, with every government loan there are stipulations and guidelines for its use and its forgiveness. The main people that are going to have difficulty here are the small businesses however, which one might have thought that this program was for.

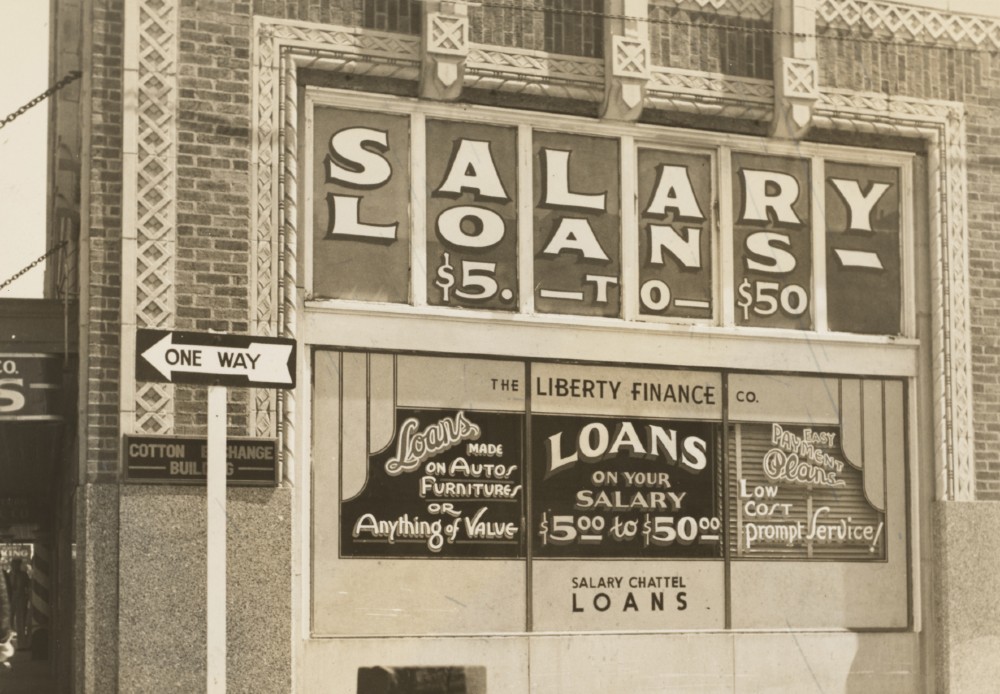

The program has guidelines that stipulate how much of it is forgivable. One of the main criteria is how the money is spent, openly requiring that 75% of the loan must be used to cover payroll for it to be forgivable, RED FLAG. What about small businesses that don’t have employees? Well some people may have thought that for a single person business, retirement and health-care would count towards that payroll total. Therefore, keeping costs down and keeping businesses alive. That’s not the case. Those expenses aren’t counted toward forgivable payroll costs, only salaries are.

Now others may have asked why that matters because someone can see that this type of loan wouldn’t be helpful for someone in those conditions. The problem comes in when the calculation for how much a business is able to borrow is done. The amount that can be borrowed through the PPP is based on payroll but it also includes health-care and retirement plan payments.

This is, as a matter of course, different for independent contractors and self-employed people that run their business income through a checking account. They were given a maximum amount that couldn’t exceed according to an April 20th interim final ruling. That amount is the lesser of eight weeks of their 2019 net profit or no more than ~$15K. As it stands currently neither retirement nor health-care premiums are eligible for forgiveness here either.

Something else that doesn’t seem to have been taken into account is rent and mortgage for these one person companies. The 25% that is stipulated in the program is no where near what is necessary for rent or mortgages in some places. The Small Business Administration (SBA) openly stated that they assumed that “many such individuals operate out of either their homes, vehicles or sheds and thus do not incur qualifying mortgage interests, rent or utility payments.” Personally, that small oversight is enough to make me wonder if these people have ever worked in the real world before.

What this means however is that people who have taken out the full amount that they are allowed and cannot stick to the requirement must pay the loan back in full on a two year deadline with an interest rate of 1%. As lawyers gather to attempt to filter through these murky waters and to hopefully make things better for those that need this relief we can only sit back and wait. Anyone looking to take out a loan from this program I highly recommend caution before jumping in.

Robert Raney is a geoscientist whose been writing and painting for years to get his creative fix in. While working on his thesis in theoretical planetary physics he was also creating fantastical worlds on paper for fun. He's an at home Texan Houstonite who currently works slinging drinks at a local LGBTQ+ bar in the gayborhood, when not fielding oil & gas jobs that have taken him around the world.

Pingback: Latest coronavirus relief bill means another round of aid for businesses