Although the economy isn’t recovering as quickly as anyone would have hoped, most people believe that now is a good time to buy a home. According to the latest quarterly National Association of Realtors (NAR) Housing Opportunities and Market Experience (HOME) survey, three in four hold that belief, yet half of young adults with student debt are uncomfortable taking on additional debt (like a mortgage).

![]()

So far this year, the share of homeowners and renters that believe now is a good time to buy a home has held steady, at 80 percent of homeowners (82 percent in March) and 62 percent of renters (unchanged from last quarter).

That said, the share of renters who think now is a good time to buy has fallen from 68 percent last December, and those under 35 were the least confident that now is a good time to buy.

The ongoing disparity

Dr. Lawrence Yun, NAR Chief Economist, says the survey brings to focus the ongoing disparity in buyer confidence between current homeowners and renters.

“Existing-home prices surpassed their all-time peak this spring and have climbed on average over 5 percent nationally through the first five months of the year and even faster in areas with severe supply shortages,” he said.

“Most homeowners appear to realize that if they’re ready to sell, they’ll likely find a buyer rather quickly and be able to use the sizeable equity they’ve accumulated in recent years towards their next home purchase,” notes Yun. “Meanwhile, renters interested in buying continue to face minimal choices, strong competition and home prices growing faster than their incomes.”

Elephant in the room: Student debt

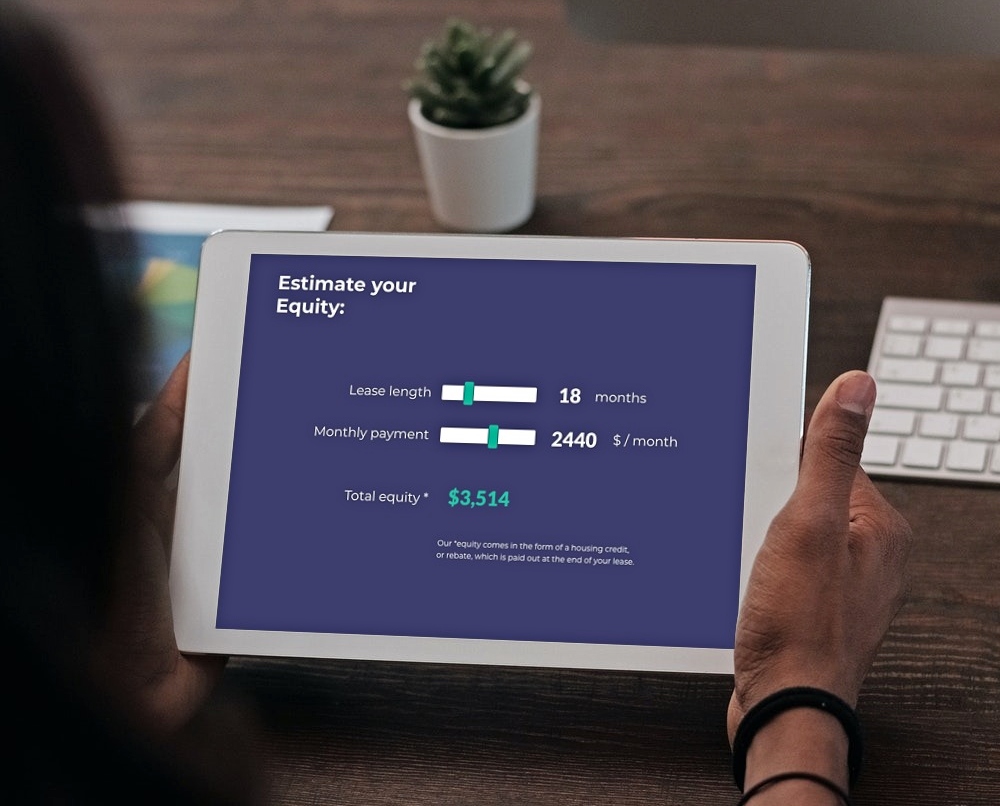

We’ve long covered the consensus among economists that student debt is holding back housing, with NAR leading the charge. This quarter’s report emphasizes that those carrying student debt are “uneasy” taking on any additional debt.

Who doesn’t want a mortgage? Two out of three non-homeowners, and half of respondents under 35 said they’re not “comfortable” having a mortgage. Of those with student debt, non-homeowners and younger adults are less likely to believe they’d qualify for a mortgage if they applied.

“It’s becoming very evident from this survey and our research released last month that the financial and emotional impact of repaying student debt is contributing to a delay in purchasing a home for many would-be buyers,” adds Yun. “At a time of quickly rising rents, mortgage rates at all-time lows and increasing housing wealth, a lot of young adults in their prime buying years are struggling to enter the market and are ultimately missing out on the stability and wealth accumulation that owning a home can provide.”

The belief that now is a good time to sell

Sales are picking up and prices are up, so more current homeowners (61 percent) believe it is a good time to sell compared to the first quarter of this year (56 percent).

“More homeowners acknowledging this pent-up demand may perhaps mean we begin to see more supply come online in the near future,” adds Yun.

When asked about their outlook for home prices in their community in the next six months, almost all believe that prices will stay the same or rise (93 percent), which is consistent with last quarter (91 percent). Respondents from the West, those living in urban areas and renters are most likely to believe prices will go up in their communities.

#HOMEsurvey