Urban Outfitter steps in another pile

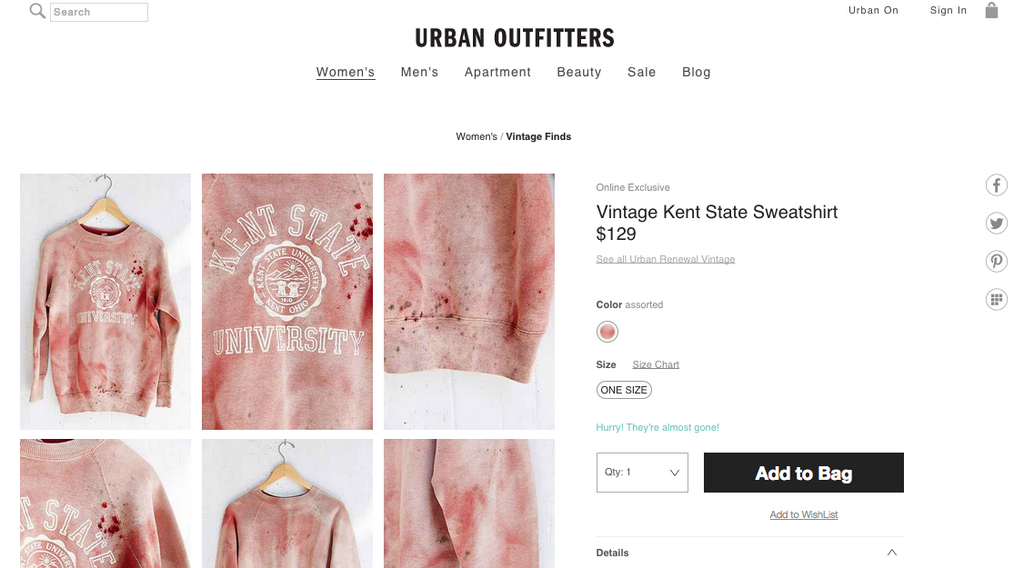

Already known for blatantly stealing unknown artists’ work and featuring them on clothing items for a healthy profit, Urban Outfitters has stepped in again by selling a “Vintage Kent State Sweatshirt” as depicted above, featuring blood splatter and a clear reference to the 1970 Kent State shooting wherein National Guard members killed four unarmed protestors.

Urban Outfitters says we all have it wrong, that it was just a sun-faded shirt. Are you buying that line? We aren’t either…

![]()

In a statement posted to Twitter, Urban Outfitters states:

Urban Outfitters sincerely apologizes for any offense our Vintage Kent State Sweatshirt may have caused. It was never our intention to allude to the tragic events that took place at Kent State in 1970 and we are extremely saddened that this item was perceived as such. The one-of-a-kind item was purchased as part of our sun-faded vintage collection.

There is no blood on this shirt nor has this item been altered in any way. The red stains are discoloration from the original shade of the shirt and the holes are from natural wear and fray. Again, we deeply regret that this item was perceived negatively and we have removed it immediately from our website to avoid further upset.

In other words, they’re not sorry that they screwed up, they’re sorry that you perceived it negatively.

Kent State said in a statement, “We take great offense to a company using our pain for their publicity and profit. This item is beyond poor taste and trivializes a loss of life that still hurts the Kent State community today.”

The shirt has been removed from the website and eBay users have taken down their listings featuring the controversial design as well.

How the Kent State tragedy shaped my career

The year was 1970. I wouldn’t be born for another 11 years. I wouldn’t even hear of Kent State until I was 14.

When we studied the tragedy in school my sophomore year, I also happened to be studying journalism and was tasked with one of my first real stories after months of laboring over the AP Stylebook and memorizing tedious rules.

Before I embarked upon my first story (which I had decided would be about how Kent State students in the 90s were living with the aftermath), I decided to meet with the only journalist I knew and ask her how she got her start and learn more about the trade.

Jenny had been running one of CNN’s southern state bureaus and was visiting for the weekend, so the timing was perfect, and she agreed to meet with a hopeful kid journalist.

I recall vividly the tablecloth with a toile pattern that adorned the table where I sat nervously, waiting for her, knowing that even casual questions would be scrutinized by this industry veteran. I traced and retraced the patterns with my fingers and thought I was going to throw up, even though I’d known her for most of my life.

“Whatcha got, kid?” was her first question.

I told her I was studying journalism and had competed for years, and hoped to study the trade in college. I asked how she got her start.

Her first major story was the Kent State shootings as a Kent State newspaper reporter and witness to the tragedy.

Okay, whoa.

She described the sounds, the smells, the chaos, the color of blood, the fact that she was so close that she could smell how metallic it was. She described how difficult it was to report objectively when she knew one of the victims and was on the front line, and insisted that breathing deeply and pretending to be an impartial third party was key to her fair reporting.

Jenny passed away while I was in college and I never got to chat with her again on the topic.

So, this week, when this shirt popped up in my FB feed, I just remembered her description of the metallic smell of a friend’s blood, and how this person summoned the strength to tell the story fairly, and how strongly she inspired me.

It was in that serendipitous moment that I decided that I would never be anything but a writer, so for a different reason, Urban Outfitter’s ridiculous “apology” sullies the memory of Jenny and the greatness that inspired my career path.

My memories are nowhere near as painful as Jenny’s or the families that lost their children in 1970, but I’m mostly focused on the fact that this ridiculous brand will probably never offer a real apology, but they should. And this time, they should admit what they did and apologize for that.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Pingback: Urban Outfitters step in it again, this time offending Holocaust survivors - AGBeat