At the beginning of 2020, the housing market started off strong. While there was a nine-week downturn at the onset of the pandemic, sales resumed and have continued an upward trend through the rest of the year, resulting in higher prices (jumping 14.6%). This increased demand has been primarily driven by lower mortgage rates and employees working from home (which in turn means a reassessment of where people want to live, with many opting away from cities given that their personal choice is now more easily obtainable).

It has not been entirely beneficial at all times, however, with sales declining for the first time in six months, due to lower inventory and the aforementioned rising costs. Still, this suggests that the market has continued to flourish.

The National Association of Realtors began tracking various trends for home real estate in 1981 with a total of 59 questions designed to understand the market over a twelve month period from July to June. In doing so, a snapshot of the current landscape was obtained for that year, and this data has since been collected annually. Further, it has grown to include additional considerations, covering a massive 131 questions in the most recent 2020 report.

Of the numerous subjects covered, for sale by owner sales (i.e., without assistance from a realtor) are directly profiled. This FSBO information is collected here, and several insights can be gleaned with regard to this particular selling method.

As this report shows, there are certain circumstances that – when tracked across the entire survey – show positive outcomes. A quick example is that not having a previous relationship with the buyer yields higher selling prices and a smaller percentage of times where the asking price was reduced. Interestingly, data also shows a seller’s starting median income being higher than situations where there was a previous relationship with the buyer.

Let’s take a deeper look into this specific topic.

For Sale By Owner Sales Show Steady Decrease Since Inception

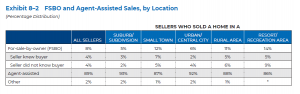

In 1981, FSBO sales accounted for as much as 15%, but this has declined gradually over time, accounting for only 8% in 2020 (though this is up 1% from the previous year). Additional analysis showed that these sales were evenly split between the buyers and sellers having a previous relationship versus not, with the latter as generally more advantageous toward the seller. Sales mostly came from suburban and urban locations (as opposed to recreational and resort territories).

Demographics Breakdown – Median Income

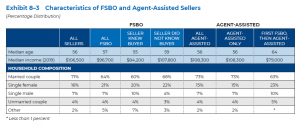

In comparison to agent-assisted sales, FSBO owners differ on a number of data points that are significant. For example, FSBO sellers had a median age of 57, which is just above agent-assisted sellers at 56. Further, their median income is over ten thousand dollars lower ($96,700 vs $108,300), which falls even further if an agent was used later in the process after an initial attempt at a self-sale ($79,000).

Interestingly, there is a correlation between higher median seller income when it comes to selling their home to someone where no previous relationship existed ($107,800 versus $84,200).

Types of Homes Sold

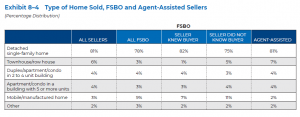

The majority are detached single-family homes at 81%; there is a small dip to 78% (down from 82% in 2019) with regard to FSBO sales. The main differences here are that FSBO shows a lower percentage of townhouse sales (6% versus 3%) but an increase overall in mobile/manufactured homes (3% versus 9%).

We also still see differences when a previous relationship is not present – there’s an increase in townhouses and mobile/manufactured homes and a decrease in detached single-family. Otherwise, both groups are comparable.

Home Location

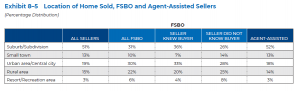

FSBO sales tend to skew slightly higher in rural areas compared to agent-assisted transactions, though there is a significant difference in resort/recreational sales for those who do not have a prior relationship.

Selling Price

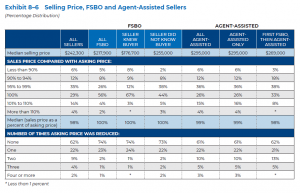

Overall, FSBO sales result in a lower median price than with agents ($217,900 versus $295,000), but there has been an increase in the price over 2019 (rising up from $200,000). It’s worth noting that agents will take a percentage of the sale as commission (around 1%). In situations where an agent was employed after an initial attempt at a direct sale, the owner would receive 98% of the asking price, but usually had to reduce their listing before a deal could be made.

In short, this does seem to suggest that an agent’s knowledge of the market and skillset can benefit a seller.

Factors That Determined Selling Price

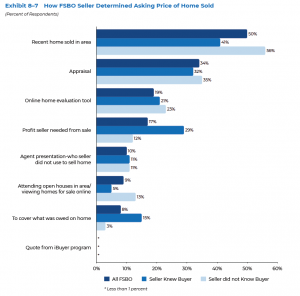

When settling on an initial listing, FSBOs who knew their buyers tended to focus on comparables in their area 41% of the time. Other methods trailed behind, such as appraisals (32%), profit needed by seller (29%), online evaluation tools (21%), and covering what was owed (15%). Those who did not know their buyer saw an increase when relying on comparables (56%).

Length of Time on Market

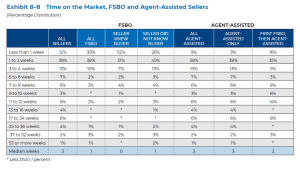

One of the most important factors in real estate is the amount of time a home will be on the market until it is sold. In this regard, FSBO sales have a slight edge, with an average duration of two weeks (with agents having a median of three weeks). This is increased when the seller knows the buyer, with an average just under a week, rising by 6 points in 2020 to 52%.

As such, homes sold by FSBO tend to move more quickly, and knowing the buyer beforehand accelerates the process.

Remaining Factors – Urgency, Incentives

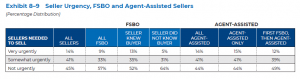

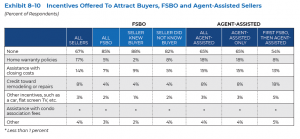

Compared to agent-assisted sales, FSBO tended to be less urgent overall, with over half saying they did not need to sell urgently regardless of knowing the buyer (52%) or not (64%). There was also a lower tendency to give incentives to the buyer in these conditions, as all FSBO sales offered nothing 85% of the time.

Reason For Selling as FSBO

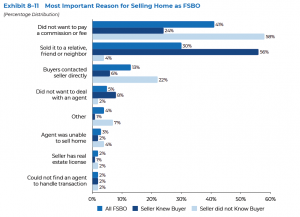

A majority of owners chose this route due to not wanting to pay a commission or fee, citing this reason as 41% of the time. Selling to a relative, friend, or neighbor was the next most frequent reason, covering 30% of all FSBO sales.

Regardless of why an owner was selling, there was almost always a large disparity between knowing the buyer versus not. This is most pronounced in situations where the buyer contacted the seller directly – 6% of sales versus 22%.

Method For Selling

Interestingly, a majority of FSBO sales utilized no active methods for marketing their home at 46%, with a large discrepancy between knowing the buyer (68%) versus not (24%). Selling to a friend, relative, or neighbor occurred 22% of the time, while third party aggregators such as Zillow and Redfin were at 24%. Yard signs covered 25%.

When the buyer was not known, the owner relied much more heavily on third parties, social networking sites (such as Facebook), yard signs, and open houses. This would follow given that more work would need to be done to locate a buyer. We can see from the data that third parties are becoming more and more utilized when there is no prior relationship, which would tie into the real estate market becoming more intertwined with digital methods.

What did FSBO sellers say?

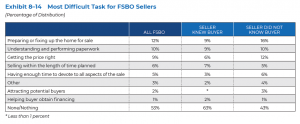

While 8 in 10 successful FSBO sales reported being very satisfied with the process to sell their home. 53% reported that there was nothing truly difficult or arduous when it came to the selling process, which far outshone other reasons such as preparation, completing paperwork, price adjustments, and attracting buyers.

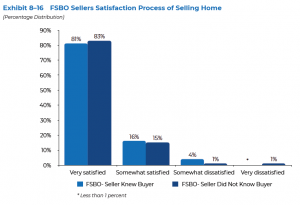

When they knew the buyer, 16% said they would sell their current home when the time arose, while 45% who didn’t know the buyer reported the same. This would suggest that this method is overall successful and attractive, despite that over a third reported not knowing what process they’d take with their current home.

Conclusion

Both types of sellers were overwhelmingly satisfied with the process they used to sell their homes, with 81% and 83% responding with “very satisfied.” Despite some of the perceived additional challenges and the foregoing of an experienced realtor, it suggests that FSBO works a large part of the time for owners.

With the advent of third parties and social networking, a greater wealth of knowledge accessible via the internet (looking up comparables, recently sold homes, guidance from other home sellers and realtors, etc.), and a rich inventory of resources available, home owners can conceivably move forward with selling their home directly and still enjoy positive results.

Robert Snodgrass has an English degree from Texas A&M University, and wants you to know that yes, that is actually a thing. And now he's doing something with it! Let us all join in on the experiment together. When he's not web developing at Docusign, he runs distances that routinely harm people and is the kind of giant nerd that says "you know, there's a King of the Hill episode that addresses this exact topic".