Whether you’re a real estate veteran, or looking to expand your services to the real estate investment world, a wild shortcut has just been launched, and you already have access to it for free if you’re a Realtor.

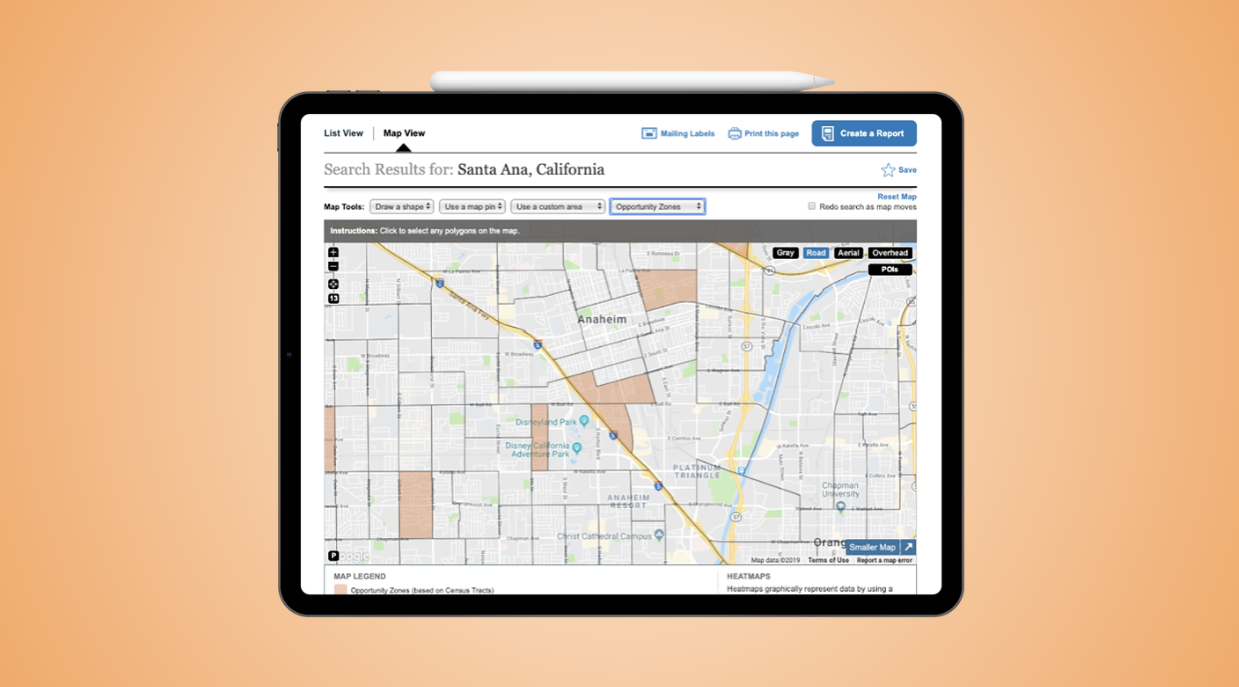

Realtors Property Resource (owned by the National Association of Realtors (NAR)), rolled out a map layer to unveil the Qualified Opportunity Zones (QOZ) across the nation this year, and it’s a tool we should all be using regularly…

The QOZ program was created in 2017 as part of the Tax Cuts and Jobs Act and is designed to improve local economies (specifically the economically disadvantaged areas) through long-term investments with real estate investors.

There are 8,700 QOZs in America, and real estate investment and development in those areas are rewarded with tax incentives (potentially reducing their tax liability by 10-15%, and appreciation on the investment is tax free if held for at least 10 years).

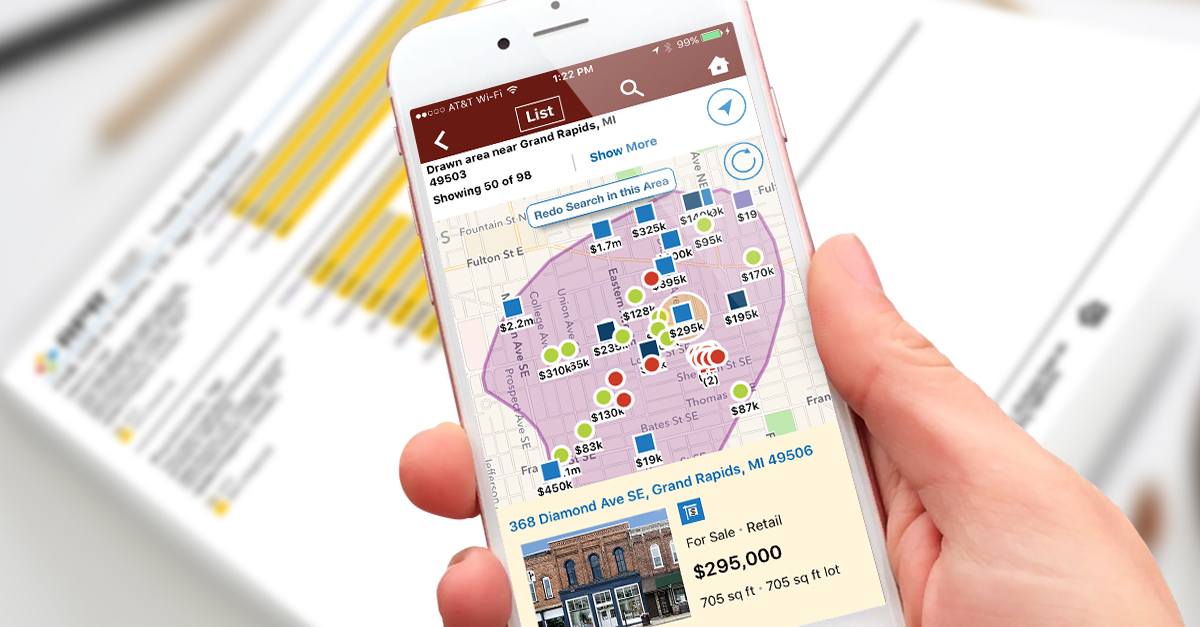

And now, you can find the investment opportunities in seconds, generate reports for investors, connect with homeowners (via the “Mailing Labels” feature) in those areas, and so much more – the new RPR features combine to create one hell of a shortcut for you. Check it out:

“With the Opportunity Zone initiative poised to transform American communities that have long been shunned by investors, NAR has developed resources to help facilitate and expedite investments in these areas. As our work continues, REALTORS® are committed to ensuring Americans can take full advantage of this valuable new initiative”, said Joseph Ventrone, NAR Vice President, Federal Policy and Industry Relations.

“These Opportunity Zones encourage private investment into low-income communities, with the intent of stimulating economic growth and job creation,” said Bob Turner, NAR’s 2019 Commercial Liaison and RPR Advisory Council Member. “Residential practitioners will notice homes that fall within Opportunity Zones gain a boost to their marketability because of increased attention, while Commercial practitioners will likely see properties once being skipped over turn into desirable investment opportunities.”

It’s not just a shortcut for practitioners and real estate investors, but meaningful help for underserved areas. Talk about a real win-win.

This story was first published July 31, 2019.

The American Genius' real estate section is honest, up to the minute real estate industry news crafted for industry practitioners - we cut through the pay-to-play news fluff to bring you what's happening behind closed doors, what's meaningful to your practice, and what to expect in the future. Consider us your competitive advantage.