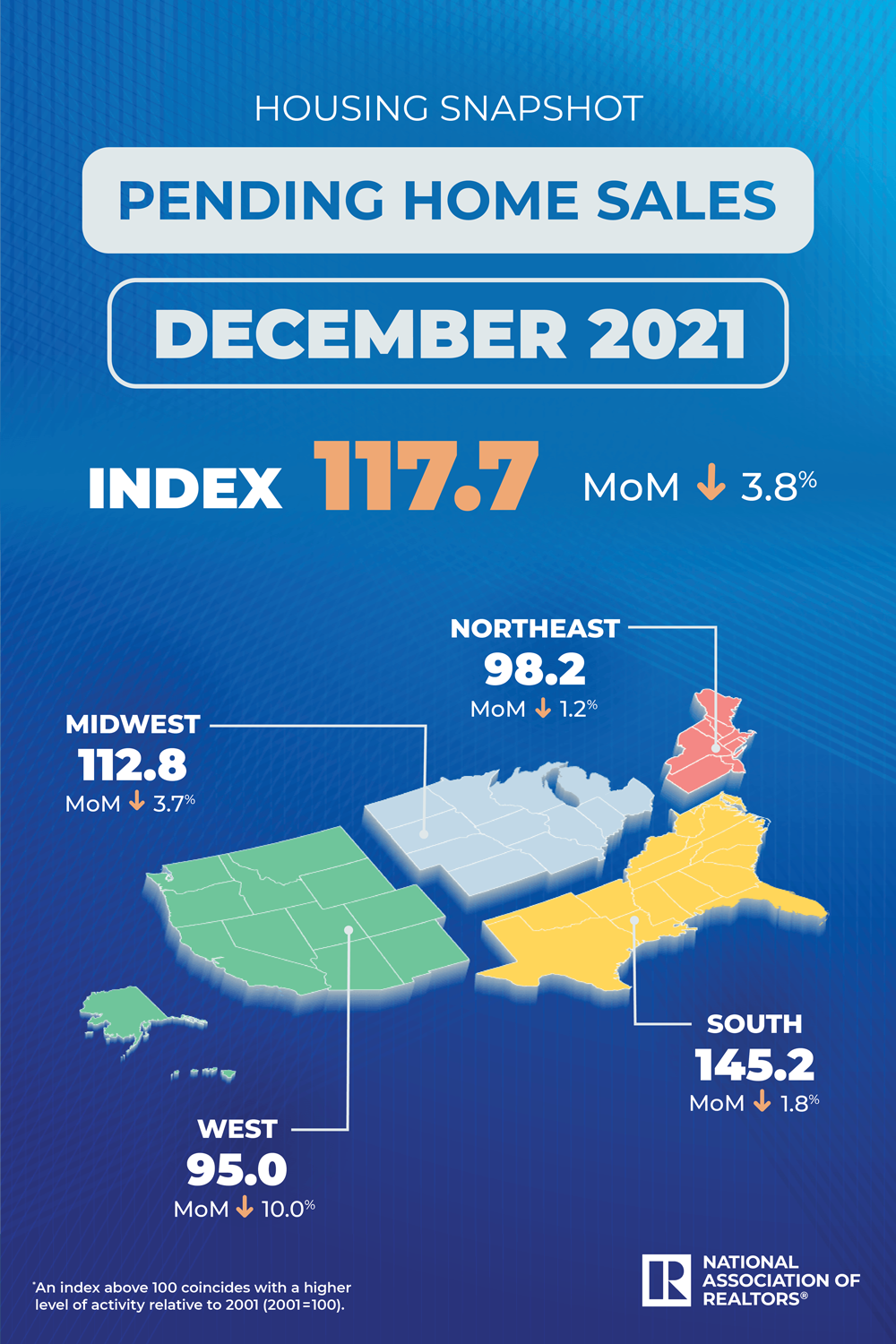

Pending home sales (contracts signed on deals not yet closed) fell 3.8% in December compared to November, according to new data from the National Association of Realtors (NAR). The stumble was slightly more than economists had previously forecast, but there was no immediate reaction in the stock market to this decline.

Last week, NAR reported a 4.6% dip in closings for the same time period, but a historic 8.5% increase from the year prior. The trade group expect closings to dip 2.8% this calendar year.

Unfortunately, signed contracts didn’t enjoy that same annual and historic bump, actually down 6.9% year-over-year, inventory levels remain tight, and home prices are forecast to jump 5.1% despite an expected rise in housing starts.

“Pending home sales faded toward the end of 2021, as a diminished housing supply offered consumers very few options,” said Dr. Lawrence Yun, NAR’s chief economist. “Mortgage rates have climbed steadily the last several weeks, which unfortunately will ultimately push aside marginal buyers.”

The silver lining Dr. Yun observed for 2021 was not just sales, but price appreciation (a win for current owners, a lingering challenge for hopeful first time buyers).

For those people that have been edged out of the market, Dr. Yun expects housing inventory to improve which could slow home price growth this year.

“The market will likely endure a minor reduction in sales as mortgage rates continue to edge higher,” he noted.

Finally, Dr. Yun said, “The combination of a more measured demand and rising supply will bring housing prices better in line with wage growth.”

In December, when compared to November, contracts signed fell 1.2% in in the Northeast, 3.7% in the Midwest, 1.8% in the South, and a painful 10.0% in the West.

Compared to December of last year, contract signings dipped 10.5% in the Northeast, 1.2% in the Midwest, 3.9% in the South, and 16.2% in the West.

Dr. Yun has long said that builders are the key to loosening inventory levels and improving housing conditions, but with that sector continuing to struggle with labor, as well as obtaining building materials in the midst of a supply chain crisis (much less getting reasonable prices on them), there is no expectation that a fix is imminent.

The American Genius' real estate section is honest, up to the minute real estate industry news crafted for industry practitioners - we cut through the pay-to-play news fluff to bring you what's happening behind closed doors, what's meaningful to your practice, and what to expect in the future. Consider us your competitive advantage.