Print Solution

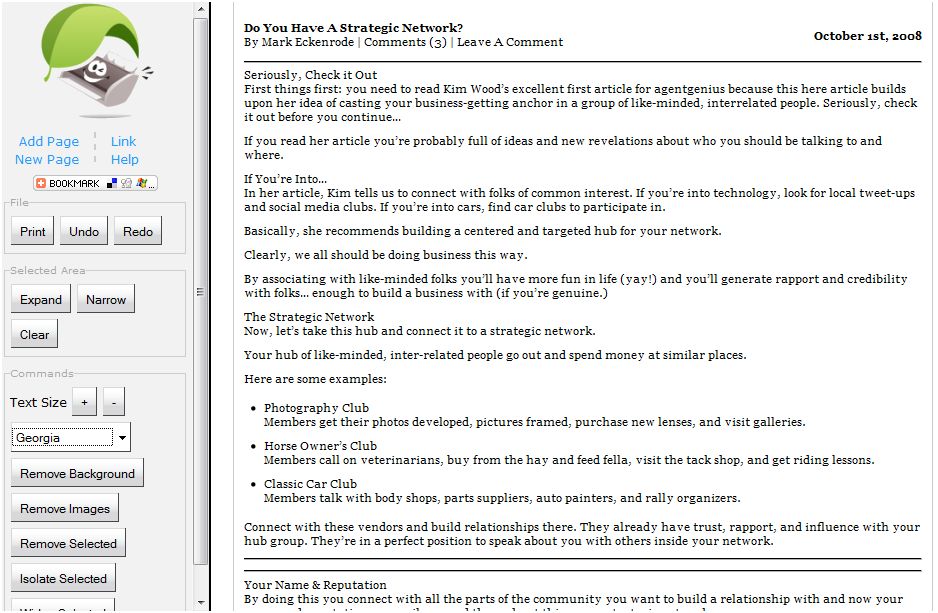

Sometimes we want to print a blog, a news story or a map but know it’s going to take the entire print cartridge to do so. In steps PrintWhatYouLike.com giving you control over what you print. Check this out- you go to PrintWhatYouLike.com and enter the URL that you want to print and it pulls up the site with the control panel on the left, like this:

Your Options

You can select limited areas to print rather than print the whole page’s content and expand and contract that selected area. What I find most helpful for saving ink and paper is that you can remove images and even remove the background which looks like this:

Then, you can choose the font that is easiest on your eyes and even select the size of the font which can do even more to condense the printing:

Be Green, Be Awesome

Not only is this an effort to save ink, paper and money, it makes it much more attractive to print out the reading you want to catch up on but can’t always be in front of the computer (which we discourage of course, lol).

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Dave Smith

October 8, 2008 at 3:39 pm

Lani,

Concept is nice, unfortunately if your page can’t load in less than 5 seconds they can’t bring it up saying it is a limitation google places on them.

Second, when you do get a page to come up with images it can’t format that page with the images as they appear on screen. They are all moved to the left with no text beside them.

It is a nice concept. I hope it can be useful in the near future. For now it seem very limited in functionality.

Lani Anglin-Rosales

October 8, 2008 at 3:45 pm

Dave, in using it several times, I didn’t experience any of the problems you’ve mentioned. I’m running Firefox 3 on Windows Vista, I did not test it in another browser.

For me, it’s been a great ink saver plus some sites are in fonts that I hate so I print it in whatever font I want to read while riding in the car. Call me a tree hugger, that’s fine, I like trees! 🙂

Dave Smith

October 8, 2008 at 4:06 pm

Lani,

First it has nothing to do with being a tree hugger. (How does printing to read in the car save a tree?) : )

Second, I’ve tried it with three different browsers IE7 Flock and FF on an XP pro system. It won’t function under any of those. I guess we wait and see what other experience when they try it.

Like I said above. Great concept. But your page better load in under 5 seconds.

Great find. Just reporting what my experience with the site. Have a great Day!

Mark Eckenrode | HomeStomper

October 8, 2008 at 4:24 pm

haven’t even tried it yet but… do you know if you can create a printsheet via a link? this way you can have a Print Me link at the bottom of a blog post that sends folks over to the site and it’s all cued up there for them.

that’d be nifty. if they don’t have this option… lani, get coding! 😉

p.s. thanks for all the linkage you’ve been sharing lately to some cool online tools

Linsey

October 8, 2008 at 4:28 pm

I’m going to try this one. I find articles in here, and in other places on the internet, that I like to share at my mastermind group. My solution has been to copy what I like and then open Word, paste, and print. Kind of a pain but this sounds like the solution I’ve been searching for. Thanks again Lani!

Jennifer Rathbun

October 8, 2008 at 8:35 pm

This could not come at a better time! I happen to be 132 posts behnd (sorry!) and I was going to use this tool to print out these posts – the ones that looked like I needed. It did not work tonight. Maybe it’s the satelite internet. Either way, I will definately keep this little tool. Thanks!

Kim Wood

October 8, 2008 at 8:42 pm

Making note of this. I have wanted to print articles that I have written to give or mail to a client for a “touch” and an invite to my blog.

Sounds like this would be a good possibility with the format.