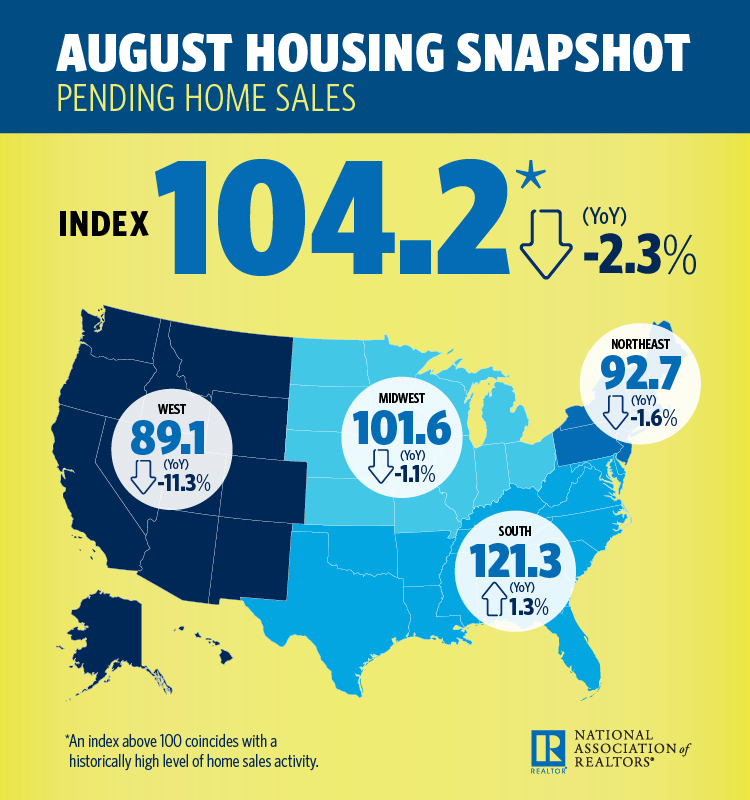

Pending home sales (contract signings on homes) fell 1.8 percent in August, marking the eighth consecutive month of slight decreases, according to the National Association of Realtors.

This metric is important as it is an indicator of what is to come in the housing market.

As he has repeatedly in recent years, Dr. Lawrence Yun, NAR Chief Economist reiterates that tight inventory levels continue to restrict the market. He points directly Westward.

“The greatest decline [of pending home sales] occurred in the West region where prices have shot up significantly, which clearly indicates that affordability is hindering buyers and those affordability issues come from lack of inventory, particularly in moderate price points,” Dr. Yun observed.

Further. Dr. Yun asserts that rising prices has homeowners sitting on the sideline, hoping to accumulate more equity, but as values begin to decelerate, it is anticipated that more properties will come online, alleviating the inventory challenges that have long put a wet blanket on sales.

Regarding rising mortgage rates, Dr. Yun believes that while rising rates are always a deterrent to potential buyers, it should not lead to a significant decline.

“We have two opposing factors affecting the market: the negative impact of rising mortgage rates and the positive impact of continued job creation,” adding that “as long as there is job growth, rising mortgage rates will hinder some buyers; but job creation means second or third incomes being added to households which gives consumers the financial confidence to go out and make a home purchase.”

Dr. Yun projects that existing home sales will dip 1.6 percent his year, while the median home price will rise 4.8 percent. Next year, he projects existing sales are forecast to rise 2 percent and home prices around 3.5 percent.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.