The traditional multi-office unit has an attendance problem.

It varies by city, but anywhere between 5% and 25% vacancy, can be expected, adding up to a fifth of these spaces unused.

It’s not just the ongoing effects of the Covid Pandemic keeping those buildings empty. Despite being bullish on offices filling back up; Real Estate professional, David Smith: Cushman & Wakefield’s head of Americas Insights, gave four distinct, non-virus related reasons for the rise in vacancies to NPR’s Sacha Pfiefer:

“[Firstly]…we’ve had a lot of economic uncertainty going back to 2020 and early 2021 and then, again, certainly over the last year as interest rates have risen. “

Makes sense. Mass layoffs and startup dissolutions will do that.

“The second reason… is that we’ve seen increased amounts of remote work and hybrid work, and that’s shifting how occupiers are thinking about their footprints.”

Keeping things smaller means keeping things cheaper. Some owners don’t mind the sinking (correct) suspicion that naps are happening during work hours so long as the cost of keeping the lights and internet on stay with their employees.

“Third is we’ve seen a lot of new construction come online. Those spaces do get leased up, but people move out of other spaces that end up being vacant.”

Totally! As new buildings get built nearer to more desirable, Whole Foods worthy locations, of course the people that were able to weather the storms would want to move on up, attracting more discerning senior talent. Ousting locals and messing with ‘the vibe’ is the cost of doing business in this case, but that’s a separate weeping truck rant article.

“And then the fourth thing I would say is that there is – been an increase in subleased space, especially over the last couple of years, as occupiers have looked to shed some of their footprint. We’ve seen them putting space available on the sublease, so that pushes up the vacancy rate as well.”

As people continue to improve their networking hermit crab style, subletting a space from a fellow professional that’s been otherwise deserted leaves the number of business tenants at a wash.

So does that mean we can expect to see more sustainable highrises on the horizon?

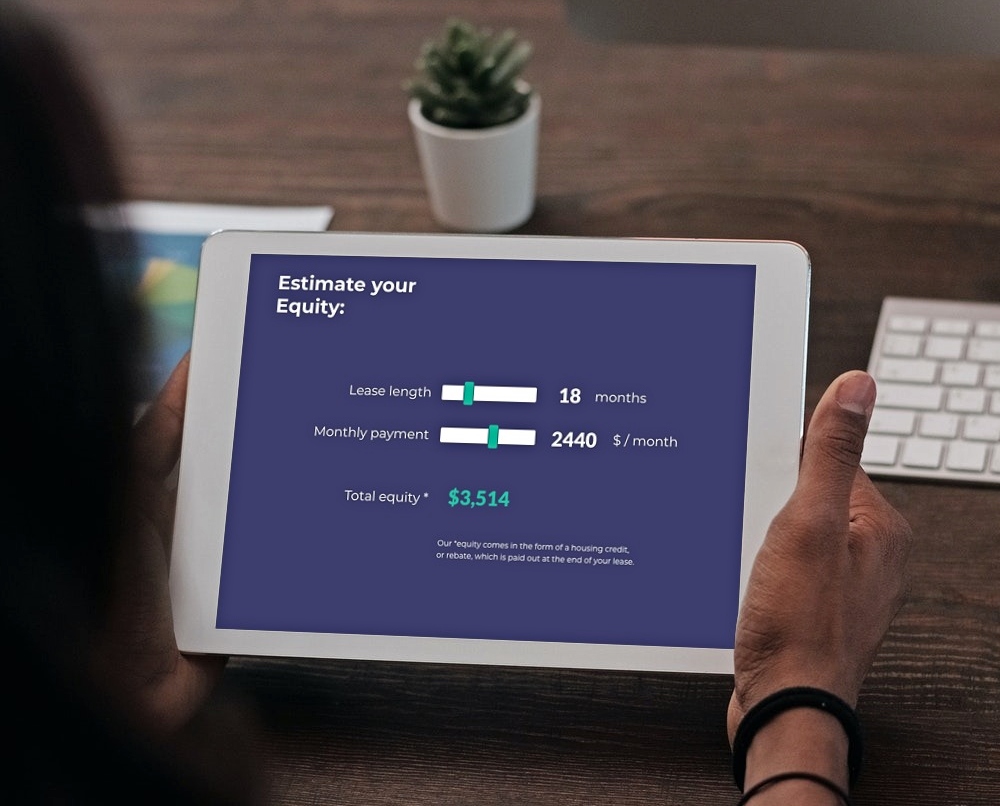

After all, this kind of movement already has precedence with American malls being converted into educational and residential arenas; and as difficulty in procuring living spaces continues to ramp up for an ever-lowering lower class, the opportunity to capitalize on office buildings in a whole new way presents itself.

It’s a lovely goal…but I don’t think it’ll happen on a large scale.

For one thing, the red tape surrounding what makes a space livable is rightfully rigorous. ‘Better than a park bench’ won’t cut it when it comes to keeping people safe. As such, the political bureaucracy regarding permits, evaluations, approvals, estimates, and even area votes mean that there’s no fast or cheap turnaround possible.

The expense brings us to another point—what kind of people could live in a converted office if it happened? I’d like to say ‘people qualifying for low-income housing’, but the combo of classist public resistance and the impossibility of seeing the satisfactorily increasing return on investment owners will seek makes it unlikely.

“…converting spaces has proved expensive, complicated and time-consuming“, notes NPR columnist Manuela López Restrepo. For buildings built after 1950, the deeper floor plans that came with the advent of central air mean a lack of window access and light, and thus a greater challenge in residential conversion.

This brings us to the exact situation we’re already in—big, freshly updated office buildings in bustling areas that no one in the service sector can afford.

Solutions to the housing crisis will need to come from a few other avenues instead—like rent caps, banning corporate buyers from purchasing single homes, ongoing short-term rental prohibition, and more.

As for office buildings, David Smith expects an uptick in populations due to projected economic growth next year, and increasing mandates of more and/or exclusively in-office work.

Don’t put the idea of getting into formerly corporate conversion completely to bed. It’s not impossible!

Just maybe start turning down the covers for later.