There’s extensive data and topics to research when it comes to the National Association of Realtors annual report – everything from the trust home sellers place in agents, home financing, home sales (naturally), and real estate professionals and their relationship with buyers. Practically every angle of this important market has been broken down and examined to help deliver a clear picture of real estate sales across the nation. It’s all extremely valuable and highly worth perusing (psst: search “NAR report”).

Of course, searching for a home is a pivotal and significant part of the entire process, and the NAR report has delivered an in-depth analysis of everything as well. Let’s take a look and see what current trends were revealed.

Initial Search

When it comes to looking for a home initially, there are two main options that most buyers tend to go with – searching online versus contacting outside help (primarily a real estate agent, but family and friends were also viable resources).

With the advent of the pandemic in 2020 keeping several people at home, online searches were at their all-time highest (though this trend has continued to increase in recent years). In fact, a staggering 97% of all buyers utilized the internet at some point during the process.

With the advent of the digital listings and databases, it’s been shown that 43% of buyers are first looking for properties online, compared to 18% that go to a real estate agent first. Speaking broadly, first time buyers were more likely to take this step first, and there was a direct increase as buyers were older (though this percentage decreases after the

age of 64).

Real estate agents were definitely the second most used avenue during the search process, and this did increase with aging demographics as well. Perhaps due to greater familiarity with searching online, younger generations did look up information on buying their first home at a higher rate than older counterparts (13% with the younger group versus 6% with the oldest).

Information Sources

Of course, when it comes to where to find information and best to listen to, real estate professionals reigned supreme (91% reported successfully being helped by agents), and were the primary resources for every demographic – first time buyers, repeat buyers, new homes, and previously owned homes. Online searches and open houses came second and third respectively, and yard signs and online video sites also saw a lot of utilization. Methods after this – print advertisements, billboards, relocation companies, and television sources – finished out the bottom, but there was a wide margin between them and other methods.

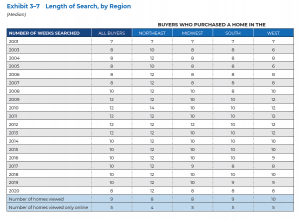

Length of Time From Searching to Buying

Perhaps again owing to the nature of the pandemic, the average time a buyer used from search to purchase decreased (a first since 2014), needing only eight weeks. A median of nine homes were looked at (five online only).

First time buyers needed a little more time on average than repeat buyers (nine versus eight weeks). Agents were still utilized frequently in all instances, and were usually contacted within three weeks of the initial search.

Difficulty During the Process

It should come as no surprise that searching for a home is a massive undertaking, and can prove to be an arduous process given the magnitude of what it entails. Just finding the right home to purchase is seen as the most difficult step, with 53% of buyers saying it gave them the most trouble. Paperwork followed at 17%, while simply understanding the process from start to finish was cited by 15% of buyers. As might be expected, first time buyers reported more difficulty across the board in all areas than repeat buyers.

Online Searching Trends

Online searching was first examined in 1995, where only 2% of buyers would utilize the internet during their home search process. This increased repeatedly until 2009 to 90%, dipped slightly until 2012, and has since generally been rising. It was almost an even split between mobile and desktop devices, with younger buyers focusing more on mobile and older more likely to use a desktop/laptop.

There’s actually a lot of information to process when it comes to online search trends – married couples versus single buyers generally searched online more, desktop searches utilizing video sites more often than mobile (46% versus 40%), and mobile users generally finding their home through their online searches while desktop might generally direct buyers to complete the process with a real estate agent.

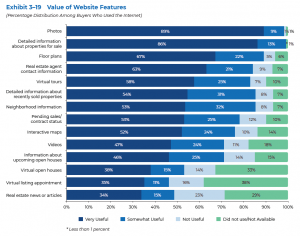

Value of Website Features

Of course, how a website helps direct a buyer is extraordinarily important to the home search process. Photos were the clear primary resource here, with 89% of buyers saying that images were extremely useful in the process.

Detailed information about properties followed at 86%, and then there was a significant jump to the next most important feature, as buyers reported that floor plans were important 67% of the time).

Next Steps After Searches

Once homes were found online that proved attractive, more than half of first (51%) and repeat (59%) buyers would proceed to walk through the home. Following this, buyers might then see the home but choose to skip seeing the inside (37%), or would contact a real estate agent for additional information (35%). First time buyers tended to look for more information in general (on the home itself, about mortgages, and so on) to better prepare themselves.

Method of Home Purchases

Perhaps the best conclusion to draw here is the home purchase itself. When that time comes, agents are still used the overwhelming majority of the time regardless of a buyer using mobile or desktop more than 50% of the time. With the former, an agent helps 88% of the time, and 90% of the time otherwise. Builder agents or direct contact with the previously owner – known or not – are far overshadowed here.

Satisfaction with the Search Process

Given all of the tools and data available to buyers, 64% reported that they were very satisfied with the entire process, 30% were somewhat pleased, and the remaining group said they were unhappy.

Conclusion

The NAR Report really shows an incredibly exhaustive look into the home search process. Generally speaking, with so much information available online, buyers were eager to search with devices first and speak with real estate agents early on in the process. Further, digital resources such as photos, floor plans, and other data proved incredibly useful in helping determine if buyers should seek out the home or continue their search.

Perhaps the best conclusions to draw here are that first and repeat home buyers are actively consuming data from online sources, but still rely heavily on agents to help guide them through the process (including ultimately with purchasing the home). Given the unique circumstances of the 2020 Pandemic, it’s clear that searches and next steps are best started through websites and other repositories, and are then usually followed with experts that can provide their professional experience. It’s likely that these trends will – on average – continue in ensuring years.

Robert Snodgrass has an English degree from Texas A&M University, and wants you to know that yes, that is actually a thing. And now he's doing something with it! Let us all join in on the experiment together. When he's not web developing at Docusign, he runs distances that routinely harm people and is the kind of giant nerd that says "you know, there's a King of the Hill episode that addresses this exact topic".