Keeping vacationers in check

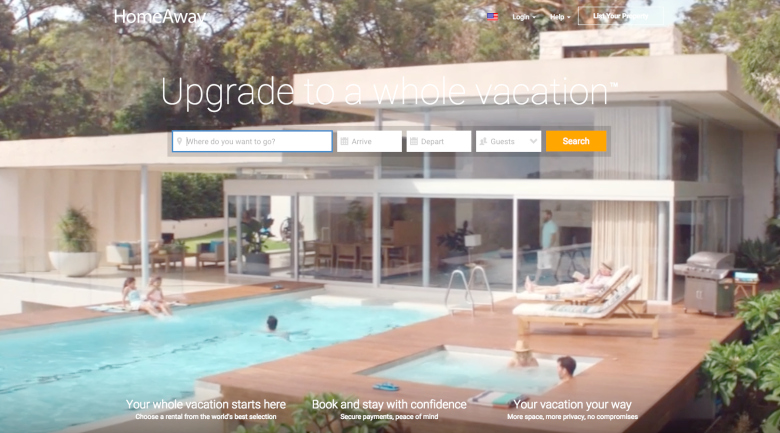

The concept is simple enough: With HomeAway you plug in a city, look at the short-term vacation rental properties and book the one you want to stay in. Pay online, arrange with the owner where to find the keys, and off you go.

![]()

Silicon Hills News reports that a pilot program is set to kick off in none other than Austin, entitled “Stay Neighborly” which among other things will help ensure that renters are complying with city ordinances. Of particular interest is a new no-tolerance policy in the plan which identifies owners who don’t want to play nice and follow the rules.

Big city in a small location

Austin, in case you’ve been living in a fallout shelter and don’t get out much, is about as close to the promised land as you can get without walking on water: not only is Austin fast-eclipsing Seattle, Washington as the start-up capital of the US but as Forbes recently pointed out, “Austin consistently sits atop Forbes’ annual list of the best cities for jobs and scores highly in other demographics rankings.”

Perhaps more importantly, Austin is the “third-fastest-growing city in the nation, attracting not only large numbers of college grads, but also immigrants and families with young children.”

So you can see why there’s a lot of interest in the city of Austin in general and why it is a good location for a short term rental pilot program in particular (and not just because HomeAway is headquartered in the ATX).

The issue at hand

By its own accord, HomeAway says that “the Austin market is, in practical terms, a very small share of the company’s business,” amounting to about 400 properties in Austin out of an estimated 1.3 million rentals nationwide. The issue at hand is that HomeAway properties are considered Type 2 rentals which means that the owners do not live on the premises. What has happened on a handful of occasions is that renters have shown up, partied like it’s 1994 and left. No problem if you’re living on the beach or a secluded area but not the type of thing that you want to have happen in a residential neighborhood with family and white picket fences.

There is a proposal circulating that would eliminate the category of Type 2 rentals altogether. Conversely, if the rental category is upgraded to a Type 1, that means the owners must be on the premises which does lend itself to some kind of crowd-control. But is problematic if the owner lives elsewhere.

The future

How this plays out is anyone’s guess. You can’t argue the fact that home sharing represents an essential economic lifeline to help middle class [Austin] families pay the bills and make ends meet. For its part, Airbnb which also is a home sharing entity is fully backing HomeAway’s efforts. And why not? They stand to lose if the Type 2 category goes away and other cities follow suit.

#HomeAway

Nearly three decades living and working all over the world as a radio and television broadcast journalist in the United States Air Force, Staff Writer, Gary Picariello is now retired from the military and is focused on his writing career.

Jane

February 22, 2016 at 6:50 pm

“You can’t argue the fact that home sharing represents an essential economic lifeline to help middle class [Austin] families pay the bills and make ends meet.” – are you kidding me? What middle class family do you know that owns multiple homes? By definition if you are an STR 2 owner you are a real estate investor that lives in one home and rents at least one other short term. (It is estimated that folks that operate more than 1 STR 2 make up about 47% of Airbnb’s revenue in Austin. COnsidering HomeAway only rents entire homes it is probably even more of their revenue stream in this town.) Considering the average cost of a home anywhere in ATX I would say the “folks” operating STR 2s are far from middle class and contrary to your point are removing otherwise needed housing stock from actual middle class families living in Austin full time.

Mike Polston

February 22, 2016 at 8:21 pm

The middle class use case for home sharing is defined as STR Type 1. STR Type 2 is a pure investment use case, used by investors seeking a better payback they can get from Stocks and Bonds etc. Austin has several investors who own from 3 to 9 properties each. One owns 5 properties and makes $700,000 a year from them in rent. There is a very long list of cities that support Type 1 only use cases. There is a very short list of cities that support Type 1 and Type 2. Austin is on the short list and was put there as an experiment by HomeAway 3 years ago. We are working hard to get Type 2 out of here.

Pingback: Latest Rental Properties News - ELLC Properties Management

Frugal Traveler

February 23, 2016 at 12:42 pm

When we signed up with VRBO to find people to stay in our home while we traveled, short-term rentals were hardly noticed by investors. Owners and travelers actually talked to one another, building relationships before making a deal. I think that the huge increase in problem tenants is a result of the shift from personal transactions to Big Business. Investors who rent out a house or apartment purely for profit are unlikely to take the time to learn who they’re renting to. These new business models, which block direct communication with prospective tenants until their money is on the table, makes it very difficult for homeowners like ourselves to stay in the game. @trvlohnthehouse