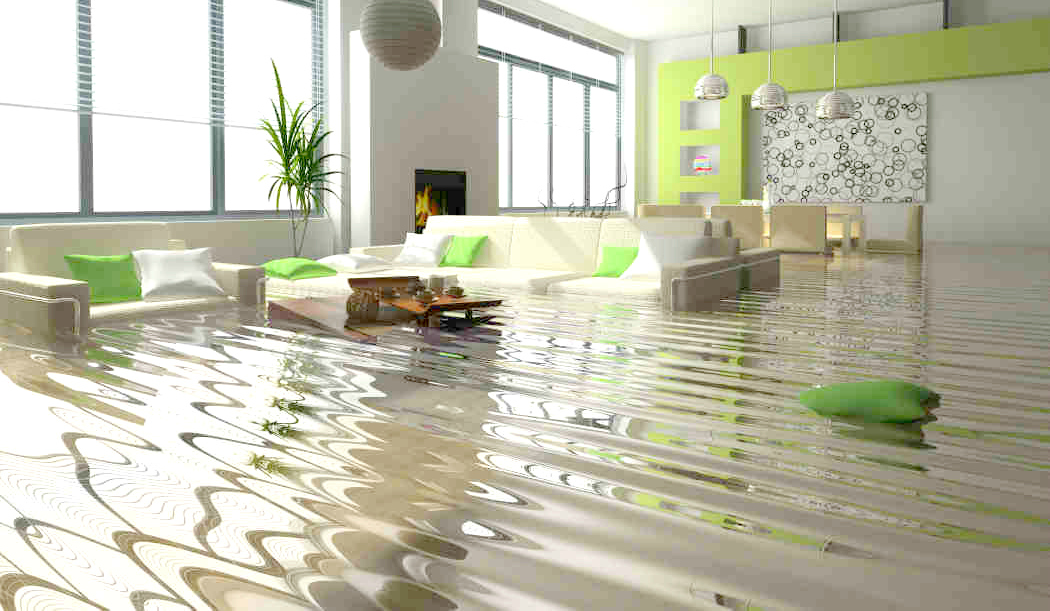

When the unthinkable happens

As a responsible property owner, you purchase insurance to mitigate against loss from factors you feel likely to impact your home.

![]()

For many who do not live near a body of water, however, purchasing flood insurance is not in their insurance portfolio. Typically flood insurance is an afterthought after the damage has occurred.

Elevating the elevation standards

HUD proposed new elevation standards in an attempt to protect buyers and ensure that properties seeking Federal Housing Administration (FHA) mortgage insurance or financial assistance from HUD are safeguarded. The proposal calls for properties identified as “non-critical” to be a minimum of two feet above the location’s base flood elevation (or the 100-year floodplain).

“Critical” properties, such as police/fire stations, hospitals, and nursing homes, should be three feet higher than the base flood elevation or the 500-year floodplain, whichever is higher.

Additionally, the proposal seeks to widen the horizontal floodplain around both critical and non-critical properties.

It also revises the single-family home and public housing development Minimum Property Standards with mortgages insured by FHA.

For properties located within the 100-year floodplain, the lowest floor in both new construction and structures which are substantially improved must be built at least two feet above the base flood elevation based on the best information at hand. Horizontal flooding patterns are not considered as a result of this new proposal for these types of properties.

An historical proposal

This proposal is the first in 40 years to identify the need to raise current required elevation levels for properties.

The proposal is based on an anticipated increase in flooding risks based on climate change and associated rise in sea-levels.

Furthermore, HUD utilized the work of the 2014 National Climate Assessment, which identified that significant damage from infrastructure likely occurs based on extreme weather events.

“If we’re serious about protecting people and property from flooding, we have to think differently than we did 40 years ago,” noted HUD Secretary Julian Castro. “Today we begin the process of aligning our regulations with the evidence to make sure taxpayer dollars are invested in the most responsible and resilient manner possible.”

Not all parties affected, however, see the same line of reasoning. “HUD must stick to the original intent of the president’s executive order by stipulating that expanded floodplain rules only apply to federally funded projects,” said Ed Brady, chairman of the National Association of Home Builders (NAHB).

Brady takes a harsher view of the effect the proposal would have on the housing market. “HUD’s proposal is a disaster for housing affordability. It will trigger delays and higher construction costs for properties facing little risk of flooding,” he asserts.

Better for all

Half of all homes in the United States affected by floodwaters do not have flood insurance prior to the event. Many homeowners are under the mistaken belief that flooding is covered under their standard home insurance policy. Flood insurance is sold specifically to cover that instance, which is not covered under the “multi-peril” clause of the standard home insurance policy.

The National Flood Insurance Program (NFIP), which provides flood insurance for homeowners, found almost 25 percent of claims they process are from properties outside areas identified as a high-flood risk. As such, both homeowners and the federal government alike must consider taking expanded steps to protect their investments.

#HUDFlood

Roger is a Staff Writer at The Real Daily and holds two Master's degrees, one in Education Leadership and another in Leadership Studies. In his spare time away from researching leadership retention and communication styles, he loves to watch baseball, especially the Red Sox!