After a rocky few years for housing, all eyes are on a smoother road toward recovery, but one obstacle remains: tight lending conditions and many borrowers’ inability to obtain a mortgage.

In recent years, the National Association of Realtors (NAR) has repeatedly asserted that lending conditions remain restrictive, especially for would-be first time buyers, and without pushing the lending world to offer lines of credit willy nilly (which many believe is why the housing market crashed in the first place), the trade group has long insisted that the conditions remain too tight.

Many in the housing industry believe that Fannie Mae, Freddie Mac, and other mortgage financiers could safely increase access to mortgage credit by adopting alternative credit scoring models when evaluating the creditworthiness of potential home buyers.

Roundtable on credit access

Recently, NAR, along with the Asian Real Estate Association of America and the National Association of Hispanic Real Estate Professionals met at a roundtable to discuss advances in credit scoring and their potential impact for homebuying consumers.

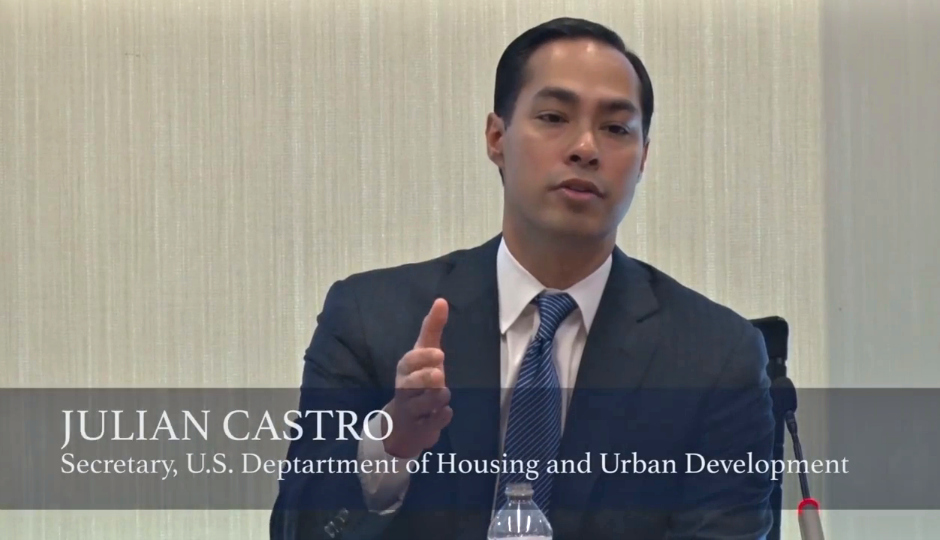

NAR President Chris Polychron opened the summit on credit access by welcoming Julian Castro, Secretary of the U.S. Department of Housing and Urban Development (HUD), who noted that his agency is looking at the credit scoring issue as part of its effort to improve credit access to Americans:

#NARsummit

The American Genius' real estate section is honest, up to the minute real estate industry news crafted for industry practitioners - we cut through the pay-to-play news fluff to bring you what's happening behind closed doors, what's meaningful to your practice, and what to expect in the future. Consider us your competitive advantage.