FRIDAY FAVORITES

I have a confession to make. I kinda sorta forgot to tell you my five favorites last week because I was so happy it was Friday I went straight space-cadet and forgot. But never fear, I’m back and have my favorites ready just for you!

1. Favorite Video

If I’m not mistaken not only is this video real, but so is the product. Yes, you read that correctly. You can actually buy that special guy in your life a business suit onesie. Heck you could buy it for your special lady too — pantsuits are a thing.

If for nothing else, this suit is the perfect gift for that one sibling that is perpetually late to brunch because they overslept.

2. Favorite Cause

Go Rings is actually a a fundraising tool. They have partnered with over 150 world-changers and adventurers who are going out and doing good work around the globe. They recognize that fundraising can be awkward or discouraging, so they aim to make it a more joyful, contagious experience.

Their story is super rad. In 2013 a recent TCU graduate, Darcie, created and began selling the very first Go Rings to fund an 11-month mission trip around the world. The rings have 11 loops for the 11 countries she went to, and 7 bindings for the 7 teammates she had.

Darcie surpassed her fundraising goal, but the rings kept selling like crazy. The product and purpose were contagious, and boom, before she knew it she had a business. Darcie teamed up with Dru, her college roommate, who took over running the Go Rings operation while she was away. After the rings took off, Darcie and Dru realized that by donating a portion of each purchase, Go Rings could provide a tangible solution to one of the biggest problems every charitable cause faces: fundraising. The little golden rings that helped Darcie fund her trip now support the work of over 150 organizations and individuals around the world.

I personally have a few Go Rings and feel like I should mention that I am not being paid or promised anything to write about them. They’re just a brand and cause that I believe in and I want you to believe in too!

3. Favorite News Story

This story blew my mind. Remember that disappearing ink that was blue that you got at fairs and stuff and you’d spray your friends with it and moms would lose their collective minds because sometimes it didn’t actually disappear? Well LL Bean has done one better and created a disappearing ad for the New York Times. Yep– the ad appears oddly spaced and largely void of content until you take the paper outside and voila! there it is!

4. Favorite Tech Toy

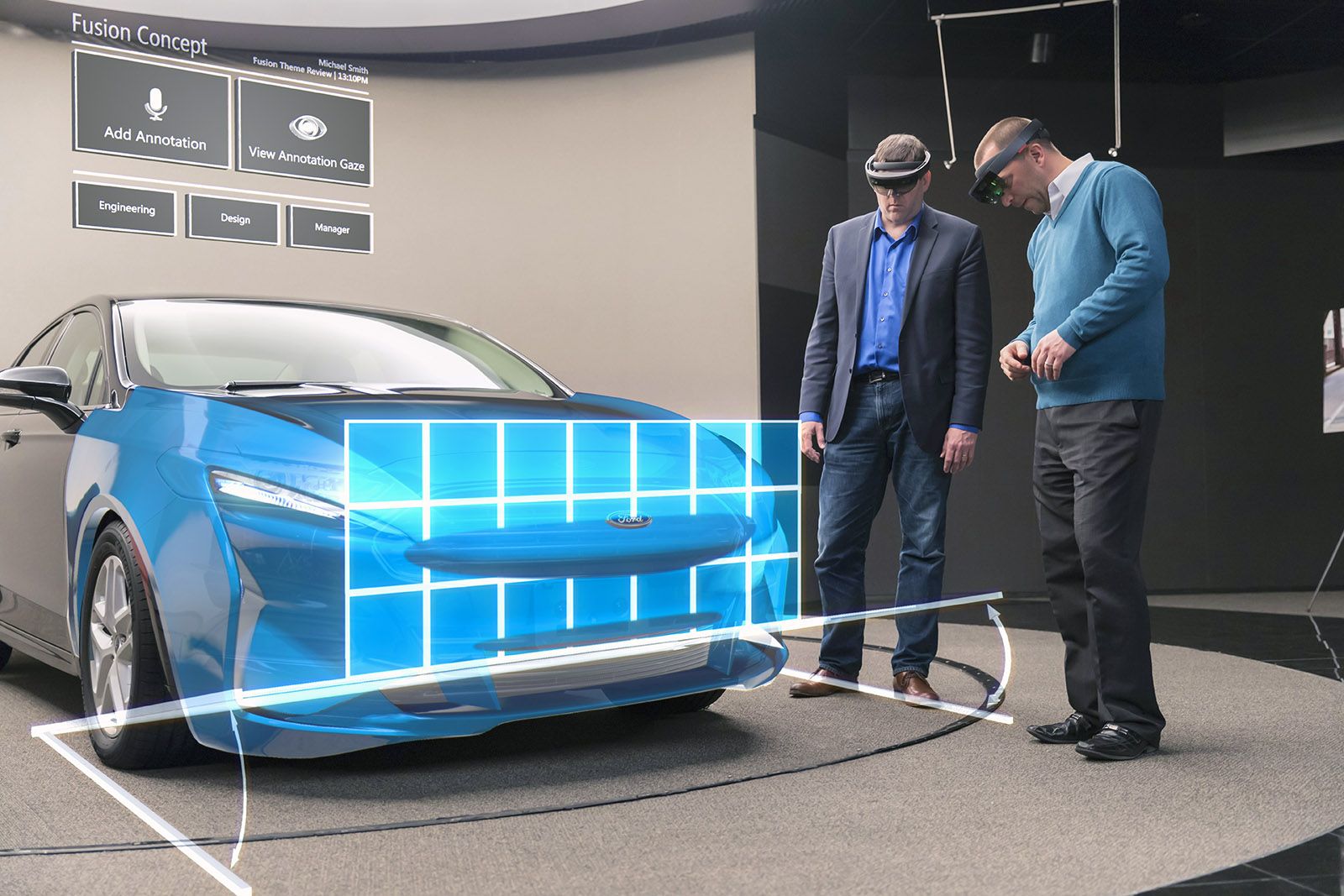

Say it with me… HoloLens.

The folks over at Ford are starting to use HoloLens to design their cars. For those of you who don’t know, even though we live in 2017, car makers still use bigass chunks of clay to create models and see their designs IRL. Now, car makers are stepping into a world where they can use digital goggles to help them scope out different ideas and streamline the design process.

5. Favorite joke

A five year old told me this and I actually giggled:

A duck walks into a bar and asks, “Got any grapes?” The bartender, confused, tells the duck no. The duck thanks him and leaves.

The next day, the duck returns and asks, “Got any grapes?” Again, the bartender tells him, “No — the bar does not serve grapes, has never served grapes and, furthermore, will never serve grapes.” The duck thanks him and leaves.

The next day, the duck returns, but before he can say anything, the bartender yells, “Listen, duck! This is a bar! We do not serve grapes! If you ask for grapes again, I will nail your stupid duck beak to the bar!”

The duck is silent for a moment, and then asks, “Got any nails?”

Confused, the bartender says no.

“Good!” says the duck. “Got any grapes?”

Maybe it’s funnier when a 5 year old with a speech impediment tells you. ¯\_(*_*)_/¯

Hasta pasta

It is easy to feel like life is just that one Rihanna song where she says work, work, work, work, work and then you don’t really understand much else– but hey, you’re doing it. Even if the biggest thing you accomplished today was getting out of bed, we’re proud of you.

Rest up this weekend, enjoy a pumpkin spice something-or-other if that’s what you’re into, and gear up to punch Monday in the throat.

#FridayFaves

Kiri Isaac is the Web Producer and a Staff Writer at The American Genius and studied communications at Texas A&M. She is fluent in sarcasm and movie quotes and her love language is tacos.