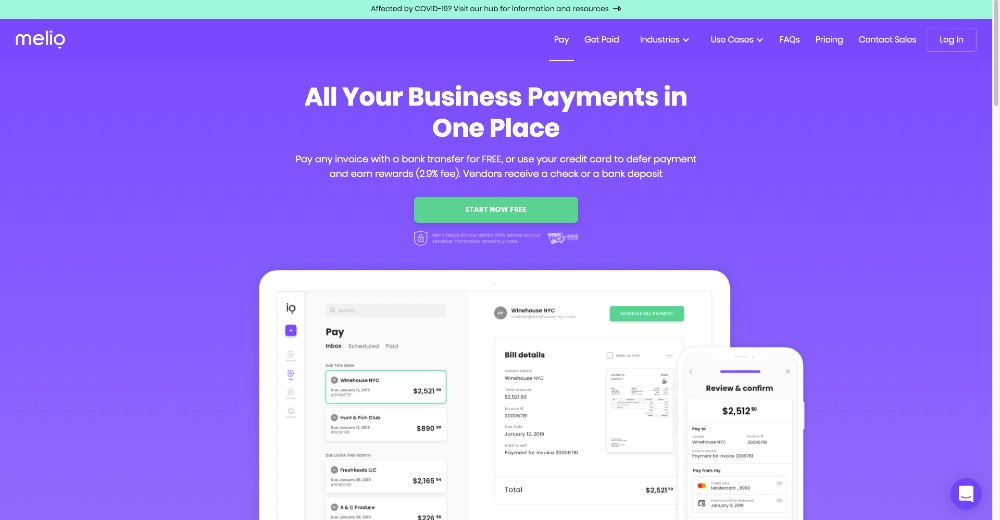

Designed to maximize cash flow and consolidate the complications of paying bills and vendors, the startup Melio could be a big boost for small businesses.

The way this payment workflow tool works is that it lets you pay any vendor –including those who do not accept credit cards- using a bank transfer, or check mailed on your behalf for B2B payments.

Specializing in small business payments, accounts payable, accounts receivable, online payments, and business to business payments; it is free to send and receive payments using bank transfers/ ACH but credit card payments incur a 2.9% fee.

The onboarding is straightforward, including integration and automatic sync with QuickBooks, which is essential for many small businesses. Lots of online customer reviews via Trustpilot and other sites claim that Melio is user friendly with responsive, human customer service. Melio fills the gap between the bill payer who wants to use a credit card to pay a bill, and the biller, who wants to receive their money as simply as possible, and without credit card fees. Many small businesses have to manage the challenge of payments to purveyors such as utilities and landlords that do not accept credit cards, or want to deal with the associated merchant fees.

Melio and bill payment services allow businesses who prefer to use a credit card for payment to do so. For a small business who could really use the float and cash flow of a 21-day billing grace period of a credit card, or using a card with a sweet rewards program, this could be a valuable option.

Melio does not have a mobile app to download, but it is described on the meliopayments.com website as having a mobile-friendly, responsive web app easily-managed across devices. Most of the reviews seem to confirm the user-friendliness of this tool, and the few poor reviews I have seen involved requests from Melio for compliance documents that were not satisfied by businesses, and resulted in undelivered payments. With more than 2 years since its founding, Melio is continuing to grow and cater to the needs of small businesses in the United States who want to streamline their accounts payable process.

Yasmin Diallo Turk is a long-time Austinite, non-profit professional in the field of sexual and domestic violence, and graduate of both Huston-Tillotson University and the LBJ School of Public Affairs at the University of Texas. When not writing for AG she should be writing her dissertation but is probably just watching Netflix with her husband and 3 kids or running volunteer projects for HOPE for Senegal.