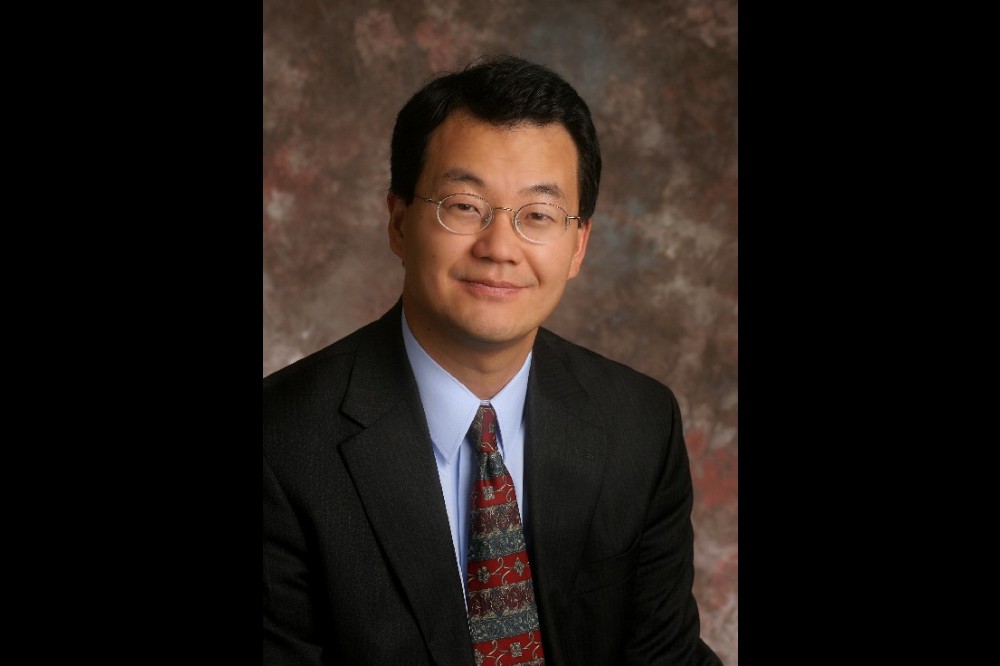

It’s no secret that the U. S. economy has taken a hit in the past few weeks. Most industries, real estate being no different, will be dealing with the aftershocks of COVID-19 for several months to come. We spoke with the National Association of Realtors (NAR) Chief Economist, Dr. Lawrence Yun about some of the big questions surround the real estate industry right now. He offered his predictions and provided helpful resources for those who may need it.

AG: There is a great deal of speculation about the how lenders will react to the current economic situation. What is your recommendation to lenders, should they tighten or loosen lending standards?

Dr. Yun: “Loosen in terms of lower rates though not in credit scores or down payments. The Federal Reserve went all-in to help interest rate-sensitive sectors like real estate to get moving and interested. A housing market recovery will help with the nation’s broader economic recovery.”

AG: Unfortunately for borrowers, there is often a difference between what lenders ought to do and what occurs. What do you anticipate lenders will do in response to this crisis?

Dr. Yun: “Tighten. Higher down payment and higher credit score requirements for non-conforming mortgages will limit the size of potential homebuyers. It lessens risk for lenders but hurts the economic recovery potential, though the risk of home price declines is low given no funny subprime mortgages and no overproduction of new homes.”

AG: Many renters are facing difficult financial situations. There has been a shock of landlords (particularly multifamily) declaring they are planning to purchase when the current lease is up. What can these renters do to protect their finances, besides calling up a realtor now and beginning the search for a new rental?

Dr. Yun: “The CARES Act includes various provisions intended to provide federal support to Americans during this time. Regular updates on NAR’s federal advocacy updates are included here.

More specifically, NAR has prepared some information for our members regarding SBA loan programs , Unemployment Assistance, and Mortgage and Personal Finance policy, as well.”

Staff Writer, Natalie Gonzalez earned her B.A. in English and a Creative Writing Certificate from the University of Texas at Austin. She is a writer and social media nerd with a passion for building online communities.