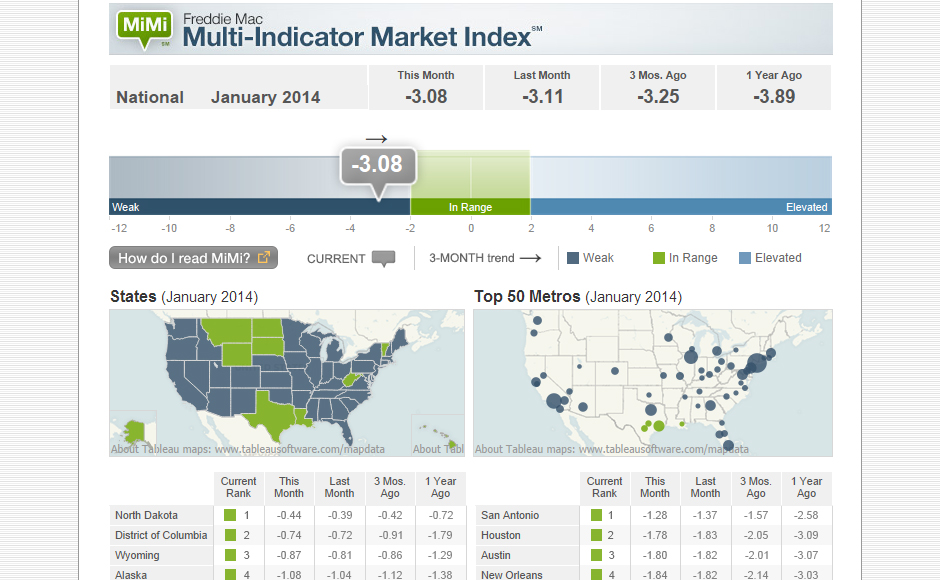

Freddie Mac recently a new economic indicator, called the Multi-Indicator Market Index (or “MiMi” for short, pronounced “Me-Me”), to pull together national information as well as offering local market overviews with interactive maps.

The indicator pulls together and combines the following four indicators:

- Home purchase applications

- Performance of homeowners in their mortgages

- Affordability

- Percent of workforce that is employed

When asked, Dr. Frank Nothaft, Chief Economist at Freddie Mac tells us that the indicator is superior because combining these indicators is an accurate baramoter for how markets have changed.

Although Dr. Nothaft was hesitant to opine on indicators from the likes of Zillow and Trulia, he reiterated the quality of the MiMi report.

Key findings from the first MiMi report

As of January, 2014:

The national MiMi value stands at -3.08 points indicating a weak housing market overall. From December to January the national MiMi improved by 0.03 points and by 0.81 points from one year ago. The nation’s housing market is improving based on its 3-month trend of +0.17 points and moving closer to its stable and in range status. The nation’s all-time MiMi low of -4.49 was in November 2010 when the housing market was at its weakest.

Eleven of the 50 states plus the District of Columbia are stable and in range with North Dakota, the District of Columbia, Wyoming, Alaska, and Louisiana ranking in the top five.

Four of the 50 metros are stable and in range, San Antonio, Houston, Austin and New Orleans.

The five most improving states from December to January were Florida (+0.11), Tennessee (+0.11), Michigan (+0.09), Louisiana (+0.07), Nevada (+0.07), and Texas (+0.07). From one year ago the most improving states were Florida (+2.12), Nevada (+1.84), California (+1.26), Texas (+1.06) and D.C. (+1.05).

The five most improving metros were Miami (+0.11), Detroit (+0.10), Orlando (+0.09), San Antonio (+0.09), and Chicago (+0.08). From one year ago the most improving metros were Miami (+2.54), Orlando (+2.08), Riverside (+1.87), Las Vegas (+1.81), and Tampa (+1.77).

Overall, in January of 2014, 25 of the 50 states plus the District of Columbia are improving based on their 3-month trend and 35 of the 50 metros are improving.

What 2014 has in store

Dr. Nothaft tells Realuoso that the data indicates a pick up in new construction of up to 19 percent in 2014.

Further, he notes that while rates currently average 4.5 percent for a 30-year fixed-rate mortgage, they will be going up this year, so the low rates won’t last.

Housing sales will increase this year, and affordability will continue tightening.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.