We’ve written for years about millennials and their reluctance to purchase homes, especially in the wake of the pandemic. Financial hesitancy is a trait long associated with millennials, but according to Hana Ben-Shabat, Gen Z is making a definitive push for homeownership where the prior generation has stagnated.

Hana Ben-Shabat is the author of Gen Z 360: Preparing for the Inevitable Change in Culture, Work, and Commerce, and she founded Gen Z Planet, a firm that “[helps] brands prepare and adjust to the changes that Generation Z is bringing to the workplace and the consumer market.”

Her insight is clearly valuable, making her assertion that Gen Z is more likely to buy homes less speculation and more prophecy.

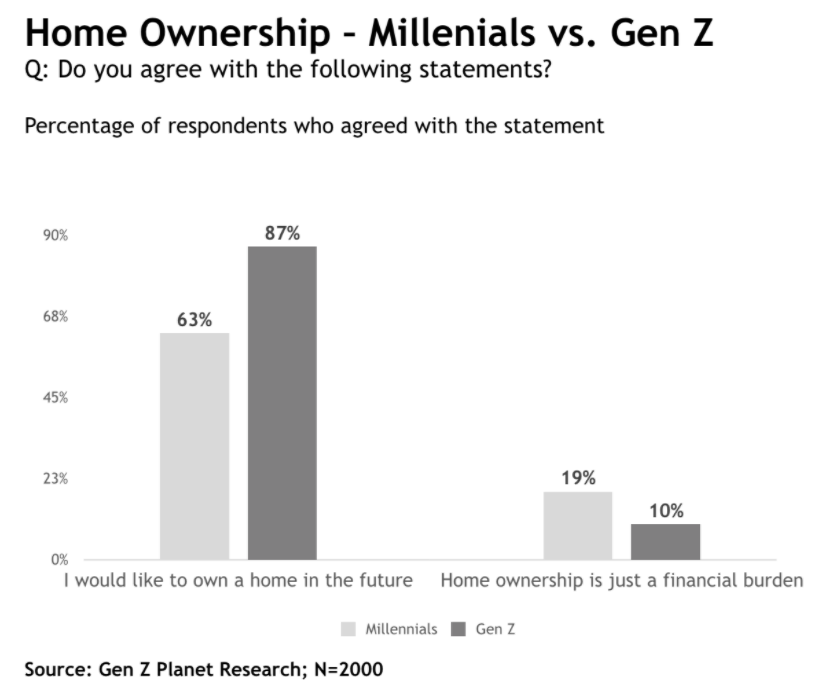

“Considering their focus on securing their future, home ownership is a piece of the puzzle,” Ben-Shabat says. In a related survey, she notes that 87% of Gen Z participants expressed interest in owning a home sometime in the future; only 63% of millennials echoed that sentiment.

Gen Z participants also had a stronger inclination toward viewing homeownership as a financially smart decision rather than a burden.

Gen Z’s open-mindedness toward purchasing homes may seem surprising at first glance. Ben-Shabat acknowledges the financial hardships placed on this generation, and posits that, having seen millennials struggle with student debt and the recession of 2008, this generation has arguably more incentive to stay away from large investments.

But she also points out that Gen Z buyers are “determined to learn from the mistakes of others and secure their financial future as early as possible,” adding that they “benefited from a wave of consumer financial education that began after the housing crisis of 2008.”

This makes for a generation that is both clear and educated regarding their financial goals and how to achieve them.

It’s also worth noting, as Ben-Shabat does, that millennials have a more tenuous grasp of DIY culture and the financial decisions that accompany it than their Generation Z counterparts. As “digital natives,” Gen Z buyers don’t object as strongly to purchasing starter homes and renovating; millennials, by contrast, find themselves purchasing more expensive properties that are “ready to move in” due to waiting an extended time before shifting toward homeownership.

Ben-Shabat’s observations foreshadow an increased market shift toward Generation Z ownership, especially in smaller, more affordable locations. As for the economic ramifications of the paradigm change, only time (and Ben-Shabat’s website) will tell.

Jack Lloyd has a BA in Creative Writing from Forest Grove's Pacific University; he spends his writing days using his degree to pursue semicolons, freelance writing and editing, oxford commas, and enough coffee to kill a bear. His infatuation with rain is matched only by his dry sense of humor.