Connecting landlords and renters in a lovely way

SAN FRANCISCO – After several month in private beta, Lovely is opening to the public and the company aims to improve the search experience for renters. Currently, the site is available in San Francisco, but with an impressive list of investors, the company will expand to metros across the nation. Additionally, they say they will be offering more landlord and property management tools that will roll out next year but are currently focused on helping renters stand out as the housing market begins to favor landlords.

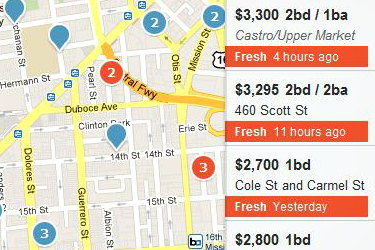

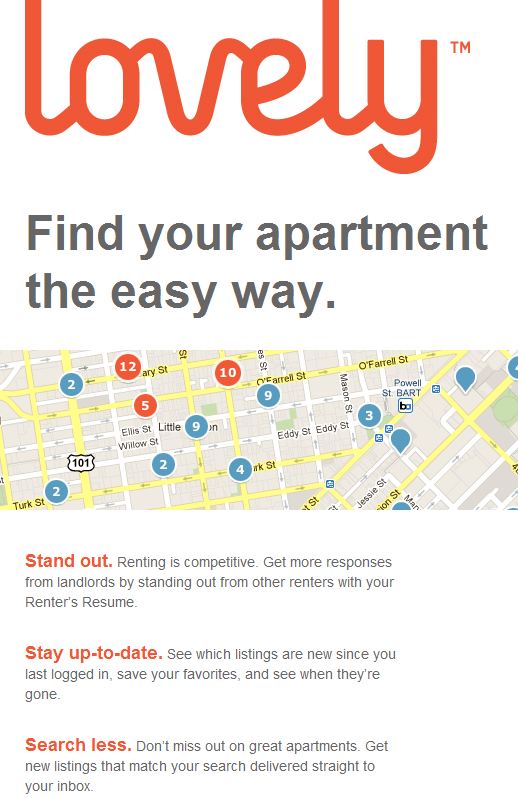

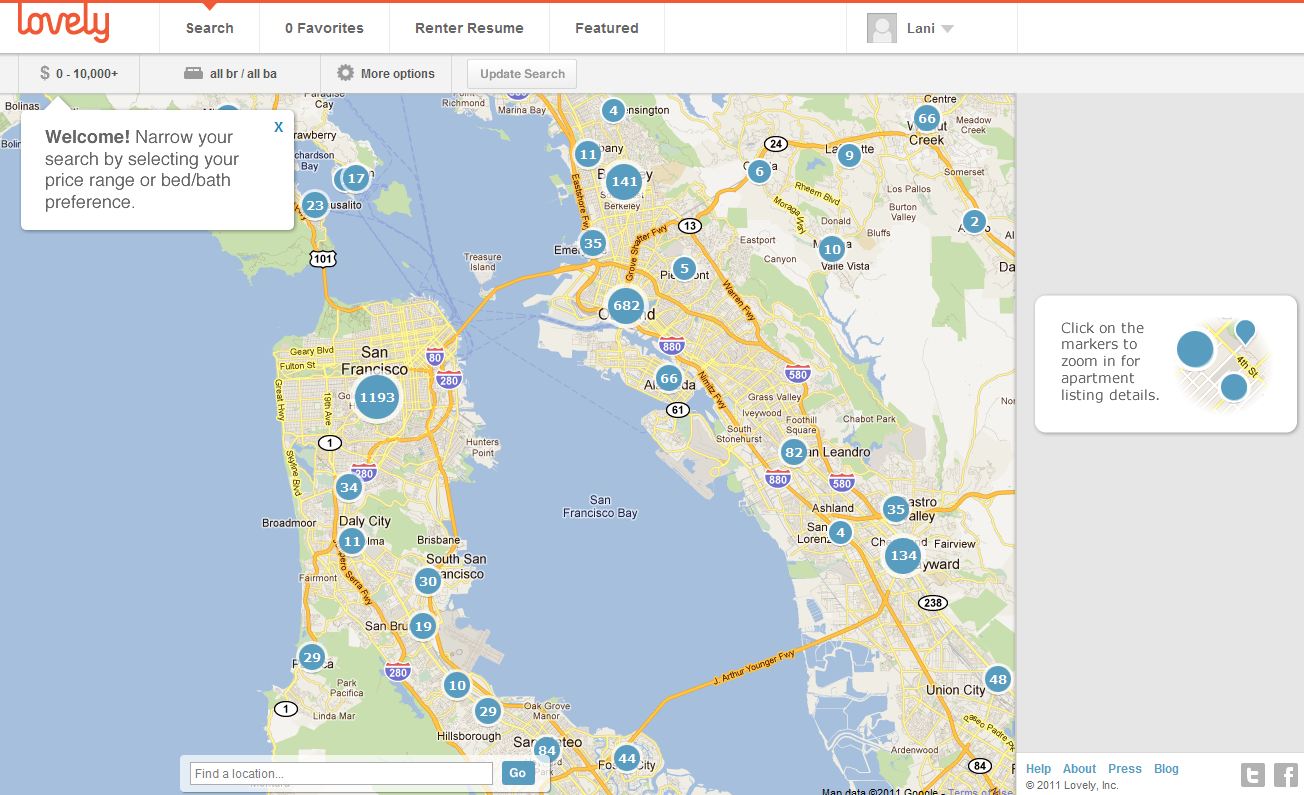

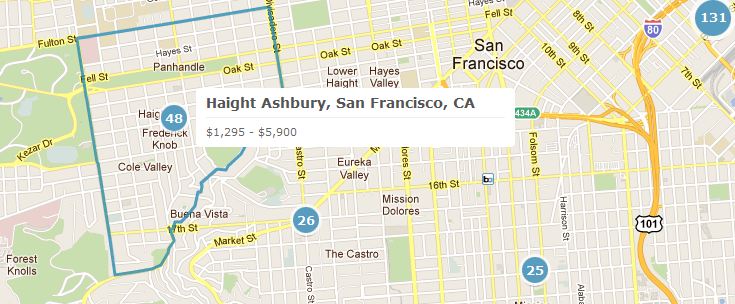

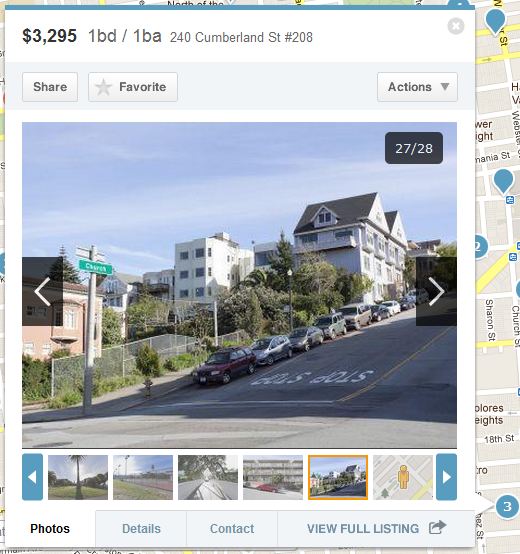

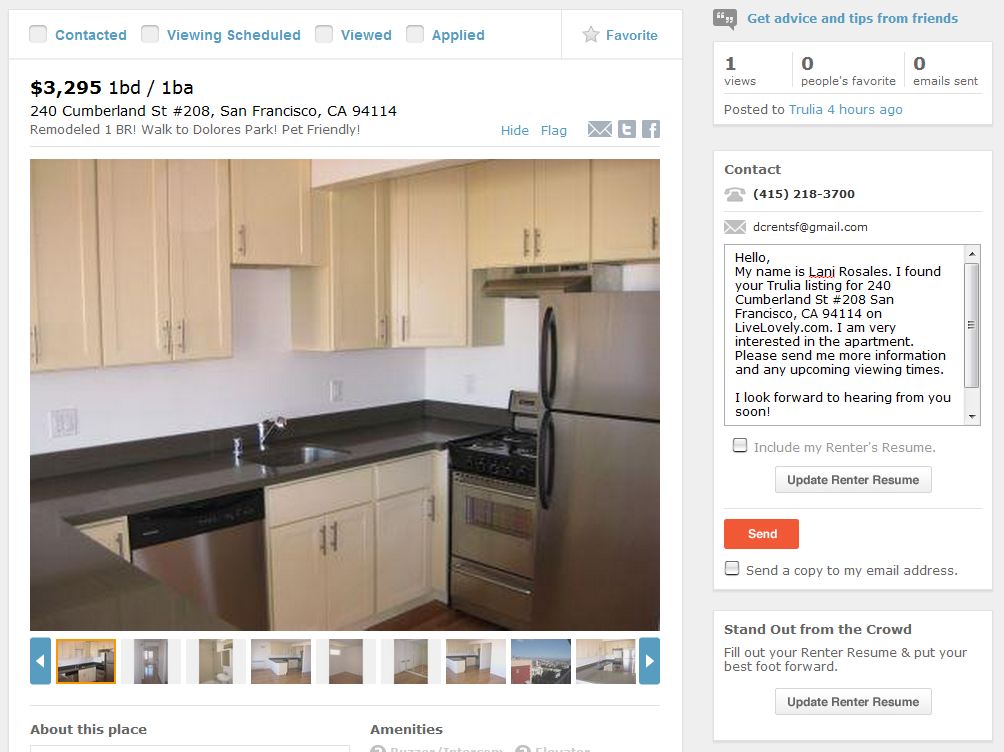

“Lovely connects people and places, helping renters find the new homes they seek. With comprehensive listings, visual location-based searches, renter profiles, and more, Lovely makes it easy to find rentals and interact with landlords,” their site says. Listings are posted in real time and are aggregated from sites like Trulia. Because users can log in with their Facebook credentials or an email address, search parameters and favorites can be saved and renters can email landlords (or listing agents) directly from the site to speed up the process (and help expedite while on a mobile device).

Lovely Founder, Blake Pierson, says, “I’ve moved around a lot and one of my worst apartment search experiences led to me, my co-founder Doug Wormhoudt and our significant others living in a doublewide trailer in a beach community in Maryland. Luckily that was only for a few months during our bootstrapped days and we now live, separately, in apartments in San Francisco, but the search experience for renters hasn’t gotten any better which is why we created Lovely.”

What sets Lovely apart

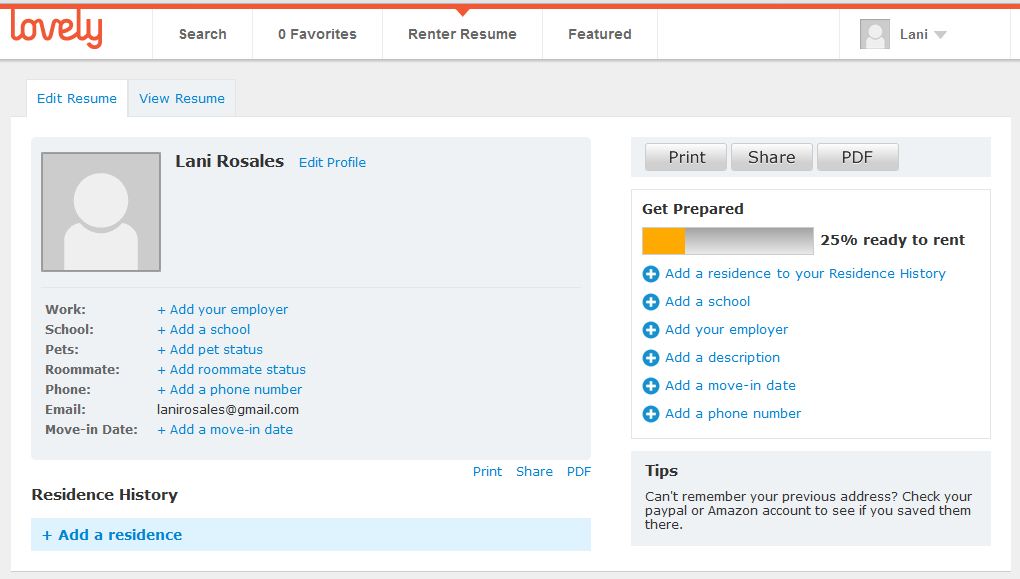

Besides clean, modern design, the site boasts an innovative tool called the “renter resume” which helps renters to “stand out,” but we see it more as a means of prepping a renter to apply, priming the pump if you will, a move that landlords will surely enjoy. The information requested is relevant and private, but our only worry about the site is that it allows users to upload a photo, which puts them in a vulnerable legal position in that storing visual data on renters (or in retailers’ case, of buyers of any kind) can later be used in a lawsuit if someone feels discriminated against (“you knew I was Hispanic because of my profile picture and you refused to rent to me based on that fact”).

Overall, the company looks like a breath of well designed fresh air in the stale world of rental search, and we wondered where the name came from. Co-founder Leslie Chicoine said, “Looking for an apartment in the city is frustrating, aggravating and just plain annoying. Our product aims to provide an experience that is just the opposite of that, something that is, well, lovely.”

As a strong vote of confidence in Lovely, the financial backing is impressive as investors include Keith Rabois, Benjamin Ling, Colin Evans, Chris Dixon, Ron Conway, Dave McClure, Aydin Senkut, Kartik Hosanagar, Alex Zubillaga, and Kal Vepuri.

Photo tour of Lovely:

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Tina Fine

October 11, 2011 at 2:24 pm

And yet another site with data from Trulia, gee.

Todd McGregor

October 12, 2011 at 11:35 am

My two cents for what it's worth:

1) Requiring someone to create an account before they can search for rentals is a REALLY bad idea. Let people in the front door, then provide incentives to create an account later.

2) I don't think landlords will care much about a renter's resume. They all have different approaches to the application process and I don't see this adding much value. A portable rental application which can auto-populate some of the most common questions on an app, now that would be great (shameless self promotion: we're actually working on this at Zakits.com. I just wish I had the investors this company does.)

3) Are they a listing aggregator or do they allow people to list directly on the site? If it's the latter of the two I wouldn't expect them to be around for very long.

-Todd