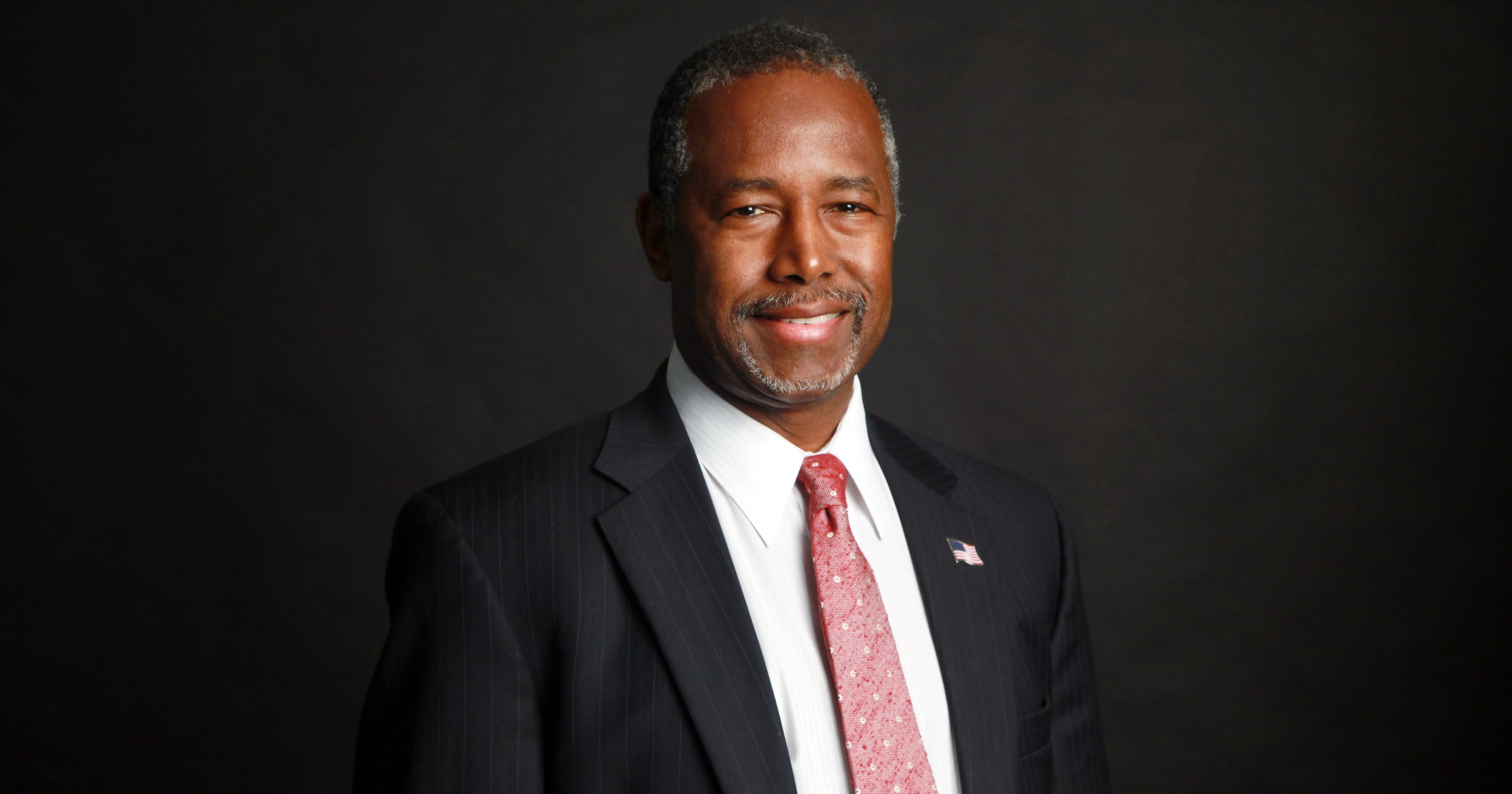

Carson accepts HUD position

Former presidential candidate and retired neurosurgeon, Dr. Ben Carson, has accepted President-elect Donald Trump’s nomination to head up the Department of Housing and Urban Development, Trump’s team confirmed on Monday.

Dr. Carson is the vice chairman of Trump’s transition team and is popular among traditional conservatives, but what does the real estate industry think of this morning’s announcement?

In response to the announcement of Dr. Ben Carson as President-Elect Donald J. Trump’s selection for Secretary of Housing and Urban Development, NAR President William E. Brown said, “Realtors® know that the incoming Secretary of Housing and Urban Development has a big job ahead. Potential homebuyers face a range of hurdles, from rising prices to mortgage credit that’s burdened by fees and extra costs.”

“We congratulate Dr. Carson on accepting this important challenge and wish him the very best of luck in meeting the task ahead,” Brown added. “While we’ve made great strides in recent years, far more can be done to put the dream of homeownership in reach for more Americans. The National Association of Realtors® and its 1.2 million members looks forward to working with Dr. Carson to fulfill this important mission.”

Why HUD is so critical

Infrastructure isn’t often sexy, but it is important. It’s the same with Presidential appointments; potential appointments to Cabinet positions such as Secretaries of State and Defense are debated and discussed( and with good reason), while candidates for seemingly less prestigious positions, such as the Secretary of Housing and Urban Development(HUD) are almost an afterthought.

As Dr. Ben Carson has now accepted the offer extended to him by President-elect Trump to become the next Secretary, he has previously said that he didn’t feel qualified to serve as a Cabinet officer because he’d never before run a federal agency.

With his reticence overcome, he’ll have an opportunity to affect the lives of more Americans than he perhaps thought.

Andrew Flowers, writing at FiveThirtyEight, provides compelling reasons why HUD plays a larger role in the lives of Americans than many think, whether the department gets the credit or not.

Scope of responsibility

With a budget of nearly $50 billion dollars and over 8,000 direct employees, HUD isn’t just a vast federal agency, but one whose responsibility touches the lives of millions of Americans through their programs on home ownership, public housing, and civil rights, such as the Fair Housing Act.

A staple of President Lyndon Johnson’s Great Society, the agency was established and given Cabinet status in 1966 and has created opportunities for millions of Americans to become first-time homeowners throughout their fifty years in existence, as well as ensuring that poverty and homelessness were battled at their front lines by ensuring that support was available for those who needed it most.

Breaking the Cycle of Homelessness

In the fight against chronic homelessness, a surprisingly common-sense approach seems to be working the best: give homes to the homeless. Based on the work of social researcher Sam Tsemberis, Utah has slashed their chronically homeless population by 72 percent between 2005 and 2014, reducing that number from nearly 2,000 to just over 500 in that time.

Similar results have been seen in urban metropolises such as New York City and Washington, D.C. with the same approach: provide housing, and a greater sense of stability emerges, from which the now former homeless can build while they find solutions to the other problems which may have faced them. Flowers identifies research by Matthew Desmond, a Harvard sociologist, that agrees with this.

This housing first approach ends the pattern of residential instability, which negatively impacts children and their parents. Although this seems to be a practical approach that’s meeting with success, it’s not backed by current U.S. housing policy.

Although HUD supports the housing voucher program, popularly known as Section 8, assisting 5 million people, and providing public housing to another 2 million, there’s a critical disconnect between those who qualify for assistance and those who get it. The Center on Budget and Policy Priorities has identified that 75 percent of Americans who qualify for housing assistance don’t receive it, for multiple factors.

Supporting mortgages

The Federal Housing Administration, a component of HUD, is involved in the underwriting of one out of every six mortgages, placing HUD on the hook for securing over $1 trillion in mortgages in the United States. That backing, in the form of FHA insurance is critical, especially for those homeowners in a lower-income bracket, to get the mortgage that they need at a lesser price than they could have secured on their own.

In the wake of the 2008 financial crisis, HUD served a vital role in ensuring that the housing bust that led to the downturn in the United States wouldn’t be repeated.

Working with other regulatory agencies, HUD helped to provide a working definition of a “qualified residential mortgage”; this change in the definition has stopped some of the mortgage securitization that was a key component in the creation, and ultimately, the bursting of the housing bubble.

Fair play for all Americans

Making sure that all Americans, regardless of race, religion, creed, or gender, have an equal footing in obtaining housing was central in the Fair Housing Act, the 1968 bill that was a keystone of LBJ’s Great Society, and the raison d’etre for HUD’s action in their early days as a Cabinet agency.

Under the law, they were initially responsible for combating discriminatory practices in housing, such as refusing to rent or sell housing based on a protected category, setting different terms or conditions for sale or rental based on a protected category, or refusing disabled persons the ability to make reasonable accommodations to their property as necessary. However, their responsibilities extended beyond just ensuring that discrimination in housing was ended, as they were required to further the spread of fair housing in the United States.

In the Obama administration, this has been accomplished by refusing to allow federal funds to be used in areas that have been historically segregated; in order to access embargoed funds, both state and local public housing authorities would have to identify plans to provide changes in zoning regulations and in developing affordable housing to combat the segregation patterns.

America By The Numbers

HUD is also a robust source in the collection and reporting of housing data in America. Their biennial survey, The American Housing Survey (AHS), is a comprehensive examination of a wide variety of topics related to housing in the United States, covering information on homes and housing costs, and is used by multiple sources to drive legislation as well as to better understand patterns of change in cities and communities across the nation.

Flowers points out that HUD has shown the ability to improve their data reporting when needed; for example, in response to criticism that there was a dearth of information regarding evictions, HUD field tested questions regarding the topic that will be included in the 2017 version of the AHS.

A Time For Change

As with every transition in the presidency, change is bound to occur across all levels of the government. What was a priority for one administration may not even be an afterthought in another. As Dr. Carson has accepted Mr. Trump’s offer, he will have the opportunity to provide a safety net for those who need it, and reform where it is needed, to ensure that the impact that the housing market has on the U.S. economy is regulated safely, as much as is possible in a free market society.

Some believe that Carson’s conservatism may spell a shift in HUD’s priorities to fight desegregation and discrimination, and the political realities of the administration in which he serves leads others to believe that further assistance for those who need it most may not be swift in coming. Alternatively, bringing new blood into the department could shake it up and strengthen housing for decades to come and Carson could help Trump make good on his repeated promises to focus on urban renewal. No one can quite say, especially given how little attention Carson’s role has received compared to other appointments.

One thing is clear: Carson’s new role is far from ceremonial.

#CarsonHUD

Roger is a Staff Writer at The Real Daily and holds two Master's degrees, one in Education Leadership and another in Leadership Studies. In his spare time away from researching leadership retention and communication styles, he loves to watch baseball, especially the Red Sox!