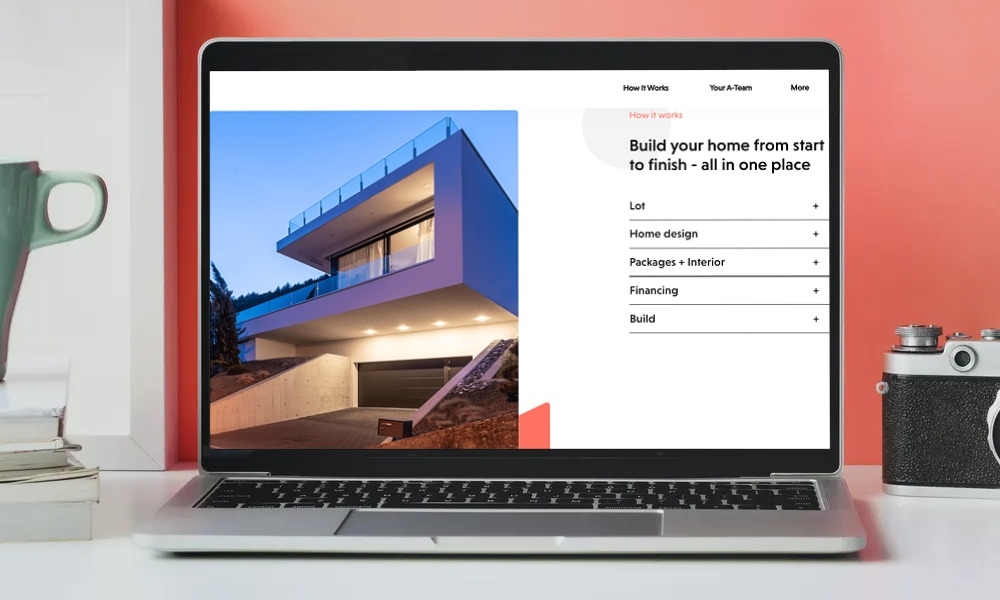

A start-up plans to bring together people, processes, and tools into one digital place for buyers to design and build their homes from start to finish. Co-founder and CEO of Atmos, Nicholas Donahue, grew up in a homebuilding family and always wondered what it would look like to use technology to rebuild the industry.

“Nearly everyone used to want to build a home; it was the American dream, but most people choose not to do it because of the complexity,” Donahue said, “While everything else has moved fully online, homebuilding is still the same in-person process. We are making the process simple enough that anyone can build the home of their dreams, modernizing and revitalizing the American dream.”

The way Atmos works is that they partner with local home builders that they claim to vet based on accreditation, reputation, proof (insurance + funds for construction loans), and pricing. Customers input their desired location and floor plan for the site on the platform. Atmos finds builders that best match the plan and coordinate the rest of the tasks to get the home built, including design, fixture packages, and financing. The company partners with local real estate agents to help sell a client’s existing home, or allows customers to use their own real estate agents if they prefer.

Atmos is participating in the California-based Y-Combinator accelerator, most known for launching companies like Airbnb, DoorDash and Instacart. The company has raised more than $2 million in VC seed round funding from Sam Altman of YC/ OpenAI, Adam Nash of Wealthfront, JLL Spark, and others.

According to Donahue, the rise in demand for housing in emerging cities coupled with low inventory makes building a more attractive option for buyers. He said “homeowners are converting from buying to building and when doing so are being forced to go online because of in-person restrictions. This has provided a huge opportunity for an online alternative to come into the space.”

Additionally, an increasing number of remote workers have come to envision their homes as combined office, schooling, and family spaces. In response, real estate agents report more requests for larger homes with outdoor space and dedicated offices, particularly for homes in the under $400k price range.

Atmos is currently focusing on Raleigh-Durham and Charlotte markets as they continue to refine their business model. Long-term, Donahue says the goal is to “redefine the way people live by enabling the next generation of homes and neighborhoods to exist.”

Yasmin Diallo Turk is a long-time Austinite, non-profit professional in the field of sexual and domestic violence, and graduate of both Huston-Tillotson University and the LBJ School of Public Affairs at the University of Texas. When not writing for AG she should be writing her dissertation but is probably just watching Netflix with her husband and 3 kids or running volunteer projects for HOPE for Senegal.