CZI investments

The Chan Zuckerberg Initiative (CZI), the $45 billion philanthropy vehicle created by Mark Zuckerberg and his wife, Priscilla Chan, has recently pledged $5 million to Landed, a Y Combinator startup dedicated to helping educators buy homes.

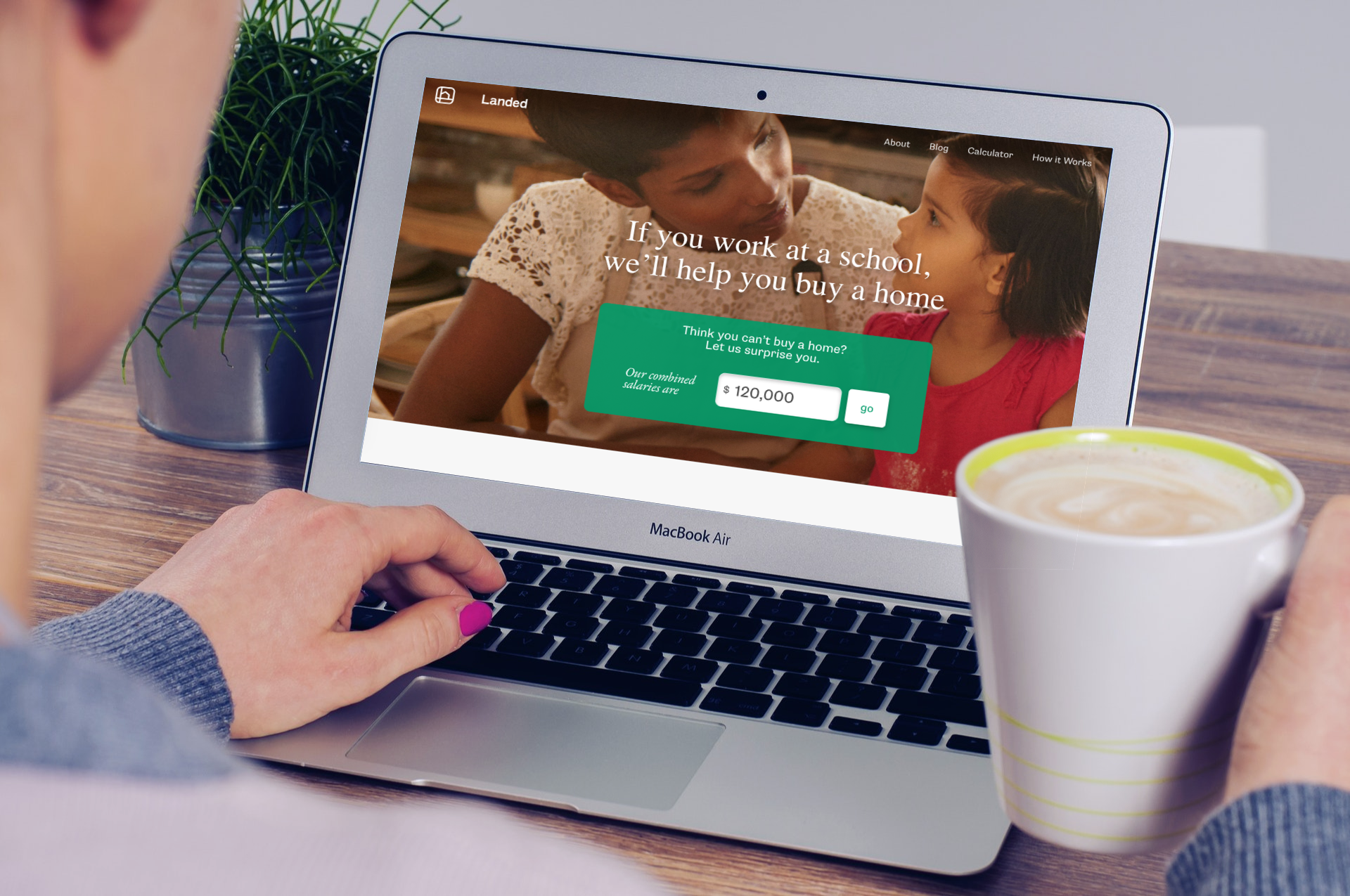

![]()

The most recent in a number of programs seeking to assist educators with the ever-increasing housing prices in the San Francisco Bay Area, Landed seeks to connect investors with educators that would otherwise be unable to afford a house on their own.

First things, first

The startup offers to pay up to half of the standard 20% down payment required to purchase a house featuring zero interest or monthly payments for the buyer aside from the mortgage.

graphic courtesy of TechCrunch

Instead, Landed makes a return on its investment whenever the homeowner decides to sell or refinance the house, taking a cut of up to 25% of the appreciation or depreciation of the home’s value.

It also makes money in the meantime by taking a cut of the standard realtor referral fee, who in turn pay nothing extra for using Landed’s services.

Being a lifelong Bay Area resident and the son of an educator, I can assure you that it’s a pretty sweet deal. Not that it’s much easier around the rest of the country, but finding housing in the Bay Area on a teacher’s salary is no joke.

How it works

After applying online, educators are paired with a lender who then determines whether or not they qualify for a mortgage. If approved, they are then linked up with a real estate agent that helps them find a home.

Once they have found a home, Landed pays up to 50% of the down payment in return for its equity stake in the house.

Viewing Landed as a “stair-step to ownership,” CEO Jonathan Asmis hopes that educators helped by the startup will earn enough from the home’s appreciation to purchase their next home without assistance.

graphic courtesy of TechCrunch

Paying it forward

CZI’s $5 million pledge to Landed will help roughly 60 educators working at schools near Facebook’s headquarters in Menlo Park afford down payments on homes.

Any money earned if the homes appreciate in value will be put back into CZI’s fund for Landed to help future educators.

According to a post on CZI’s Facebook page, their “hope is that [their] partnership with Landed will help create a sustainable model to help make home ownership a reality for more educators and others at risk of getting priced out of the communities they serve.”

Diversifying the portfolio

Thus far, CZI has primarily focused on donating and investing in health science and education, such as their $3 billion BioHub initiative focused on ending disease. However, this is not the first time the initiative has diversified, as it has also began funding programs for the underprivileged.

A prime example of this is the $3.1 million it gave in February of this year to Community Legal Services in East Palo Alto, which offers legal services pertaining to immigration, housing and economic advancement.

It seems that CZI is aware of the economic disparities in the Bay Area that are largely due to the region’s “tech bubble,” and are in turn taking action to aid increasing number of families that are getting priced out of their homes.

Educators interested in purchasing a home with Landed’s help can apply on their website.

Andrew Clausen is a Staff Writer at The American Genius and when he's not deep diving into technology and business news for you, he is a poet, enjoys rock climbing, monster movies, and spending time with his notoriously naughty cat.